| Photo Credit: SHAILESH ANDRADE

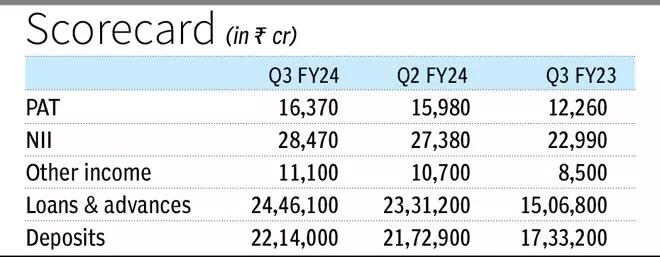

HDFC Bank posted a 33.5 per cent year-on-year rise in net profit for Q3 FY24 at ₹16,370 crore, on the back of robust growth in both net interest income and other income. Sequentially, the profit after tax was 2.5 per cent higher.

Net interest income (NII) rose 23.9 per cent y-o-y and 4.0 per cent q-oq to ₹28,470 crore. Other income for the quarter was up 31 per cent y-o-y and 4 per cent q-o-q to ₹11,140 crore, led by strong growth in fees and commissions, and trading and mark to market gains.

The year-on-year figures for the bank include the impact of the merger of erstwhile parent HDFC effective July 1, 2023, and are thus not directly comparable.

Gross advances were at ₹24.69-lakh crore, registering an increase of 62.4 per cent on year. Domestic retail loans grew 111.1 per cent, commercial and rural banking loans by 31.4 per cent, and corporate and other wholesale loans (excluding non-individual loans of eHDFC Ltd of approximately ₹98,900 crore) grew by 11.2 per cent. Overseas advances constituted 1.7 per cent of total advances.

In the post earnings call, CFO Srinivasan Vaidyanathan said much of the commercial and rural banking book, which has seen strong growth, is eligible under priority sector lender (PSL), and is thus also helping the lender meet its PSL targets.

In the retail segment, the bank sees good opportunities in the mortgage book, both from existing and new customers. In the non-mortgage book, the lender has a strong pipeline of pre-approved and eligible customers, and the bank now has a dominant share in the high credit quality (above 760 credit score) customers. Vaidyanathan said the bank will continue to focus on more margin accretive segments and expects the share of retail and mortgage loans to continue to rise from the current level.

On the wholesale side, while the bank is seeing demand it has turned slightly cautious due to pricing competitiveness in the market, especially from PSU banks. Even so, HDFC Bank will continue to maintain business relationships with all its client corporates to facilitate other funding avenues such as supply chain finance and tapping the capital markets, Vaidyanathan said.

Core net interest margin for the quarter was at 3.4 per cent on total assets, and 3.6 per cent on interest earning assets, flat compared with the previous quarter. In the year ago period, NIM was 4.1 per cent on total assets and 4.3 per cent on interest earnings assets.

Vaidyanathan said margins will continue to remain under pressure due to the ongoing deposit repricing which tends to happen with a lag, and the propensity of customers to invest in higher yielding investments such as term deposits towards the end of a rate cycle in order to lock-in the higher returns. However, the bank’s margin sensitivity has historically been low at 5-10 bps and margins should continue within this range going forward supported by the increasing share of retail loans in the asset mix.

Deposits of the bank rose 27.7 per cent yoy to Rs 22.14 lakh crore, led by 42.1 per cent growth in time deposits and 9.5 per cent in CASA deposits. CASA ratio of the bank stood at 37.7 per cent at the end of December.

Gross NPA ratio of the bank fell to 1.26 per cent as of December 31, 2023 from 1.34 per cent a quarter ago, but was slightly higher than 1.23 per cent a year ago. Net NPA ratio stood at 0.31 per cent, with Vaidyanathan saying that the credit quality of the portfolio is ‘stable to improving’ and the credit environment remains benign.

Published on January 16, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.