Coin stacks and chart graphs on a chessboard background. Horizontal composition with selective focus and copy space. | Photo Credit: MicroStockHub

Stock Market today | Share Market Live Updates - Find here all the live updates related to Sensex, Nifty, BSE, NSE, share prices and Indian stock markets for 16th June 2025

- 13:44 | June 16, 2025

Commodity Calls: Lead futures probing a barrier

- 13:40 | June 16, 2025

Stock Market live today: ITC completed the acquisition of a 100% equity stake in Sresta Natural Bioproducts, stocks trade up

ITC share inched up 0.99% on the BSE to ₹418 after opening at ₹413.90. ITC completed the acquisition of a 100% equity stake in Sresta Natural Bioproducts Pvt Ltd (SNBPL) for ₹400 crore.

- 13:21 | June 16, 2025

Stock market live updates today: Bigbloc Construction approves proposal for issuance of equity shares by way of an IPO; stock zooms on NSE

Bigbloc Construction has informed the shareholders of subsidiary company, Starbigbloc Building Material Ltd, that it has approved a proposal for issuance of equity shares by way of an Initial Public Offering (IPO), subject to receipt of necessary regulatory approvals, market conditions, and other applicable approvals as may be required.

Bigbloc Construction stock zoomed 14.62% on the NSE to ₹73.60

- 13:11 | June 16, 2025

Stock market live updates today: Sanjay Kumar, CEO & MD, Rassense Pvt Ltd on WPI Data of May 2025

The cooling down of WPI consecutively for the third time in a row to a 14-month-low, trailing CPI to a nearly 6-year low, along with the RBI rate cut, defines an ideal economic growth sentiment across the country. This has led to a well-sustained moderation in food inflation, which is a great relief for both individual consumers and the food services sector. With the backdrop of a favourable monsoon and a strengthened liquidity flow in the hands of the consumers, we foresee a balanced sentiment going forward that will continue to keep the inflation within the targeted range.

Having said that, it will be critical for industry players to keep a constant watch on commodity trends and develop agile procurement models. There is massive scope for policymakers and businesses to collaboratively balance inflation control through the integration of AI at the grassroots level which will ease the burden on consumption-driven sectors like food services and retail.

- 13:08 | June 16, 2025

Stock market live updates today: Market rebound sharply driven by IT stocks, Nifty 50 climbs to 24,900 level

Equity benchmark indices staged sharp rebound on Monday following broad-based selling in the last two trading sessions due to geopolitical situation in Iran and Israel, and ongoing US-China trade negotiations.

- 13:07 | June 16, 2025

Stock market live updates today: Waterways Leisure Tourism which operates “Cordelia Cruises” files DRHP for IPO

- 13:02 | June 16, 2025

Stock market live updates today: Arkade Developers announced their foray into Thane with a Rs 2000 crore project.

- 12:51 | June 16, 2025

Stock market live updates today: Hindustan Zinc targets ramp up of silver output using new technology

Mining major Hindustan Zinc plans to increase its silver production to 1500-2000 tonne from 700 tonne amid the ongoing rally in the precious metal.

- 12:47 | June 16, 2025

Stock market live updates today: Muthoot Capital Services board proposes issuance of Non-Convertible Debentures amounting to ₹50 crore; stock traded at ₹294.35 on the NSE, down 3.11%.

- 12:46 | June 16, 2025

Stock market live updates today: Archies has received a $8 lakh export order from big US parties. Stock surges 5.07% on the NSE to ₹22.60

- 12:21 | June 16, 2025

Stock market live updates today: Capri Global Capital Ltd completes Qualified Institutions Placement, raising primary equity capital of ₹2,000 crore; stock trades down

Capri Global Capital Ltd completes Qualified Institutions Placement, raising primary equity capital of ₹2,000 crore by issuing approximately 136.5 million shares to Qualified Institutional Buyers. Stock traded at ₹168.87, down 1.32%

- 12:19 | June 16, 2025

Stock market live updates today: AlphaGrep receives in-principle approval from SEBI to sponsor mutual fund

- 12:19 | June 16, 2025

Stock market live updates today: TCS inks long-term strategic partnership with Denmark-based Salling Group, retail group operating across Denmark, Poland, Germany, Estonia, Lithuania, and Latvia

Tata Consultancy Services (TCS) has entered a long-term strategic partnership with Denmark-based Salling Group, a major retail group operating across Denmark, Poland, Germany, Estonia, Lithuania, and Latvia. The collaboration, announced on June 16, 2025, focuses on driving digital transformation and AI-enabled cloud migration to enhance sustainability, accelerate technology innovation, and improve operational efficiency across Salling Group’s 2,100 stores and 68,000 employees. TCS will leverage its AI-enabled Cloud Exponence solution to optimize cloud management through automation and intelligent services, supporting Salling Group’s transition to a scalable cloud infrastructure. The partnership also aims to enhance Salling Group’s e-commerce platform to align with evolving consumer expectations.

- 12:17 | June 16, 2025

Stock market live updates today: Zee Entertainment Enterprises in focus amid two critical board meetings

Zee Entertainment Enterprises Ltd. is in focus today, June 16, 2025, due to two critical board meetings. An investment banker will present a strategic review covering the company’s 3–5-year business plans, growth strategies, risk mitigation measures, and fundraising options. A second meeting will see the board deliberate on these recommendations, deciding whether to adopt them fully or partially.

This comes amid recent developments for Zee, including the resignation of independent director Adesh Kumar Gupta on June 12, 2025, due to increased professional commitments, and the company’s ongoing recovery efforts post the collapsed Sony merger and a failed $1.4 billion cricket TV rights deal with Disney Star. Some users optimistic about Zee’s stock potential, citing a target price of 165–170, while others note concerns over high valuations and promoter share pledging (99.81% as per BSE data).

These meetings could signal pivotal strategic shifts, impacting investor confidence and stock performance.

- 12:15 | June 16, 2025

Stock market live updates today: Spicejet shares flat after rocketing 5% on Q4 results; Nuvama, InCred maintain hold calls

SpiceJet shares gained 5 per cent in early trade on Monday after posting a record high quarterly net profit of ₹319 crore for Q4 FY25.

- 12:15 | June 16, 2025

Stock market live news: Baltic Dry Index, a key indicator of global shipping rates for dry bulk commodities, surged 20% last week, reaching 1,968 points, its highest level since October 2, 2024

The Baltic Dry Index (BDI), a key indicator of global shipping rates for dry bulk commodities like coal, iron ore, and grains, surged 20% last week, reaching 1,968 points, its highest level since October 2, 2024. This followed a 9.6% jump on Thursday to 1,904 points, driven by rising rates across capesize, panamax, and supramax vessel segments. The rally reflects robust global trade activity, with increased demand for shipping raw materials, particularly linked to economic signals from China. Also highlight sentiment tying the spike to geopolitical tensions, such as the Iran-Israel conflict, pushing tanker and shipping rates higher. However, the index’s rise suggests strong trade flows, countering recessionary concerns.

- 12:13 | June 16, 2025

Stock market live updates today: BELRISE IND Q4 ; NET PROFIT AT 110 CR V 16.3 CR YOY

REVENUE AT 2274 CR V 1526 CR

BELRISE Q4 ; EBITDA AT 277 CR V 180 CR YOY

MARGINS 12.1 % V 11.7 %

- 12:12 | June 16, 2025

Stock market live updates today: United Drilling Tools secures ONGC order for casing pipes; United Drilling shares rally on NSE and ONGC shares rise 1.71%

United Drilling Tools has secured an order from Oil and Natural Gas Corporation (ONGC) Ltd for the supply of Large Outer Diameter (OD) casing pipes with connector and the order valued at ₹1075.47 million (including GST) is scheduled to be fulfilled over a period of approximately nine months.

United Drilling shares rallied 12.11% on the NSE to ₹227.95 and ONGC shares rose 1.71% to ₹255.80.

- 12:09 | June 16, 2025

Stock market live updates today: InCred Money enters retail broking through proposed acquisition of South Asian Stocks

InCred Money has announced its entry into retail broking through the proposed acquisition of South Asian Stocks Ltd (SASL), which operates as ‘Stocko’. Stocko clocks a daily notional turnover of around ₹1 lakh crore - making it one of the most active discount brokers in the country.

- 12:08 | June 16, 2025

Stock market live updates today: BSE snapshot at 12 noon

Of 4,042 stocks traded on the BSE at 12 noon on June 16, 2025, 1,454 advanced against 2,363 stocks that declined, and 225 remained unchanged. While 78 stocks recorded a 52-week high, 60 hit a 52-week low. A total of 194 stocks traded in the upper circuit, and 220 in the lower circuit.

- 12:07 | June 16, 2025

Stock market live updates today: String Metaverse secures Canadian fintech licence, Rebrands to STRING PAY X LTD (String Group Entity)

- 12:06 | June 16, 2025

Stock market live updates today: Nazara Publishing Launches Pokerverse VR

Pokerverse VR, an immersive multiplayer poker experience for Meta Quest and Apple Vision Pro, is now available worldwide. Developed by Hyderabad-based studio YesGnome and published by Nazara Publishing, this marks Nazara’s debut in Virtual Reality / Metaverse gaming.

Nazara stock traded flat on the NSE at ₹1,337.

- 12:05 | June 16, 2025

Stock market live updates today: Omaxe Ltd extends presence in Punjab with launch of integrated township — New Amritsar; stock jumps 9.03% on NSE

Omaxe Ltd., one of India’s leading real estate developers, is deepening its presence in Punjab with the launch of its latest integrated township — New Amritsar, through its subsidiaries. Located strategically on the GT Road, just 12 minutes from the Golden Temple, Omaxe has acquired 260 acres of land for this township, and in the first phase, is developing 127 acres with an investment of over Rs. 1,000 crore

Stock jumps 9.03% on the NSE to ₹103.99

- 11:45 | June 16, 2025

Stock market live updates today: India Inc’s operating profit margins seen at 18.2-18.5% in Q1 FY2026, 10-40 bps higher YoY: ICRA

Rating agency ICRA forecasts India Inc’s operating profit margins (OPM) at 18.2-18.5% in Q1 FY2026, following thesequential recovery over the past few quarters. This, coupled with a moderation in interest costs, owing to therecent repo rate cuts aggregating to 100 bps, will result in an improvement in the interest coverage ratio for IndiaInc. to around 5.1-5.2 times in Q1 FY2026, against 5.0 times in Q4 FY2025.Commenting on the trends, Kinjal Shah, Senior Vice President & Co-Group Head – Corporate Ratings, ICRALimited, said: “Given the uncertain global environment, ICRA expects the private capital expenditure (capex) cycleto remain measured. However, certain sunrise sectors such as electronics, semi-conductors and niche segmentswithin the automotive space like electric vehicles will continue to see a scale-up in investments, in line with thevarious production-linked incentives programmes announced by the Government of India (GoI). Further, entitieslinked with the Indian Railways and Defence sectors would also see their large order books translating into revenuesand earnings.”ICRA’s analysis of the performance of 589 listed companies (excluding financial sector entities) in Q4 FY2025revealed 7.6% YoY revenue growth, supported by improved demand across consumption-oriented sectors likeconsumer durables, retail, hotels and airlines as well as infrastructure-oriented sectors like power, real estate andconstruction. On the other hand, sectors like iron and steel saw some decline, following lower realisations owingto weak global demand and influx of cheaper imports from China.India Inc. is expected to report stable revenue growth in Q1 FY2026 supported by resilient domestic demand - whilerural demand is expected to remain healthy, urban demand looks set to recover supported by income tax relief,easing food inflation, and reducing EMI burden. Nonetheless, the ongoing geopolitical tensions continue to impactdemand sentiments, especially for export-oriented sectors such as agro-chemicals, textiles, auto and autocomponents, cut and polished diamonds, and IT services.Corporate India reported a YoY expansion in OPM in Q4 FY2025, by 63 bps to 18.5% reaching its peak since Q4FY2022. The expansion was on the back of improved operating leverage owing to robust demand led by sectorslike power, airlines and real estate, coupled with some moderation in input costs. Moreover, on a sequential basis,the OPM improved by around 41 bps in Q4 FY2025. The interest coverage ratio of ICRA’s sample set companies,adjusted for sectors with relatively low debt levels (IT, FMCG and pharmaceuticals), improved on a YoY basis to 5.0times in Q4 FY2025 from 4.8 times in Q4 FY2024 due to increased profitability. Range-bound debt levels coupledwith better profitability of India Inc. in FY2025 across industrial, capital goods and construction sectors led to animprovement in gearing and total debt vis-à-vis operating profit before interest, tax and deprecation.The recovery in the OPM for India Inc witnessed over the past quarters is likely to be sustained at 18.2-18.5% in inQ1 FY2026, supported by steady demand owing to improved consumer sentiments and softening of some inputcosts like crude oil, coal and steel. Coupled with the expected decline in interest costs following the rate cuts, thisshall lead to an improvement in the interest coverage ratio to around 5.1-5.2 times in Q1 FY2026.

- 11:43 | June 16, 2025

Stock market live updates today: SEBI resolves 4,493 investor complaints in May 2025 through its SCORES complaint redressal platform

The Securities and Exchange Board of India (SEBI) resolved 4,493 investor complaints in May 2025 through its SCORES (SEBI Complaint Redressal System) platform. SEBI received 4,793 new complaints during the month, with 4,563 complaints remaining unresolved by May 31, slightly up from 4,263 pending cases at the end of April. The average resolution time for Action Taken Reports (ATRs) submitted by entities was eight days, while First Level Review complaints took five days on average. Notably, Smartowner Capital Growth Trust was the only entity with a complaint unresolved for over three months as of May 31.

- 11:42 | June 16, 2025

Stock market live updates today: Tata Consultancy Services inks long-term, strategic partnership with Salling Group; stock rises on NSE

Tata Consultancy Services has entered a long-term, strategic partnership with Salling Group to drive sustainability, technology innovations and improve organizational efficiency.

TCS stock rose 1.58% on the NSE to ₹3,500.30.

- 11:23 | June 16, 2025

Stock market live updates today: Integrum Energy Infrastructure Limited received in-principle approval from BSE

The Bombay Stock Exchange (BSE) has approved the Draft Red Herring Prospectus of Integrum Energy Infrastructure Limited for IPO.

- 11:09 | June 16, 2025

Share market live updates: Geopolitical tensions drive gold toward $3,500 as safe-haven demand surges, says Renisha Chainani, Head of Research at Augmont

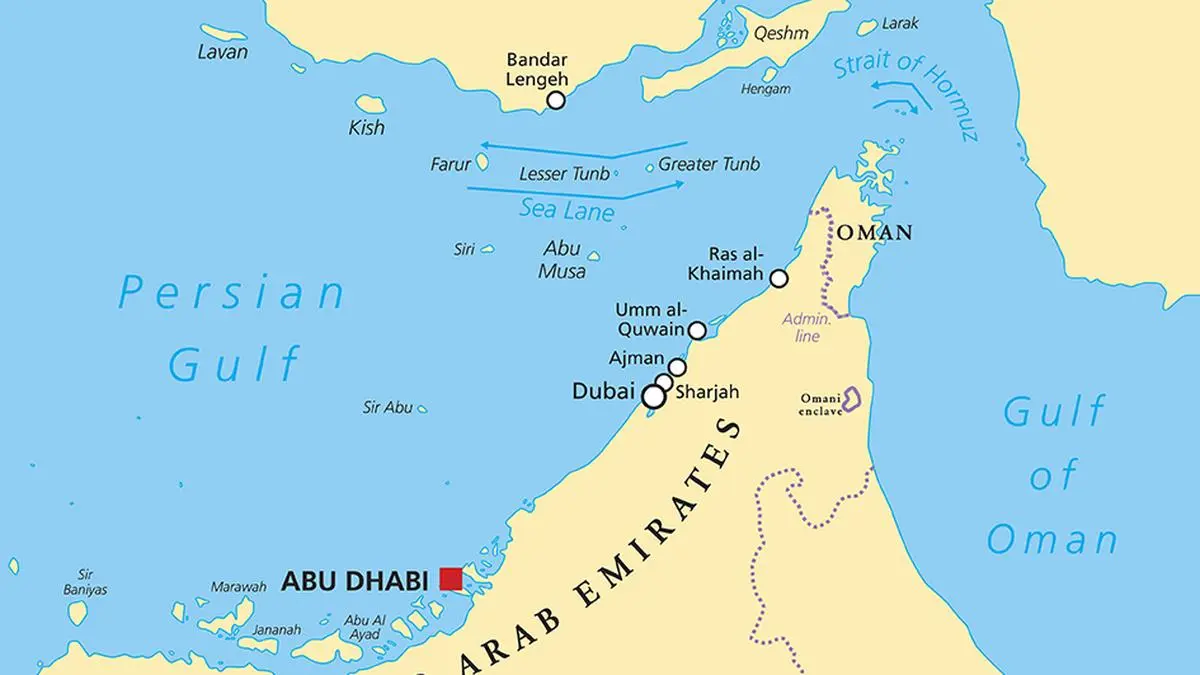

Renisha Chainani, Head of Research at Augmont, writes: Geopolitical tensions in the Middle East, particularly those involving the US, Iran, and Israel, maintain the demand for safe-haven assets high, which is keeping precious metals in a bullish momentum. China and Russia are the two central banks that are still hoarding physical gold, and the Dollar Index’s stabilisation below 105 provides another technical tailwind.

The rally has been mostly fuelled by the threat posed by President Donald Trump’s aggressive tariff program to global economic development, but the recent spike in geopolitical risk has given it further energy. In 2025, gold has increased by almost 30%, and central banks’ attempts to diversify away from the dollar have been a major factor.

Over the weekend, Israel and Iran bombarded one another with missiles and drones, with the fighting raising energy prices and endangering regional transportation and energy infrastructure. The head of Iran’s Islamic Revolutionary Guard Corps, Major General Hossein Salami, and the chief of staff of the army were killed last week when Israel attacked Iranian nuclear installations and the nation’s military leadership.

Iran responded by firing missiles and drones at Israel, claiming that Israel had declared war. However, there are concerns that the battle may escalate, endangering the Persian Gulf oil supply and causing broader economic repercussions that might reinforce the precious metal’s price.

What was once classified as tail risk — a speculative “what if everything goes wrong” situation — is now a live-wire reality. There is no fat tail here. There are teeth on this tail. Like a war tax, a geopolitical premium has been imposed on every barrel, and traders are adjusting more quickly than you can say “South Pars.”

In a traditional safe-haven move, gold increased in value alongside the dollar after the Israeli attack. It remains to be seen if the attack was the catalyst that rekindled the gold market and sparked a new surge towards over $3,500. Nonetheless, it appears to be the least difficult course of action when combined with central bank demand, worries about fiscal debt, and improving US economic data that suggests rate decreases.

Three pivot points are currently being watched by markets: To what extent will Iran respond? Will proxies and patrons be involved, or will this be a bilateral matter? Will American assets be directly targeted or even seen as such? As soon as Washington becomes involved, even through rhetoric, we can anticipate a spike in oil prices and an increase in gold prices due to demand for safe-haven assets.

Since US President Donald Trump will be imposing tariffs on trading partners in the upcoming weeks, investors are also anticipating further details about his tariff plans.

Technically speaking, gold prices are above the $3410 (~₹99000) resistance zone, which corresponds to the upper bound of the rising wedge formation. The April ATH of $3500 (~₹101,500) may reappear if a move above this zone opens the way for last week’s high around the psychological level of $3468 (~₹100,700). A violation of this zone might open the door for the next significant psychological milestone of $3270 (~₹92500) if bearish momentum is to acquire traction.

- 11:04 | June 16, 2025

Share market live updates: Sensex climbs over 500 pts

- 11:03 | June 16, 2025

Share market live updates: Lupin inks pact with Sino Universal for Tiotropium DPI in China

Lupin and Sino Universal Pharmaceuticals Sign License and Supply Agreement for Tiotropium DPI in China

Lupin shares traded flat on the NSE at ₹2,007.40

- 11:01 | June 16, 2025

Share market live updates: Sun Pharma stock falls 2% to ₹1,655.70 after USFDA visit

Sun Pharmaceutical stock fell nearly 2% to ₹1,655.70 after its drug manufacturing facility in Halol, Gujarat, received eight observations from USFDA.

The stock currently trades flat on the NSE at ₹1,679.20.

- 10:59 | June 16, 2025

Share market live updates: Tata Motors share price falls 6% as JLR trims FY26 margin forecast

- 10:49 | June 16, 2025

Stock market live updates today: Nifty Bank prediction today – June 16, 2025: Index tracing a narrow range

- 10:39 | June 16, 2025

Stock market live updates today: Kings Infra Unveils Strategic Growth Vision with BlueTech Transformation, Andhra Expansion, and Professional Leadership

- 10:38 | June 16, 2025

Stock market live updates today: Spicejet shares traded positive on record high quarterly net profit of ₹319 crore for Q4 FY25

Spicejet shares traded 1.44% positive on the BSE at ₹44.44 on posting a record high quarterly net profit of ₹319 crore for Q4 FY25, from a loss during the corresponding period of the previous fiscal year.

The stock opened higher at ₹46 from the previous close of ₹43.81.

- 10:37 | June 16, 2025

Stock market live updates today: MSCI rejig: Swiggy, Mazagon Dock, Hitachi Energy & Waaree Energies likely to be added in August 2025 rebalancing

The MSCI India Standard Index is set to rebalance after the market hours on August 7, 2025. According to JM Financial, the MSCI August 2025 rejig would see as many as four inclusions having an estimated inflow of $850 million.

- 10:36 | June 16, 2025

Stock market live updates today: Domestic markets muted as West Asia conflict dents sentiment

The benchmark indexes were muted on Monday, pausing after two straight sessions of losses as the conflict between Israel and Iran showed no signs of cooling, keeping investors wary and adding to geopolitical uncertainty around the world.

- 10:25 | June 16, 2025

Stock market live updates today: Nifty prediction today – June 16, 2025: Intraday rise possible. Go long now and on dips

Nifty 50 began the week on a flat note and is trading stable. The index has been oscillating between 24,700 and 24,800. It is currently trading at 24,731. The Israel-Iran conflict is continuing to weigh on the market sentiment. The advances/declines ratio is at 27:23. This give a mixed outlook.

- 10:21 | June 16, 2025

Stock market live updates today: BLUE STAR SAYS THEIR EXPECTED GROWTH NOW AT 10-15% VS 20% AS EARLIER STATED -NDTV PROFIT (NEGATIVE FOR STOCK PRICES

- 10:21 | June 16, 2025

Stock market live updates today: Stock Update

Tata Motors fell by 5% as JLR expects the margin of 5-7% versus 10% of previous year.

Tata Motors: 679, Down 4.80% (Support: 667/658.8)

- 10:20 | June 16, 2025

Stock market live updates today: BRokerage view

UBS on Hyundai Motor

Initiate Buy, TP Rs 2350

Capacity expansion to drive strategic shift

Co has led in driving premiumisation in India

Operating leverage & exports to drive industry-leading margins

Foresee mix & operating leverage improvement, driving a 16% FY26-28 EBITDA CAGR

GS on Kotak BK

Buy, TP Rs 2478

Management meet takeaways

Margins to face near-term pressure, though decline in deposit costs to offer support eventually

Expects credit costs to remain elevated in 1HFY26 but to trend lower in 2nd half

Focus on profitable growth

Deposit growth to be supplemented by excess liquidity as well as tax cuts.

Mixed signals in Commercial Vehicles

Branch Expansion and Tech Investment to Elevate Cost Ratios in FY26.

Antique on HDFC Life

Takeaways from management meet

Regulatory concerns and competitive pressures seem to be receding;

Management reiterated their aspiration to grow APE ahead of industry average and double VNB every 4-4.5 years;

1QFY26 is trending better with Apr-May’25 posting 10% retail APE growth and 14.4% total APE growth;

Focus on driving higher absolute VNB growth rather than margins

Favorable product mix may aid VNB margin performance, but the same would be invested in distribution and technology, and hence margins may remain rangebound in the near-term with a positive bias in the medium term.

Agency & broker channel to drive higher growth; banca to focus on profitability

Our FY26-27E APE/ VNB/ EV estimates remain unchanged.

Expect 16%-17% APE/ VNB CAGR over FY25-27E

Jefferies on Indian Hotels

Maintain Buy with target price of Rs 980

Management alluded to the scale-up and transformation over the past 8 years

Focus on topline diversification to hedge cyclicality

Reaffirmed positive demand-supply hospitality cycle in India

It maintained double-digit rev growth guidance for FY26

UBS on OMCs

Crude prices up sharply; OPEC+ spare capacity limits upside

OMCs: above normal margins even with crude at $75/bbl

CGDs: higher crude prices to increase cost of gas, pressuring margins

Gas utilities : marginal impact on LNG imports; positive for GAIL

Jefferies on GMR Airports

Buy, TP Rs 100

Mgmt discussed India’s regulatory landscape & recent receipt of new Tariff for Delhi Airport, which should drive steep profit uptick for Co & moderation of leverage ratios

Co is focussing on adding strong consumer retail biz at airports

Jefferies on BSE

Hold, TP Raised to Rs 2900

Transition to common contract note can aid liquidity & mkt share.

Newer derivatives instruments & growth in data services will aid profits.

See 30% PAT CAGR over FY25-28

Jefferies on Ambuja Cements

Buy, TP Rs 700

Mgmt remains confident of touching cement capacity target of 140MTPA by FY28

It updated on cost efficiency targets scaling up over next few yrs

Mgmt expects industry demand to recover to 7-8% in FY26.

Jefferies on HDFC BK

Buy, TP Rs 2380

NIMs will have near-term correction & rise in FY27; asset quality is holding up well

See recent allegations on bank/CEO as a non-event, albeit noisy.

Bank stays among top picks in sector

Jefferies on Interglobe Aviation

Buy, TP Rs 6300

Int’l segment is a key growth lever with new fleet, new routes.

Co is expanding its Geo and customer profile with recent initiatives.

Jefferies on Max Fin

Buy, TP Raised to Rs 1830

Reduced risk of banca norms with benefits of Insurance Act changes can be positive for them.

Axis-Max Life offers better risk reward and is among our top sector picks.

Kotak Inst Eqt on NMDC

Sell, TP Rs 55

Ramp-up of merchant iron ore mines in India and weaker exports should add to pricing pressure.

Fundamentals of seaborne iron ore market remain challenging, with increasing low-cost supply and weak Chinese demand

CITI on NMDC

Sell, TP Rs 60

Think STK prices could likely correct:

Expect domestic steel prices to correct as steel imports pick up (May25>Apr25) – pricing is at a premium to import parity.

Our global team believes iron ore market is likely to remain in small surplus in 2025

Macquarie on Persistent

O-P, TP Rs 7330

With RoCE of 40% as of FY25 and EBIT margin that has room to expand, think PSYS’ valuation premium vs peers will sustain

UBS on Sun Pharma

Buy, TP Rs 2450

Industry expectations on tariff announcement is for next month

In interim, nature of eight observations at Halol plant are important

JPM on HDFC AMC

Downgrade to Neutral, TP Rs 5000

Further, SIP flows stay resilient, which see as a medium-term driver of investment case for stock

These positives appear to be adequately discounted at FY26/27 PE of 37x/33x

- 10:20 | June 16, 2025

Stock market live updates today: Listing ceremony of Sacheerome Limited will be starting soon at our exchange @NSEIndia . Watch the ceremony live!

- 10:17 | June 16, 2025

Stock market live updates today: Rupee falls 6 paise to 86.17 against US dollar in early trade

Rupee declined 6 paise to 86.17 against the US dollar in early trade on Monday as global crude oil prices continued to surge amid escalating tensions in West Asia.

- 10:15 | June 16, 2025

Stock market live updates today: Crude oil futures rise as Israel-Iran tensions escalate

Crude oil futures traded higher on Monday morning as Israel and Iran continued attacks on each other over the weekend.

- 10:14 | June 16, 2025

Stock market live updates today: Govt must urgently review energy risk scenarios due to Iran-Israel war: GTRI

With the Israel-Iran conflict intensifying, the government must urgently review energy risk scenarios, diversify crude sourcing and ensure strategic reserves are sufficient, think tank GTRI said on Sunday.

- 09:54 | June 16, 2025

Stock market live updates today: Major gainers and losers on the NSE as at 9.50 am

Major gainers: Cipla (+1.45%), Bharti Airtel (+0.88%), SBI Life (+0.80%), Power Grid (+0.80%), UltraTech (+0.70%)

Major losers: Tata Motors (-4.64%), Jio Financial (-2.07%), Dr Reddy’s (-1.43%), Coal India (-1.23%), Adani Enterprises (-1.12%)

- 09:54 | June 16, 2025

Stock market live updates today: Gold glimmers near two-month high as Middle East conflict escalates

Gold prices rose on Monday, nearing a two-month high as investors sought refuge in safe-haven assets after intensified clashes between Israel and Iran stoked fears of a broader regional conflict.

- 09:52 | June 16, 2025

Stock market live updates today: Bajaj Finance Share Price Live: Stock trades ex-bonus, ex-stock split

Catch share price movements of Bajaj Finance live here

- 09:43 | June 16, 2025

Stock market live updates today: Sterlite Technologies expands Data Centre portfolio to meet emerging requirements for AI data centres. Stock soars 5.96% on the NSE to ₹88.30

- 09:43 | June 16, 2025

Stock market live updates today: Crude oil futures trade higher on Monday morning as Israel and Iran continue attacks on each other

Crude oil futures traded higher on Monday morning as Israel and Iran continued attacks on each other over the weekend. At 9.32 am on Monday, August Brent oil futures were at $74.88, up by 0.88 per cent, and August crude oil futures on WTI (West Texas Intermediate) were at $71.94, up by 0.91 per cent. June crude oil futures were trading at ₹6338 on Multi Commodity Exchange (MCX) during the initial hour of trading on Monday against the previous close of ₹6285, up by 0.84 per cent, and July futures were trading at ₹6206 against the previous close of ₹6161, up by 0.73 per cent.

- 09:40 | June 16, 2025

Stock market live updates today: HBL gets South Central Railway contract for upgradation of the Kavach system; HBL Engineering stock surges on NSE

South Central Railway has issued a letter of acceptance to HBL for upgradation of the Kavach Version 3.2 to Version 4.0 in Mudkhed (Including)- Manmad. Contract value: ₹30.67 cr. HBL Engineering stock surges 3.22% on the NSE to ₹608.40

- 09:37 | June 16, 2025

Stock market live updates today: Godrej Properties to develop 14-acre land parcel in Hoskote, Bengaluru. Stocks inch up 0.69% on the NSE to ₹2,418.60

- 09:36 | June 16, 2025

Stock market live updates today: Nucleus Software appoints Aabhinna Suresh Khare as its new Chief Marketing Officer

- 09:22 | June 16, 2025

Stock market live updates today: Sensex gained 248.02 points or 0.31% to 81,366.62 as at 9.18 am after opening lower at 81,034.45, and Nifty 50 was up 68.80 points or 0.28% to 24,787.40

- 09:02 | June 16, 2025

Stock market live updates today: India Forex And Asset Management Pvt Ltd. (IFA Global)

The Rupee is likely to open around 86.16 and trade a 86-86.40 range with weakening bias

The Indian currency had weakened 49 paise to end at 86.09 on Friday after trading a 85.94-86.21 range intraday.

1 year and 5 year implied forward yields had ended at 1.89% and 2.82% respectively

- 08:44 | June 16, 2025

Stock market live updates today: Weekly Market Update (09th June 2025 – 13th June 2025)

•Fixed Income

The New 10-Year Benchmark GOI 6.33 2035 traded between 6.24% - 6.33% during the week ending on 13th June 2025 (Closing yield: 6.2996%)

The Old 10-Year Benchmark GOI 6.79 2034 traded between 6.29% - 6.40% during the week ending on 13th June 2025 (Closing yield: 6.3584%) tracking movement involved around US Treasury, CPI Data, Currency, Crude oil and geopolitical escalation between Iran-Israel.

•Auction Highlights

RBI conducted the Auction for G-sec, SDL, and T-bills for the aggregated amount of INR 30,000 crore (25,000), INR 29,400 (28176.512) Crore and INR 19,000 Crore, respectively.

G-sec Cutoff:

6.79% GS 2031: 102.84/6.2535%\u0009\u0009

7.09% GS 2074: 99.33/7.1389%

SDL Cutoff:

03 Years: TN 6.00%

06 Years: JK 6.42%

08 Years: AP 6.65%

09 Years: AP 6.65%\u0009

10 Years: AP 6.68%, TN 6.66%

14 Years: AP 7.05%, HR 7.03%, MZ 7.08%

15 Years: AP 7.08%, PU 7.09%

25 Years: TN 7.13%

30 Years: TS 7.10%

Re-issue of 6.62% Puducherry SDL 2028, issued on November 24, 2021 at 101.76/6.0462%

Re-issue of 6.89% Punjab SGS 2046, issued on May 28, 2025 at 97.22/7.1475%

Re-issue of 6.94% Tamil Nadu SGS 2055, issued on June 04, 2025 at 98.09/7.0944%

T-Bill Cutoff:

091 Days: INR 9000 Crore 98.6790/5.3694%

182 Days: INR 5000 Crore 97.3622/5.4334%

364 Days: INR 5000 Crore 94.8003/5.5000%\u0009

•Commodities:

1)Brent Crude Oil: $66.07-$78.50 (Per barrel) (Closing: $74.23)

2)Gold: INR 98,830-INR 1,02,270 24 Carat (10 Gram)

3)Silver: INR 1,07,000-INR 1,10,000 (1 KG)

•Currency:

1)USD/INR: 85.401-86.217 ($) (Closing: 86.108)

•US Treasury Yield:

1)US 2 Years Treasury: 3.85%-4.05% (Closing: 3.949%)

2)US 5 Years Treasury: 3.90%-4.13% (Closing: 4.005%)

3)US 10 Years Treasury: 4.31%-4.51% (Closing: 4.406%)

•Corporate Bond Highlights

1)AAA 3 Years Bond traded between 6.70%-6.75% this week.

2)AAA 5 Years Bond traded between 6.75%-6.80% this week.

3)AAA 10 Years Bond traded between 7.00%-7.05% this week.

•News Highlights

INDIA

1)India’s retail inflation dropped to a 75-month low of 2.82% in May, down from 3.2% in April, driven by a sharp decline in food inflation, which fell below 1% for the first time in nearly four years, according to government data released on June 12. This marks the fourth straight month that headline inflation has remained below the Reserve Bank of India’s (RBI) target midpoint of 4%. Notably, food inflation — a major component of the Consumer Price Index — has remained under 3% for three consecutive months.

2)Food inflation, a crucial indicator, dropped to 0.99% in May, significantly lower than April’s 1.78%. Vegetable prices saw a sharp decline, falling by 13.7% in April, while cereal prices rose by 4.77% in May.

3)India’s forex reserves rose by $5.17 billion to $696.66 billion for the week ending June 6, 2025, as per RBI data. Foreign currency assets — the largest component — grew by $3.47 billion to $587.69 billion. Gold reserves inched up by $1.5 million to $85.88 billion, while Special Drawing Rights (SDRs) rose $102 million to $18.67 billion. India’s reserve position with the IMF also increased by $14 million to $4.4 billion.

4)As of early June 2025, loans and advances by the RBI to state governments rose by ₹2,962 crore over the week to ₹30,444 crore, while central government borrowing remained at zero. Scheduled commercial banks saw a 1.2% fortnightly growth in aggregate deposits and a 0.3% rise in bank credit, with non-food credit driving the expansion. On the money supply front, broad money (M3) increased 2.8% since March-end, with time deposits being the major contributor. RBI’s liquidity operations continued to reflect a strong absorption trend, with net liquidity absorption peaking at ₹3.21 lakh crore on June 6 through Standing Deposit Facility (SDF) and variable rate reverse repo operations.

5)As of May 30, 2025, India’s total money supply (M3) stood at ₹279.34 lakh crore, reflecting a 1% increase over the previous fortnight and a 9.4% rise year-on-year. Currency held by the public reached ₹37.13 lakh crore, up 7.7% from a year ago. Demand deposits surged 18.1% year-on-year to ₹31.31 lakh crore, while time deposits grew 8.6% to ₹209.56 lakh crore. Bank credit to the commercial sector rose 9.7% year-on-year to ₹186.90 lakh crore, showing a moderation from the 15.5% growth recorded in the same period last year.

6)As of May 30, 2025, aggregate deposits with all scheduled banks in India stood at ₹236.63 lakh crore, marking a fortnightly rise and reflecting sustained deposit growth. Bank credit (excluding interbank) rose to ₹187.54 lakh crore, showing mild growth from mid-May but a moderation in momentum compared to last year. Investments of scheduled banks reached ₹68.62 lakh crore, while their borrowings from the RBI declined sharply to ₹6,516 crore, indicating reduced short-term liquidity reliance. Cash with banks and balances with the RBI remained stable. Food credit outstanding rose to ₹70,581 crore, up notably from ₹40,259 crore a year ago, signalling higher disbursements to procurement agencies.

7)In May 2025, mutual fund inflows in India plunged 89% to ₹29,572 crore from ₹2.78 lakh crore in April, even as total AUM rose 3% to ₹71.93 lakh crore.

Equity mutual fund inflows fell 22% to ₹19,013 crore, marking a 13-month low and the fifth straight monthly decline. Large-cap, mid-cap, and small-cap funds saw inflows shrink to ₹1,250 crore (–53%), ₹2,808 crore (–15%), and ₹3,214 crore (–20%) respectively, while flexi-cap funds led with ₹3,841 crore. Outflows were recorded in ELSS (₹678 crore), value/contra (₹92 crore), and dividend yield funds (₹20 crore).

Debt mutual funds witnessed net outflows of ₹15,908 crore, reversing from April’s ₹2.19 lakh crore inflow. Liquid funds saw the steepest outflow at ₹40,205 crore, followed by overnight (₹8,120 crore) and floater funds (₹254 crore). Corporate bond and money market funds saw inflows of ₹11,983 crore and ₹11,223 crore, respectively.

Hybrid funds gained traction with inflows rising 46% to ₹20,765 crore, led by arbitrage funds (₹15,701 crore) and multi-asset allocation funds (₹2,926 crore). Passive fund inflows fell 73% to ₹5,525 crore, with other ETFs (₹4,086 crore) and index funds (₹1,104 crore) leading. Gold ETFs saw ₹291 crore in inflows, while overseas FoFs brought in ₹42 crore.

Nineteen open-ended NFOs were launched in May, mobilizing ₹4,170 crore — with sectoral/thematic funds contributing ₹1,792 crore.

8)The World Bank has cut its growth forecast for India to 6.3% in the current financial year 2025-26 from the 6.7% it had projected in January, citing dampened export and investment growth. This 0.4% point cut in India’s growth forecast is in line with an equivalent reduction in the global growth forecast to 2.3%.

9)The RBI has announced the cancellation of the 14-day variable rate repo (VRR) auction for the next fortnight, marking the third consecutive cancellation.

This decision reflects the central bank’s confidence in the banking system’s liquidity, even with anticipated outflows of approximately ₹3 lakh crore for advanced tax and GST payments.

10)India Inc’s net debt rose 6% in FY25 to ₹37.4 lakh crore, largely driven by the top 10 corporate borrowers, who accounted for nearly half of the total debt. This rise in leverage coincided with a 20% surge in capital expenditure by listed non-financial companies, reaching ₹11 lakh crore — the highest in years. Out of 3,426 companies, most saw only marginal increases in borrowing, with the broader corporate sector maintaining high cash reserves of ₹13.5 lakh crore as of March 2025. Notably, 157 companies each invested over $100 million (₹850 crore) in capex — the highest count in over a decade. Key borrowers included Reliance Industries, NTPC, Vodafone, Bharti Airtel, Grasim, ONGC, IOCL, Power Grid, L&T, and Mahindra & Mahindra.

11)The Reserve Bank of India has allowed trading of state government securities in the STRIPS (Separate Trading of Registered Interest and Principal of Securities) format, enabling bondholders to trade principal and interest components separately. This move, effective after consultations with states and market participants, extends the STRIPS mechanism—already permitted in central government securities since April 2010—to state bonds. Eligible securities include fixed-coupon state government bonds with a residual maturity of up to 14 years and a minimum outstanding amount of ₹1,000 crore, provided they qualify for statutory liquidity ratio (SLR) purposes.

12)The RBI plans to use the CRR more actively for liquidity management, rather than only in crisis situations, according to a Reuters report. Last week, it cut CRR by 100 bps in four tranches to 3%, releasing ₹2.5 trillion ($29.25 billion) into the system. With the banking sector’s growing deposit base, the earlier 4% floor is seen as unnecessary. Between Dec–May, RBI injected nearly $100 billion via OMOs and FX swaps. This shift may reduce reliance on bond purchases and help anchor the overnight call rate near the 5.5% repo rate. The RBI is also reportedly uncomfortable with the sharp fall in 10-year bond yields.

WORLD

1)Inflation in the United States (US), as measured by the change in the Consumer Price Index (CPI), rose to 2.4% on a yearly basis in May from 2.3% in April, the US Bureau of Labor Statistics (BLS) reported on Wednesday. This reading came in below the market expectation of 2.5%. The core CPI, which excludes volatile food and energy prices, rose 2.8% in May, matching April’s increase. On a monthly basis, the CPI and the core CPI both increased 0.1%, against analysts’ estimate of 0.2% and 0.3%, respectively.

2)The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) in May increased by 2.6% YoY, one-tenth above April’s reading. At the same time, core PPI, which excludes volatile items like food and energy, dipped from 3.1% to 3% YoY.

3)US initial jobless claims rose to 248,000 for the week ending May 31, matching the previous eek’s revised figure and exceeding expectations, according to the US Department of Labor. The seasonally adjusted insured unemployment rate held steady at 1.3%, while the four-week moving average increased by 5,000 to 240,250. Continuing jobless claims rose by 54,000 to 1.956 million for the week ending May 24.

4)The Eurozone’s trade surplus narrowed to €9.9 billion in April 2025 from €13.6 billion a year earlier, falling short of market expectations of €18.2 billion. Exports declined 1.4% YoY to €243 billion, driven by sharp drops in mineral fuels and lubricants (–25.3%) and machinery and transport equipment (–5.6%), while chemical exports rose 6%, down from a 50.5% surge in March. Export growth to the US slowed to 3.9% from 63.9%, and exports to China and the UK fell by 14.9% and 6.0%, respectively. Imports inched up 0.1% YoY to €233 billion, supported by gains in chemicals (+6.2%) and food and drink (+6.8%), though other key segments declined, with slower import growth from both the US and China.

5)The UK trade deficit widened sharply to £7.03 billion in April 2025 from £3.70 billion in March, marking the largest trade gap since June 2022, as exports fell while imports rose. Exports fell by 3.4% to a four-month low of £73.44 billion, while imports grew by 1.0% to a 32-month high of £80.47 billion.

6)The UK economy contracted by 0.3% in April (MoM), reversing a 0.2% expansion in March and falling short of the expected 0.1% decline, according to data from the Office for National Statistics. The Index of Services rose 0.6% in the three months to April, down slightly from 0.7% in March. Meanwhile, industrial production fell 0.6% and manufacturing output declined 0.9% month-on-month in April, both missing market forecasts.

7)The UK’s ILO unemployment rate rose to 4.6% in the three months to April from 4.5% in the previous quarter, in line with market expectations, according to the Office for National Statistics. The number of people claiming jobless benefits increased by 33,100 in May, reversing a revised decline of 21,200 in April and missing the forecast of a 9,500 rise. Employment change stood at 89,000 in April, down from 112,000 in March.

8)Japan’s producer prices rose 3.2% year-on-year in May 2025, easing from a slightly revised 4.1% in April and below market expectations of 3.5%, marking the lowest annual rate since September and the 51st consecutive month of producer inflation. On a monthly basis, prices declined by 0.2%, reversing a 0.3% gain over the previous three months and registering the first monthly drop in nine months.

9)Japan’s GDP was flat in Q1 2025, beating the expected 0.2% contraction but slowing from 0.6% growth in Q4. Private consumption rose 0.1% for a second straight quarter, while business investment grew 1.1%, below the 1.4% estimate but up from 0.6% in Q4. Government spending fell 0.5%, the first decline in five quarters. Net trade dragged GDP by 0.8 percentage points, as exports fell 0.5% (vs +1.7% in Q4) and imports surged 3.0% (vs –1.4%), driven by higher energy and food costs.

10)Japan’s GDP Price Index has shown a notable increase in the first quarter of 2025, with the indicator reaching 3.3%, up from the previous 2.9%. This data was updated on June 8, 2025, highlighting a significant year-over-year progression, suggesting potential shifts in Japan’s economic environment.

11)China’s Consumer Price Index (CPI) declined 0.1% YoY in May 2025, matching April’s drop but coming in better than the expected 0.2% fall, while monthly CPI fell 0.2% after a 0.1% rise in April. Meanwhile, the Producer Price Index (PPI) fell 3.3% YoY in May, deeper than April’s 2.7% decline and slightly worse than the market consensus of a 3.2% drop, according to data from the National Bureau of Statistics.

12)China’s trade surplus expanded in May 2025, with the trade balance in yuan terms rising to CNY 743.56 billion from CNY 689.99 billion. Exports grew 6.3% YoY (vs. 9.3% in April), while imports declined 2.1% (vs. –0.8% prior). In dollar terms, the surplus widened to $103.22 billion, beating expectations of $101.3 billion and up from $96.18 billion in April. Dollar-denominated exports rose 4.8% YoY (vs. 5% expected and 8.1% prior), while imports dropped 3.4% (vs. –0.9% expected and –0.2% previous). China’s trade surplus with the US narrowed to $18.01 billion from $20.46 billion in FY25

- 08:42 | June 16, 2025

Stock market live updates today: Update on Gas Release Incident at ONGC Rudrasagar Field

Efforts are underway to control the continuous gush of gas from the RDS#147A near Bhotiapar in the Rudrasagar field located in the Sivasagar Dist.

The Crisis Management Team of ONGC is on the job, laying out the necessary equipment for bringing the well under control. The required fluids for the subdue operation have been made ready and the next step in the operation is expected to start at daybreak tomorrow.

In view of the presence of gas, entry to the location is being restricted to the concerned operational personnel only.

- 08:41 | June 16, 2025

Stock market live updates today: Fund House Recommendations

Jefferies on Indian Hotels: Maintain Buy on Company, target price at Rs 980/Sh (Positive)

Jefferies on HDFC Bank: Maintain Buy on Bank, target price at Rs 2380/Sh (Positive)

Jefferies on Indigo: Maintain Buy on Company, target price at Rs 6300/Sh (Positive)

Jefferies on Max Fin: Maintain Buy on Company, raise target price at Rs 1830/Sh (Positive)

Macquarie on Persistent: Maintain Outperform on Company, target price at Rs 7330/Sh (Positive)

Jefferies on GMR Airport: Maintain Buy on Company, target price at Rs 100/Sh (Positive)

Jefferies on Ambuja: Maintain Buy on Company, target price at Rs 700/Sh (Positive)

Antique on HDFC Life: Management reiterated their aspiration to grow APE ahead of industry average and double VNB every 4-4.5 years (Neutral)

UBS on Sun Pharma: Maintain Buy on Company, target price at Rs 2450/Sh (Neutral)

JP Morgan on HDFC AMC: Downgrade to Neutral on Company, target price at Rs 5000/Sh (Neutral)

Jefferies on BSE: Maintain Hold on Company, raise target price at Rs 2900/Sh (Neutral)

Jefferies on HDFC Bank: Maintain Buy on Bank, target price at Rs 2200/Sh (Positive)

Jefferies on Sai Life: Maintain Hold on Company, target price at Rs 800/Sh (Neutral)

Kotak on NMDC: Maintain Sell on Company, target price at Rs 55/Sh (Negative)

Citi on NMDC: Maintain Sell on Company, target price at Rs 60/Sh (Negative)

Citi on Indusind Bank: Maintain Sell on Bank, target price at Rs 700/Sh (Negative)

- 08:40 | June 16, 2025

Stock market live updates today: China Industrial Production y/y

Actual: 5.8%

Expected: 5.9%

Previous: 6.1%

China Retail Sales y/y

Actual: 6.4%

Expected: 4.9%

Previous: 5.1%

(Data seen mixed as Industrial production trails while retail sales data are better than expected)

- 08:11 | June 16, 2025

Stock market live updates today: Nifty staring at losing 175 points at open

Domestic markets are likely to witness a gap-down opening on Monday amid the escalating conflict between Iran and Israel. Gift Nifty at 24,790 signals a gap-down opening of about 170 points for Nifty. Investors will move to a risk-on strategy and adopt a cautious approach, said analysts.

- 07:23 | June 16, 2025

Stock market live updates today: DLF Ltd to invest around Rs 5,500 crore to develop a luxury housing project in Gurugram

Realty major DLF Ltd will invest around Rs 5,500 crore to develop a luxury housing project in Gurugram, as it seeks to achieve record sales bookings this fiscal on high demand.

According to sources, the company will soon launch an 18-acre project ‘DLF Privana North’ in Sector 76/77 Gurugram, comprising more than 1,150 apartments.

The estimated cost to develop this project is around Rs 5,500 crore, they added. This upcoming project is part of its 116-acre township ‘DLF Privana’.

In this township, the company had last year launched and completely sold out two projects -- ‘DLF Privana West’ and ‘DLF Privana South’ -- for around Rs 12,800 crore.

In May 2024, DLF sold all 795 apartments for Rs 5,590 crore within three days of the launch of its 12.57-acre project ‘Privana West’.

Before that, in January 2024, the company had sold 1,113 luxury apartments in Gurugram for Rs 7,200 crore within three days of the launch of its project ‘DLF Privana South’, which is spread over 25-acre.

The new project will be the third one in this large township. - PTI

- 07:23 | June 16, 2025

Stock market live updates today: Nifty and Bank Nifty Prediction for the week 16 Jun’25 to 20 Jun’25 by BL GURU

- 07:22 | June 16, 2025

Stock market live updates today: Today’s Stock Recommendation: June 16, 2025

- 07:22 | June 16, 2025

Stock market live updates today: Hero FinCorp, financial services division of Hero MotoCorp, raises Rs 260 crore in a pre-IPO placement round

Hero FinCorp, the financial services division of two-wheeler manufacturer Hero MotoCorp, has raised Rs 260 crore in a pre-IPO placement round.

This fund mobilisation led to a reduction in fresh issue size to Rs 1,840 crore from the earlier planned Rs 2,100 crore.

The total IPO size now stands at Rs 3,408 crore, which includes a Rs 1,568 crore offer-for-sale (OFS) by existing investors. This marks a reduction from the earlier planned Rs 3,668 crore.

Those selling shares in the OFS are -- AHVF II Holdings Singapore II Pte. Ltd, Apis Growth II (Hibiscus) Pte. Ltd, Link Investment Trust (through Vikas Srivastava) and Otter Ltd.

In the pre-IPO round executed on June 5, Hero FinCorp entered into investment agreements with 12 investors, allotting 18.57 lakh shares at Rs 1,400 per share on June 13, raising Rs 259.99 crore, according to a public announcement by the company.

Under this, the company allotted shares worth Rs 69 crore to Shahi Exports, RVG Jatropha Plantation (Rs 50 crore), Mohan Exports (Rs 25 crore), and AP Properties (Rs 22 crore).

Additional participants in the round were Vivek Chaand Sehgal, Paramount Products, Tiger Laser Pte, Virender Uppal, Laksh Vaaman Sehgal, Renu Sehgal Trust, Yugal Chit Fund, and LC Hercules (Cayman).

In May, the company received market regulator Sebi’s nod to float its IPO. -PTI

- 07:21 | June 16, 2025

Stock market live updates today: Voltbek Home Appliances, a joint venture between Voltas and Turkish firm Arçelik, narrowed its losses to Rs 241.89 crore in FY25

Voltbek Home Appliances, a joint venture between Voltas and Turkish firm Arçelik, narrowed its losses to Rs 241.89 crore in FY25 while its revenue from operations rose 39.5 per cent to Rs 2,235.53 crore.

According to the latest annual report of the Tata Group firm, Voltbek also achieved robust volume growth of 57 per cent on a year-on-year basis, outperforming the industry, which experienced single-digit growth in key categories.

In the preceding financial year ended March 2024, the joint venture had recorded a revenue from operations at Rs 1,602.87 crore and a loss of Rs 267.09 crore. - PTI

- 07:21 | June 16, 2025

Stock market live updates today: Jubilant Group promoter entities offload shares of Jubilant FoodWorks, Jubilant Ingrevia and Jubilant Pharmova worth Rs 1,801 crore through open market deals

According to the block deal data available on the NSE, Jubilant Consumer, one of the promoters of Jubilant FoodWorks Ltd (JFL), sold 1.06 crore equity shares, amounting to a 1.61 per cent stake in Noida-based JFL.

Also, three promoter entities of Jubilant Ingrevia -- Jubilant Enpro, Nikita Resources and Shyam Sunder Bhartia Family Trust -- collectively sold 98.65 lakh shares or 6.2 per cent stake in the company, as per another block deal on the NSE.

In addition, Jubilant Enpro and Nikita Resources -- promoters of Jubilant Pharmova -- disposed of 32.86 lakh shares, representing a 2.06 per cent holding in the firm, through a bulk deal on the exchange.

The shares were offloaded in the price range of Rs 662-1,060.37 apiece, taking the combined transaction value to about Rs 1,800.98 crore.

Following the stake sale, the combined holding of Jubilant Group in JFL dipped to 40.33 per cent from 41.94 per cent, and its stake in Jubilant Ingrevia declined to 45.27 from 51.47 per cent.

Also, the combined shareholding of promoters of Jubilant Pharmova slipped to 48.12 per cent from 50.68 per cent.

Meanwhile, Societe Generale, Morgan Stanley, Kotak Mahindra Mutual Fund (MF), ICICI Prudential Life Insurance, Bandhan MF, Axis MF, HDFC MF, Bajaj Allianz Life Insurance, and Canada-based pension fund AIMCo (Alberta Investment Management Corporation), among others, were the buyers of JFL, Jubilant Ingrevia shares.

Additionally, Kotak Mahindra MF picked up 32.86 lakh shares or a 2.06 per cent stake in Jubilant Pharmova. Details of the other buyers of Jubilant Pharmova’s shares could not ascertained. - PTI

- 07:20 | June 16, 2025

Stock market live updates today: SPICEJET Q4 Result

NET PROFIT UP 2591% TO 342 CR (YOY), UP 1576 % (QOQ)

REVENUE DOWN 16 % AT 1464 CR (YOY) ,UP 18 % (QOQ)

EBITDA OF 73.3 CR V 235 CR LOSS (YOY), 187 CR LOSS (QOQ)

MARGINS AT 5 % V -13.5 % (YOY), -15.1 % (QOQ)

- 07:19 | June 16, 2025

Stock market live updates today: KEY INDIA & GLOBAL STOCK MARKET EVENTS

🔸1.WPI DATA MONDAY, JUNE 16:

Wholesale Price Index (WPI) Inflation: Expected to provide insights into wholesale inflation trends, following a May 2025 CPI inflation report showing a 5.4% year-on-year increase.

🔸2. WEEKLY EXPIRY THURSDAY, JUNE 19:

Weekly Nifty Futures & Options (F&O) Expiry: The weekly expiry of Nifty F&O contracts is likely to increase volatility, especially in banking and large-cap stocks. Recent data shows high Call Open Interest at 24,800 and 25,000 strikes (resistance) and Put Open Interest at 24,600 and 24,500 strikes (support).

3.🔸IPO ACTIVITY

The Tea Post IPO, with its Draft Red Herring Prospectus (DRHP) filed with SEBI, and Jainik Power and Cables IPO (allotment status pending) may attract investor attention.

🔸4. U.S.-CHINA TRADE TALKS (ONGOING)

Trade negotiations between U.S. and Chinese officials, which began earlier in June in London, are ongoing. Investors are watching for updates on tariffs, particularly on rare earth minerals and technology exports, following temporary Chinese approvals for rare earth exports and Boeing’s jet deliveries to China. Progress could boost market sentiment, while setbacks may increase volatility, especially in tech and industrial sectors.

Positive developments could lift global indices.

🔸5. G7 SUMMIT (JUNE 15–17, CANADA)

The G7 Leaders’ Summit in Canada will focus on trade security, energy cooperation, and geopolitical issues, including Middle East tensions. Discussions may influence commodity markets (e.g., oil) and defense stocks due to NATO’s proposed 5% GDP defense spending commitment by 2032.

Outcomes could affect energy stocks and global indices.

🔸6. U.S. FEDERAL RESERVE (FOMC) MEETING (JUNE 17–18)

The FOMC is expected to maintain the federal funds rate at 5.25%–5.5%. The release of updated Economic Projections and the Dot Plot on June 18, followed by Fed Chair Jerome Powell’s press conference at 2:00 PM ET, will be closely watched for signals on 2025 rate cuts. Markets currently expect a 20% chance of a 25-basis-point cut in July and 1.90 total cuts in 2025. Fed speakers (e.g., Raphael Bostic, Mary Daly, Austan Goolsbee) may also comment this week.

Hawkish signals could pressure growth stocks while dovish comments may support further gains in U.S. indices.

🔸7. BANK OF JAPAN (BOJ) MONETARY POLICY MEETING (JUNE 16–17)

The BoJ will review its monetary policy, following a May 1 cut in growth and inflation forecasts. Japan’s GDP contracted less than expected in Q1 2025 (–0.2% annualized vs. –0.7% estimated). Governor Kazuo Ueda’s comments on JGB purchase tapering could move markets, with the 10-year JGB yield at 1.46%.

Policy shifts could affect the Nikkei 225 and yen influencing Japanese and Asian markets.

🔸8. BANK OF ENGLAND (BOE) RATE DECISION (JUNE 19)

The BoE is expected to hold its key rate at 4.25%, despite cooling UK inflation expectations (3.2% for the next 12 months). Deutsche Bank anticipates a potential August cut signal, which could impact UK markets.

A dovish outlook could support the FTSE 100, particularly oil and defense majors, amid Middle East-driven commodity price spikes.

🔸9. ECONOMIC DATA RELEASES

✳️MONDAY, JUNE 16:

China: Industrial Production, Retail Sales, Jobless Rate. Weak consumer demand could pressure China’s CSI 300 and Hang Seng.

U.S.: Empire State Manufacturing Index, A gauge of regional manufacturing activity.

Malaysia: External Trade Data by State.

✳️TUESDAY, JUNE 17:

U.S.: Advance Retail Sales, reflecting consumer spending trends.

Singapore: Non-Domestic Exports, impacting Asian trade sentiment.

✳️WEDNESDAY, JUNE 18:

UK: CPI Inflation Data, a key input for BoE policy expectations.

✳️THURSDAY, JUNE 19:

U.S.: Initial Jobless Claims and PPI Inflation.

✳️FRIDAY, JUNE 20:

♦️Japan: CPI Inflation, influencing BoJ policy outlook.

♦️Sweden: Riksbank Policy Decision, potentially affecting European markets.

♦️Norway: Norges Bank Policy Decision, impacting Nordic markets.

🔸10. U.S. GENIUS ACT SENATE VOTE (June 17)

A U.S. bill to regulate stablecoins is set for a Senate vote, potentially impacting fintech and crypto-related stocks. Retail giants like Walmart and Amazon are exploring stablecoin offerings, boosting shares of Circle Internet Group (USDC issuer) by 20% recently.

Passage could lift crypto and payment stocks, while delays or rejection may dampen sentiment.

🔸11. GEOPOLITICAL AND COMMODITY MARKET

♦️Middle East Tensions Israel-Iran conflicts have driven oil price volatility Further escalation could push energy stocks higher but raise recession fears, impacting global indices.

♦️U.S. Tariff Legal Battle: A U.S. Court of International Trade response on Trump’s tariff authority (via IEEPA) is due by June 19, potentially affecting trade-sensitive sectors. A stay keeps tariffs in place during appeals.

🔸12.STOCK MARKET HOLIDAYS

♦️Australia: Markets closed on June 16 for a public holiday, potentially reducing Asia-Pacific liquidity.

♦️South Africa: Youth Day (June 16) may close the Johannesburg Stock Exchange, affecting emerging market indices.

- 07:18 | June 16, 2025

Stock market live updates today: CBI books builder Supertech, its promoter RK Arora for alleged Rs 126 crore fraud with IDBI Bank

- 07:18 | June 16, 2025

Stock market live updates today: Weekly Equity Cash and Derivative Coverage

Weekly snapshot: The Indian equities started the week with a steady move, but unwinding moves were seen amid rising Middle East geopolitical tensions

Indices Performance: The Nifty 50 Index ended the week with a loss of 1.14 percent, while Nifty Bank performed inline and closed with a loss of 1.86 percent.

Weekly Fund-flow Activities: Over the week, FIIs have sold Rs 1246.5 crore worth of shares, while DIIs bought Rs 18637.3 crore worth of shares in the cash segment.

Macro Data: There will be several macroeconomic releases this week, including Chinese industrial production, U.S. retail sales, and monetary policies from the Bank of Japan, Federal Reserve, and Bank of England.

Weekly Outlook: Markets will likely remain focused on Middle East geopolitical developments during the next week. Also, monetary policy-related announcements from major central bankers are expected to keep anxiety among the participants.

- 07:18 | June 16, 2025

Stock market live updates today: [IIFL Banks] Pockets of AQ stress (A) MFI – concerns to shift from asset quality to growth (1)

# MFI slippages rose qoq across most lenders in 4Q; ranged 3-18% in FY25 and were higher for Utkarsh, IIB, Spandana, Fusion and RBL

# MFI GNPA ratio further deteriorated qoq; declined for Equitas/Ujjivan due to accelerated write offs

# Credit cost for MFI lenders in FY25 ranged from 3-18%

# Negative correlation between stress and AUM growth of lenders - net slippages were lower for lenders with relatively higher MFI growth (e.g. LTF, Satin, etc).

- 07:17 | June 16, 2025

Stock market live updates today: United States Michigan Consumer Sentiment

Actual: 60.5

Expected: 53.5

Previous: 52.2

United States Michigan 1-Year Inflation Expectations

Actual: 5.1%

Previous: 6.6%

(Data seen mixed over the outlook)

- 07:17 | June 16, 2025

Stock market live updates today: Instl. Investors EQUITY Cash Trades PROV. - 13/06/2025 : Rs. CRS. : FIIS : SELL -1,263 (14,163-15,426); DIIS : BUY +3,041 (13,487-10,446)

- 07:17 | June 16, 2025

Stock market live updates today: Tata Motors: Moody’s upgrades JLR’s rating to Ba1 from Ba2, outlook positive: CNBC (Marginal Supportive for Tata Motors)

- 07:16 | June 16, 2025

Stock market live updates today: DIAMOND POWER INFRA: CO WINS ORDER AGGREGATING RS. 116.71 CR, OUTSTANDING ORDER BOOK CLIMBS TO RS. 1,554.08 CR (SUPPORTIVE FOR STOCK PRICES)

- 06:45 | June 16, 2025

Stock market live updates today: FEDERAL RESERVE THIS WEEK:

* FED INTEREST RATE DECISION (WED. 2:00PM ET)

* FED FOMC STATEMENT (WED. 2:00PM ET)

* FED FOMC DOT-PLOT (WED. 2:00PM ET)

* FED CHAIR POWELL SPEAKS (WED. 2:30PM ET)

IST: 11:30 PM WEDNESDAY FED INTEREST RATE DECISION

IST: 12.00 AM THURSDAY FED CHAIR POWELL SPEAKS

N.B. The Federal Reserve’s FOMC Dot Plot is a chart released by the Federal Open Market Committee (FOMC), which is part of the U.S. Federal Reserve, to provide a visual representation of its members’ projections for the federal funds rate over the next few years and in the longer term. Introduced in 2012 to enhance transparency, it’s part of the Summary of Economic Projections (SEP) and is updated quarterly (March, June, September, and December).

- 06:44 | June 16, 2025

Stock market live updates today: Q4FY25 Earning Calendar 16-06-2025

BELRISE, RAMRATNA

Q4FY25 Earning Calendar 17-06-2025

ORISSAMINE

- 06:44 | June 16, 2025

Stock market live updates today: Securities in F&O Ban For Trade Date 16-June-2025

* ABFRL

* BSOFT

* CHAMBLFERT

* CDSL

* HINDCOPPER

* IEX

* IREDA

* MANAPPURAM

* RBLBANK

* TITAGARH

- 06:44 | June 16, 2025

Stock market live updates today: Economic Calendar – 16.06.2025

07:30 China Industrial Production y/y (Expected: 5.9% versus Previous: 6.1%)

07:30 China Retail Sales y/y (Expected: 4.8% versus Previous: 5.1%)

12:00 India WPI Inflation YoY (Expected: 0.80% versus Previous: 0.85%)

18:00 U.S. Empire State Manufacturing Index (Expected: -7.2 versus Previous: -9.2)

- 06:42 | June 16, 2025

Stock market live updates today: Stock to buy today: Tech Mahindra (₹1,659) – BUY

The outlook for Tech Mahindra is bullish. The stock has surged over 5 per cent last week and has closed on a strong note. This rise has taken the share price well above the 200-Day Moving Average (DMA) and is also sustaining well above it.

Published on June 16, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.