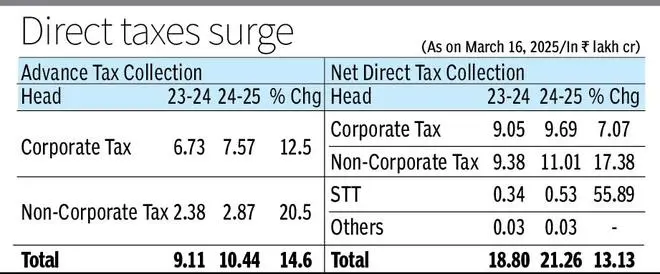

Boosted by strong growth in personal income tax-led non-corporate segments, advance tax collections in 2024-25 rose over 14 per cent, data by the Central Board of Direct Taxes (CBDT) on Monday showed.

With this, over 95 per cent of the Revised Estimate (RE) for direct taxes has been achieved.

Though the CBDT did not give any reason for the rise in the advance tax mop-up, it is believed that incomes of businesses and professionals are expected to see a significant growth. That is getting reflected in the higher advance tax collections from non-corporate assessees. At the same time, corporate profitability has seen an improvement which is why the rise in advance tax collections for both corporate and non-corporate categories was in double digits, the latter category registering a higher growth.

“The Index of Industrial Production (IIP) expanded by 5 per cent in January, marking the highest growth in eight months. This increase was driven by sectors such as capital goods, consumer durables, FMCG, healthcare, and pharmaceuticals, all of which reported strong year-on-year growth in the third quarter of FY25.

Over 4,000 listed corporates disclosed a revenue growth of 6.2 per cent, with EBITDA and PAT rising 11 per cent and 12 per cent, respectively, in Q3FY25 compared to the same quarter of the previous year,” said Aseem Mowar, Tax Partner at EY India.

According to Amit Maheshwari, Tax Partner at AKM Global, “The Income Tax Department’s continuous monitoring through AI-driven systems has played a crucial role in boosting advance tax collections by enhancing compliance and minimising evasion.”

Against the RE of ₹22.37-lakh crore for FY25, net collections reached ₹21.27-lakh crore as on March 16. With two more weeks left in the fiscal year, officials hope to meet the RE mainly on account of personal income tax-led growth in non-corporate tax.

“This trend shows an increasing reliance and growth on personal taxes as opposed to corporate income tax, said Rohinton Sidhwa, Partner at Deloitte India. Sandeep Jhunjhunwala, M&A Tax Partner at Nangia Andersen, said, “Emphasis on digitisation, exchange of information such as GST and PAN data integration, increased monitoring and audits by the Income Tax Department and improved tax awareness, have collectively left very little window for non-disclosure or non-payment of taxes both by corporates and individual taxpayers.”

Published on March 17, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.