Overseas investors sold shares worth ₹10,578 crore, while domestic institutions bought shares worth over ₹4,000 crore on Wednesday | Photo Credit: PTI

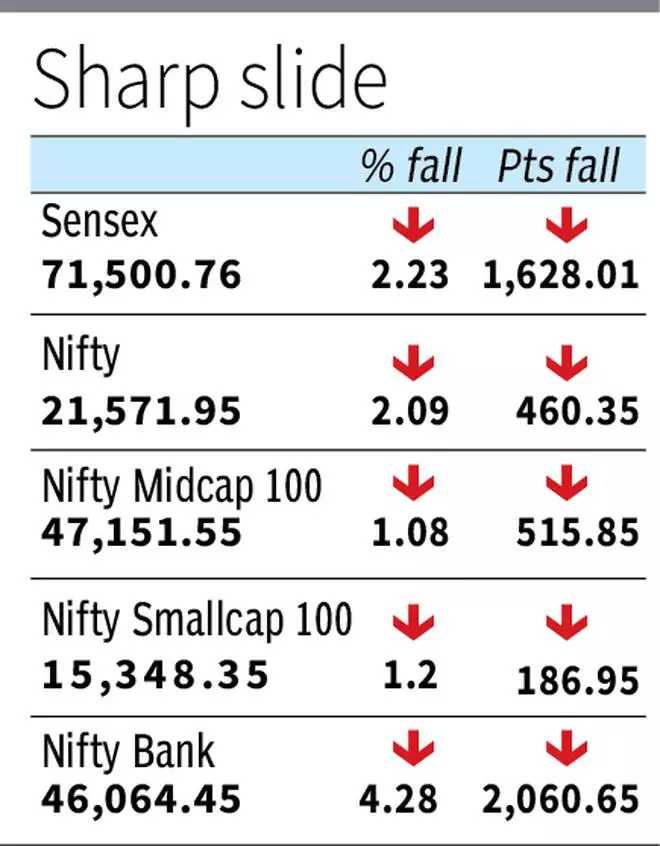

Benchmark indices went into a free fall on January 17, tanking over two per cent, to post their biggest single-day loss in the last one-and-a-half years.

HDFC Bank’s disappointing third quarter results, along with hawkish Fed commentary, escalating tension in West Asia, and weak GDP numbers from China, spooked investors.

The Nifty slid 2.09 per cent to close at 21,571. The Sensex ended at 71,500, down 1,628 points, or 2.23 per cent. Nifty VIX, a fear gauge, rose 11 per cent to 15.08.

Overseas investors sold shares worth ₹10,578 crore, while domestic institutions bought shares worth over ₹4,000 crore on Wednesday, provisional data showed.

Vinod Nair, Head of Research, Geojit Financial Services, said, “A correction in banking stocks, along with concerns over delays in US Fed rate cuts, impacted market sentiment. The addition of discouraging Chinese growth data and rising US bond yields also resulted in profit-booking.”

Federal Reserve Governor Christopher Waller said on January 16 morning that the central bank will likely cut rates this year but that the shift in monetary policy doesn’t have to be “rushed.” Ten-year US Treasury yields climbed to 4 per cent, while the dollar index rose to 103.38, its highest level in a month.

Back home, the higher-than-expected strain on HDFC Bank’s net interest margin weighed on banking stocks.

HDFC Bank shed 8.4 per cent and was the top loser, followed by Kotak Mahindra Bank, IDFC First Bank, and Axis Bank, which slid over 3 per cent each. All sectoral indices, except Nifty IT, ended in the red.

Asian indices fell, led by Hang Seng and Shanghai Composite, which slid 3.7 per cent and 2.1 per cent, respectively. European indices were trading about a per cent lower at 6 p.m. IST. China’s fourth-quarter GDP figures were slightly below expectations, bringing CY23 growth to 5.2 per cent.

The market will now turn its attention to quarterly results for stock-specific action and may consolidate after a sharp sell-off.

“With the street baking in good earnings growth for most mid-cap names, incremental flows will be driven by how close actual releases come versus built-in expectations,” said Jaykrishna Gandhi, Head of Business Development, Institutional Equities, Emkay Global Financial Services.

Published on January 17, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.