Union Finance Minister Nirmala Sitharaman addresses a post Budget press conference at National Media Centre, in New Delhi, on Tuesday | Photo Credit: Shahbaz Khan

It was a shorter than usual budget speech by Finance Minister Nirmala Sitharaman but it packed quite a punch. There were no populist announcements, nor were there measures aimed at particular constituencies. The central theme of the speech was investment in infrastructure, and development. At the end of 90 minutes, both, the stock and bond markets were left breathless-- the former with excitement and the latter with disappointment. And both had very valid reasons for the varying emotions.

First the exciting part. In a veritable “capex mahotsav”, to borrow a phrase from Aditya Birla Group chairman Kumar Mangalam Birla’s letter to shareholders last week, Sitharaman surprised everyone, including the markets, with a massive 25 per cent jump in outlay for capital expenditure at ₹7.5 lakh crore. That’s about 2.9 per cent of GDP.

Together with grant-in aid to States, the effective capital expenditure for 2022-23 is projected to be about 4.1 per cent of GDP. That’s a significant number indeed, whichever way one looks at it. Combined with the ₹1 lakh crore in assistance to States for their capital investment (up from ₹15,000 crore in the revised estimate for FY22), the capex push can do wonders for growth and jobs creation if projects are identified carefully and implemented without hitches. The Centre-State partnership can help take growth to the hinterland regions where the States have the means to execute projects suited to their needs.

The Budget is characterised by conservative projections of the vital statistics starting with GDP and going down to revenue and expenditure. The emphasis seems to be on ‘under-promise and over-deliver’, which reminds one of IT major Infosys’ strategy on its way to becoming a star of the market.

The nominal GDP growth assumption of 11.1 per cent has left analysts stumped considering that only on Monday the Economic Survey had forecast a real GDP growth of 8-8.5 per cent. Is the government assuming a sub-4 per cent inflation, which is unbelievable, or is it assuming a much lower real GDP growth than what the Survey had forecast?

Gross tax receipts at ₹27.57 lakh crore is projected to grow 9.60 per cent over the revised estimate for this fiscal. This would actually mean that tax buoyancy will be less than 1! This is taking conservative budgeting to the extreme. Total expenditure at ₹39.44 lakh crore will be a little over 4 per cent higher than FY22, which, adjusted for inflation, is flat growth. Yet, it is understandable given the need to consolidate on the fiscal front.

Sitharaman has slipped marginally on the fiscal deficit target for FY22 at 6.9 per cent but she has projected an improvement to 6.4 per cent in FY23. Despite this, net borrowings are projected to jump by a big 44 per cent from ₹7.75 lakh crore to ₹11.20 lakh crore, which brings us to why the bond markets are sweating. The Finance Minister spoke about crowding in private investment in her speech but this massive borrowing may actually crowd out private borrowers from the market! Finance costs are bound to rise not just for the government but for other borrowers as well.

There is actually a 14.6 per cent decline in projected non-tax revenue with disinvestment proceeds leading the way. Compared to last year’s budget estimate of ₹1.75 lakh crore, the FY23 projection is more conservatively set at just ₹65,000 crore. With LIC’s IPO likely to happen in the current fiscal, the only big bang privatisation on the agenda for FY23 is that of BPCL.

There has been a sharp cutback in subsidies for fertiliser, food and petroleum. With oil prices on the boil, the government may well be forced to revise oil and fertiliser subsidy provisions upwards during the year. Similarly, the outlay for MGNREGA has been retained at ₹73,000 crore though the government spent ₹98,000 crore in FY22. The thinking appears to be that the outlay can be increased on a need basis with the accent clearly being on treating MGNREGA as a safety net only and not as a regular employment scheme.

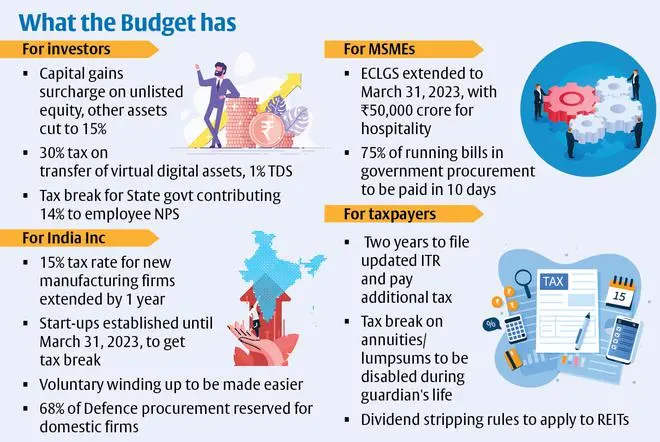

In a move that already has raised the ire of new age investors, Sitharaman proposes to tax what she calls as “virtual digital assets” or cryptos for short, at a big 30 per cent. Investors cannot set off losses from crypto trading against gains from other income and no deductions or exemptions will be allowed. Not just this, there will be a TDS of 1 per cent to get the transaction trail. And if you thought you could gift your crypto holding to non-assessee relatives, well, there will also be a tax on that! The government is clearly moving to make the crypto asset class unattractive.

For the MSMEs and the beleaguered hospitality industry, Sitharaman has announced an extension of the ECLGS scheme by another year to March 31, 2023 while also enhancing the total cover by ₹50,000 crore to ₹5 lakh crore. But she has disappointed the middle-class yet again. There are no tax breaks or concessions this year for them.

Published on February 1, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.