The number of small companies tapping the capital market itself was another new trend in 2022. | Photo Credit: indiaphotos

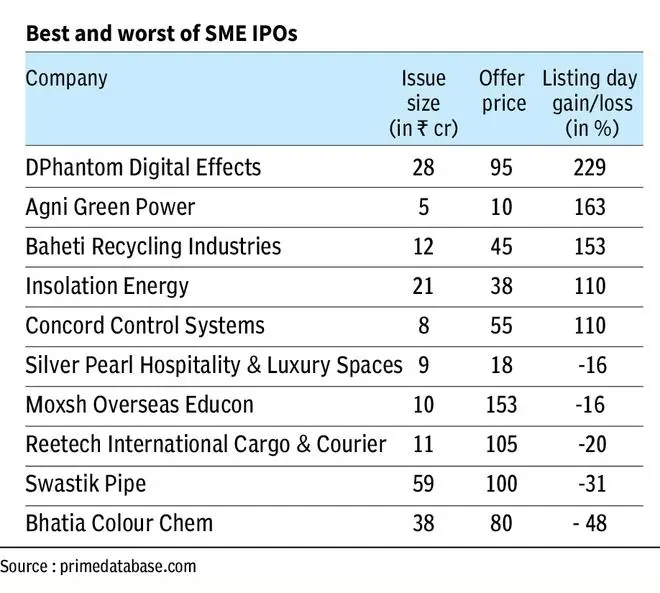

Great things come in small packages. Perhaps, investors who participated in the public issue of small and medium enterprises (SMEs) in the last one year will vouch for it. If 2021 was a blockbuster year for mainboard IPOs, 2022 turned out to be the year of SME IPOs with over two dozen stocks offering more than 100 per cent returns.

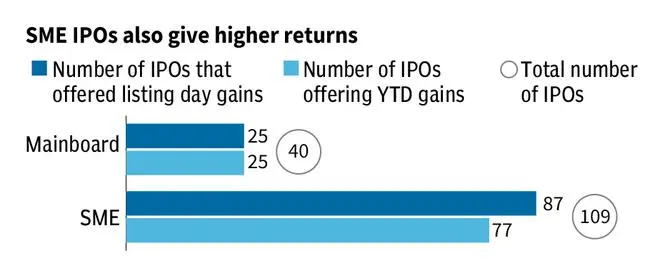

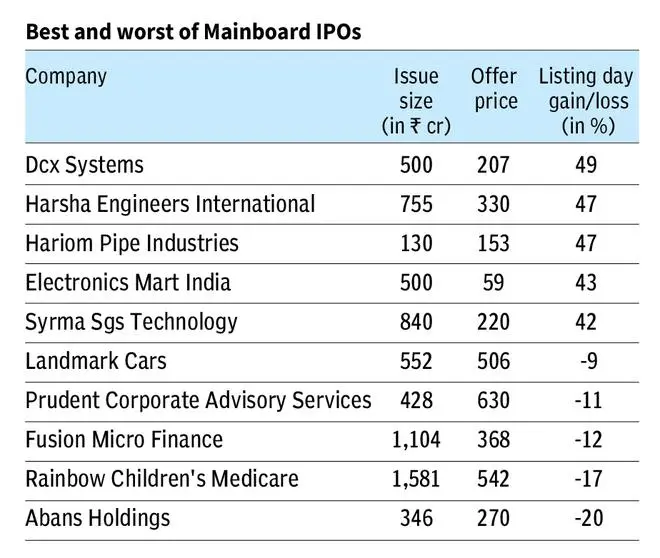

Data compiled from primedatabase.com show that 87 out of 109 SME IPOs that hit the capital market in 2022 offered listing gains to investors. The highest gain was 229 per cent. Eight SME IPOs have offered over 100 per cent listing gains to investors. In contrast, 25 out of 40 mainboard IPOs that hit the market last year delivered listing day gains.

Venkatraghavan S, Managing Director & Head - Equity Capital Markets, Equirus, said listing gains alone does not mean that the SME segment is better than the main board. He added that investors should take into account the quality of the companies, the industries they operate and various other external and internal factors.

Not just listing gains, 31 out of 109 SME IPOs that hit the market in 2022 are offering more than 100 per cent return since listing. Shares of Kolkata-based Cool Caps Industries hit a 52-week high of ₹415 apiece on Friday against its offer price of ₹38 per share. The stock closed at ₹375 apiece on the NSE with 888 percent return from its offer price. Similarly, Varanium Cloud (886 per cent), Rachana Infrastructure (637 per cent), Empyrean Cashews (584 per cent) and several other SME stocks have turned out to be a multibagger for investors.

However, not everything is hunky-dory in the SME IPO space. For instance, stocks of Pace E-commerce Ventures is trading at ₹30.5 apiece against its offer price of ₹103 per share. More than 25 SME stocks are currently trading way below their offer price.

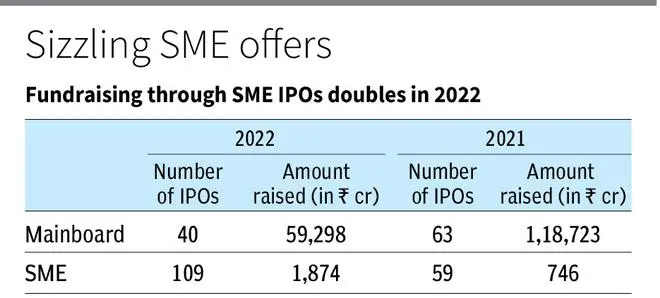

The number of small companies tapping the capital market itself was another new trend in 2022. While the number of mainboard IPOs reduced from 63 in 2021 to 40 IPOs in 2022, SME IPOs went up from 59 to 109 during the comparable period. Although insignificant compared to the mainboard IPOs, the total amount raised in SME IPOs more than doubled to ₹1,874 crore in 2022 against ₹746 crore in 2021.

Pranav Haldea, MD, PRIME Database Group, said one reason for the spurt in SME IPOs could be the funding winter faced by small companies in the private market, pushing them to tap the capital market.

Anand Varadarajan, Director, Asit C Mehta Financial Services Ltd, said, the improvement in the quality of the Indian financial market from a regulatory perspective and also the maturity of all market participants have reduced the risk perception that was present in the SME segment. “We expect the interest and performance of the SME segment to sustain and in fact improve in the future.”

Published on January 6, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.