Timing the markets is always difficult. Many great investors acknowledge that. However, beating market returns requires some broad timing in and out of sectoral and thematic plays. At bl.portfolio, we have attempted this when it comes to the IT/Digital sector mutual funds, and it has played out well so far.

In our initial review of performance of IT funds (Technology funds review: Wait for a refresh), published in our print edition dated January 23, 2022, we had recommended that investors wait for a minimum 25 per cent correction in Nifty IT before taking exposure to these funds. This was when Nifty IT was hovering at around 36,000. Following a 26 per cent correction in Nifty IT from then, we recommended investors to start buying into IT funds in our article (Why it is a good time to invest in IT sector funds) published in our print edition dated September 25, 2022).

In both cases, the timing was near perfect, with our review capturing the peak and bottom of the cycle for Nifty IT. But we acknowledge the larger role of coincidence first, and second, the merits of following a valuation-based approach in getting this right. Since our positive recommendation on the IT sector funds, Nifty IT is up 40 per cent in 18 months, bettering Nifty 50’s 22 per cent return by a wide margin.

In the last one year, actively managed funds have performed even better. Franklin India Technology Fund (Franklin), Tata Digital India Fund, Aditya Birla SL Digital Fund, ICICI Pru Technology Fund have all outperformed benchmarks/sectoral index nicely by returning 57.6 per cent, 41.5 per cent, 40.7 per cent, 37 per cent respectively as against Nifty IT TRI of 33 per cent and BSE TECk TRI of 33.6 per cent in the same time frame.

However, though IT stocks dominate the portfolio, digital or technology funds offer more than just these. Investors have the telecom, overseas product software companies, search engines, social media firms, OTTs, e-commerce players, food apps, among a few other options. Diversification into these spaces explains some of the outperformance.

At the same time, a question arises as to what should investors do now post this outperformance?

In this context, with Nifty IT hovering at all-time highs even as earnings have been sluggish for many players in the sector, and outlook too uncertain, we believe it’s time to get cautious on IT stocks again. Hope of a recovery in this space has resulted in a multiple expansion-driven rally. But this may face speedbumps as demand outlook for tech spending (excluding AI-related technology) is still hazy. Headcount trends in large IT services companies such as TCS, Infosys and Wipro indicate that slow growth may sustain for some more quarters. Amidst these, the multiple expansion in IT stocks and hope rally face risk of faltering.

Hence, we recommend against any lumpsum investing at this point in time. To those who have near-term goals linked to these investments, we recommend taking some chips off the table.

For investors with another 7-10 year horizon from here, we recommend continuing with your SIPs.

For long-term investors, the fund route to investing in the technology theme still offers potential for reasonable returns, though it is better to temper expectations for the short to medium term.

Fund managers can shuffle holdings to decrease IT stocks and increase other segments to reflect market conditions, business prospects and valuations to deliver optimal returns.

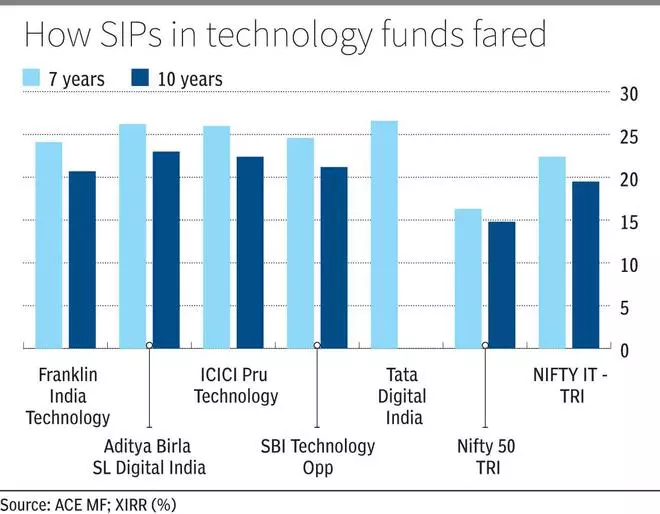

And most of the technology and digital funds have done well over the years across market cycles. The SIP route has usually worked well in the case of thematic funds. For example, despite being extremely volatile as a theme, infrastructure-related funds have done quite well when invested via the SIP route.

Three technology/digital funds have done well over the years and investors can continue with SIPs. ICICI Prudential Technology, Aditya Birla Sun Life Digital India and Tata Digital India are funds that investors can consider for long-term SIPs.

The first two are especially sound funds with a robust long-term track record. A 10-year SIP in ICICI Prudential Technology fund would have generated an XIRR of 22.4 per cent, while Aditya Birla Sun Life Digital India would have given nearly 23 per cent.

Thus, investors with a long-term perspective of 7-10 years can continue with their SIPs. This investment must be as a part of the satellite portfolio meant for diversification. Such thematic investments must not account for more than 5-10 per cent of the overall equity portfolio.

Published on March 16, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.