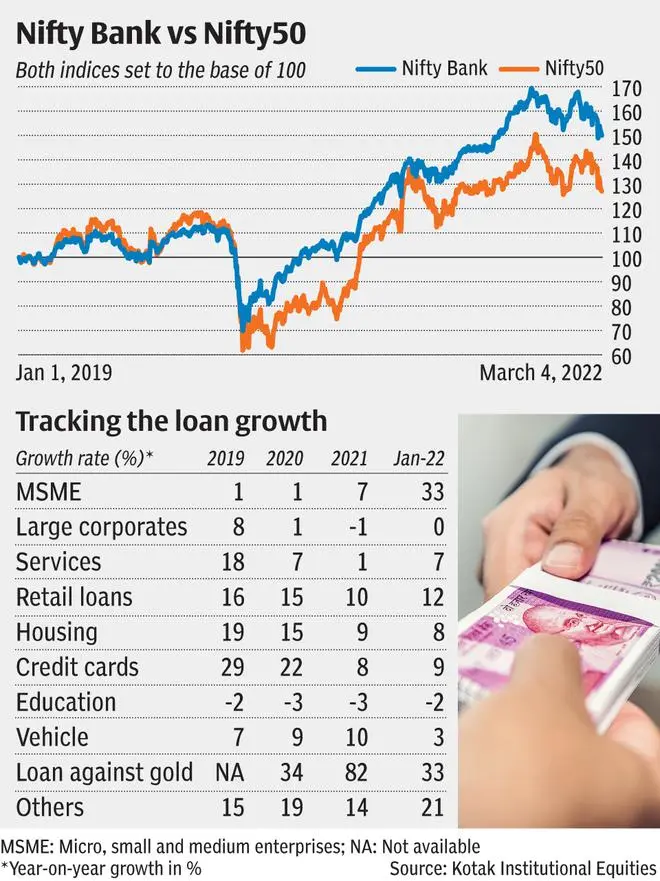

In the last month, the entire banking pack has been under pressure with the Nifty Bank index plunging by 11.3 per cent as against Nifty50’s 7.3 per cent fall. Individually, stocks of ICICI Bank and HDFC Bank have corrected by 10 – 15 per cent in a month. Stocks such as AU Small Finance Bank, Bandhan Bank, RBL Bank, Punjab National Bank and State Bank of India have seen a sharper fall.

Growing bond yields in India is perceived negatively by investors abroad, forcing them to trim their exposure to the banking space. American depository receipts or ADRs of leading private banks - ICICI Bank and HDFC Bank too, have plummeted by 15 – 18 per cent in a month.

What has triggered the underperformance and what’s in store?

Until early January, much of the price decline in banking stocks was led by sector rotation on the part of foreign investors.

But this thought process has altered. With bond yields spiking up, fresh concerns have cropped on the impact this will have on the financials of banks in the March 2022 quarter (Q4). While a marked-to-market (MTM) loss on investments could be more detrimental to public sector banks, which draw nearly 60 – 70 per cent of their ‘other income’ from this head, even their private peers won’t be unscathed.

Unlike FY19 – 20 when fee income accounted for over half of ‘other income’ for private banks, now with loan growth remaining patchy, private banks too have bumped up their earnings in FY22 from investment gains. Therefore, the impact of MTM losses in Q4 could be pronounced across the board.

There are also questions around loan growth (see table). On the face of it, eight per cent year-on-year growth seen till January paints a picture-perfect situation for the sector. But delve into the details, it’s not so rosy. For most of the calendar year 2021, loan growth was propped by the housing and small business loans segment. Banks were reluctant to dole out unsecured loans. This trend has changed, with much of the retail growth lately coming from by unsecured products. Demand for secured products such as home loans has petered out to an extent.

A recent report by Transunion CIBIL indicates that the pool of sub-prime and near-prime borrowers increased by 300 and 200 basis points year-on-year respectively in November 2021 while the downgrade in credit scores shot up by 500 basis points. Given that 60 – 70 per cent of loans restructured since August 2020 pertain to the retail segment, banks may be taking risk by increasing their exposure to unsecured loans.

So, what should investors do now?

After every market fall, banking stocks were perceived as frontline stocks driving the market revival. But the sentiments tend to fizzle away as the broader market recovery gathers steam. So, if investors are looking at banking stocks with this approach now, you could be caught on the wrong foot. It is important to take a stock-specific view especially considering today’s macro-economic environment.

For instance, Bandhan Bank and RBL Bank may remain impacted because of their exposure to microfinance space. Same holds for IndusInd Bank. Axis Bank and Kotak Bank have adopted a more conservative growth strategy and it needs to be seen if they can outpace the growth rates of private banks’ run rate at 15 – 18 per cent. As for leaders – HDFC Bank and ICICI Bank, while the quality isn’t an issue, they may remain the targets of continued selling by foreign investors.

Among the public sector banks, only State Bank of India and Bank of Baroda enjoy investor acceptance, though MTM losses could pinch their financials

Published on March 5, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.