The Indian pharmaceutical industry’s US business is growing at a rapid pace, with an average growth rate of 22% in the top five companies, compared to 7% YoY growth last year.

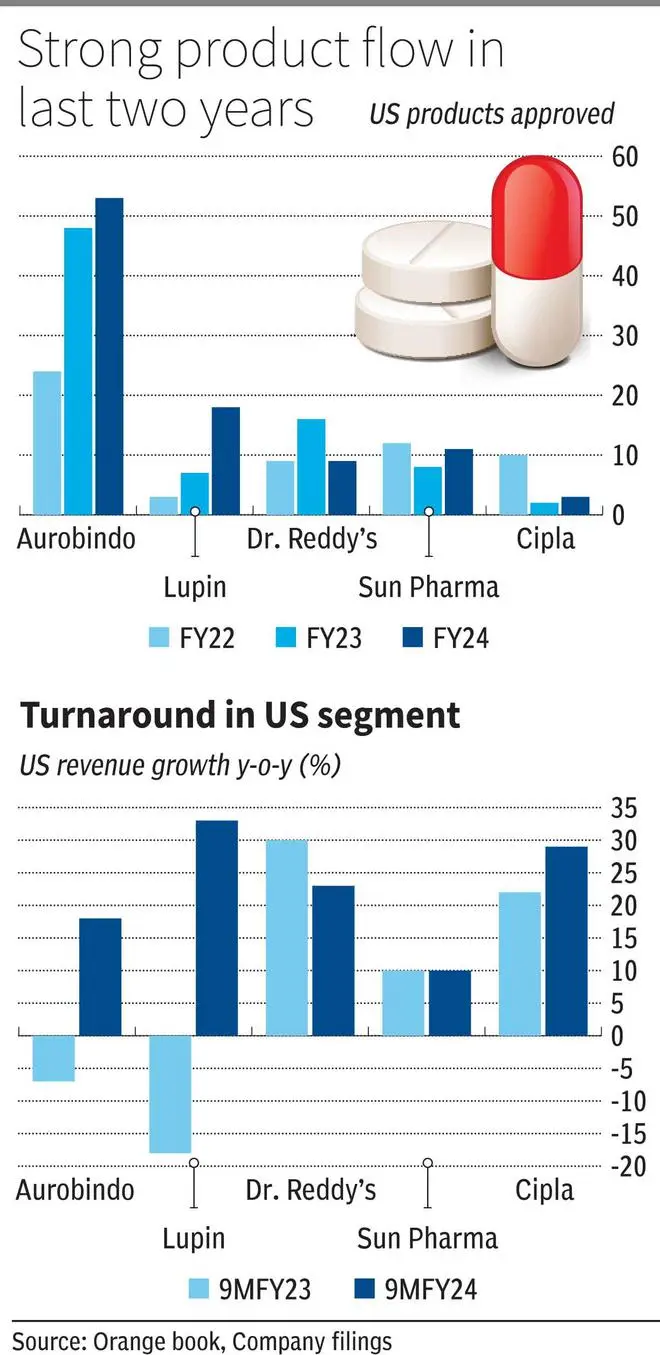

Indian pharma’s US business is back on strong footing again. In the 9MFY24, the US segment grew by an average 22 per cent across the top five companies against a 7 per cent YoY increase last year. There have been structural shifts behind the performance which is reflected in the stock returns as well. The sector indices (Nifty Pharma or BSE S&P Healthcare) have returned more than 60 per cent in the past year with valuation premium at 20 per cent (one year forward PE against past five-year average).

There are two primary drivers of the re-rating. Plants exiting US FDA’s heightened scrutiny of last three years and complex product profile developed in that period. The two drivers, being structural in nature with impact extending to several more years, valuations have also expanded in tandem.

By the middle of 2023, plant inspection outcome started turning favourable for Indian companies which started the turnaround for the sector. Only in 2020-22, Aurobindo, Sun Pharma, Lupin, Cipla and Zydus Lifesciences had plants in warning letters or import alerts. Fast forward to 2024, Lupin has cleared three of the five plants under observation, Aurobindo also reported four of its plants receiving favourable outcomes in 2023. Similarly Zydus Lifesciences, Torrent Pharma and others, reported a positive improvement.

This has led to a strong growth in product launches. Aurobindo and Lupin for instance have launched 50 and 30 per cent more products in last two years compared to their previous three years. Dr. Reddy’s which had its main plant’s approval earlier than others, had a strong launch calendar in FY23 itself.

Plant approvals translating to product approvals has a first order impact on the return metrics. Investments made on the plant, personnel and more importantly on R&D and filing expenses (which are significant for US ANDA approvals) have been utilized by way of launches with apparently very low levels of product write offs. Even with plants getting the go-ahead, analysts had expected delayed approvals to impact its relevance in the market, which has not been the case. Secondly, the high approval rate is crucial for pharma companies with a sizeable portfolio of more than $1 billion. Earlier rounds of buyer consolidation in US generics markets has forced high teens price erosion every year in legacy portfolio. New product launches ranging above 15-20 products would deliver an additional revenue of $120-200 million per year (assuming $8-10 million per launch), in order to overcome a 10 per cent price decline in base portfolio and drive growth. The renewed launch calendar also coincided with softening of price decline in US generics which is currently facing shortages and had to scale back on price discounts.

Sun Pharma and Cipla, have not witnessed a turnaround in product approval rate (Halol for Sun and Goa for Cipla are under observation). But the revenue growth has matched that of the sector, as the two companies’ complex and speciality portfolios, respectively, have delivered strongly. Even amongst others, without a stark uptick in complexity of portfolio, a slow march towards product differentiation is well underway. Lupin with its extensive respiratory portfolio has transformed a bulk of its revenue base to complex portfolio. There are now injectable, metered sprays, solutions, creams and extended release or delayed release capsules as part of the base portfolio for other players as well. On patent complexity, most of the leading players have got access to gRevlimid, which should deliver until FY26 before competition sets in. Large patent expiries in diabetes and ARV’s are expected in next few years, which can support the momentum.

Pharmaceutical companies though are not uniform and have to be analysed by their pipelines. A large turnaround in US business has supported the current segment momentum. The upside in shares and index already reflect these. But going ahead, product approvals, favourable price erosion and large one-time opportunities will have formed part of the base. Growth from such high base will determine each companies’ outlook.

Published on April 6, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.