The government on Friday initiated the process of selling over 30 per cent of its stake in IDBI Bank by inviting Expression of Interest (EoI). IDBI’s present promoter, Life Insurance Corporation of India (LIC), too, will sell over 30 per cent of stake.

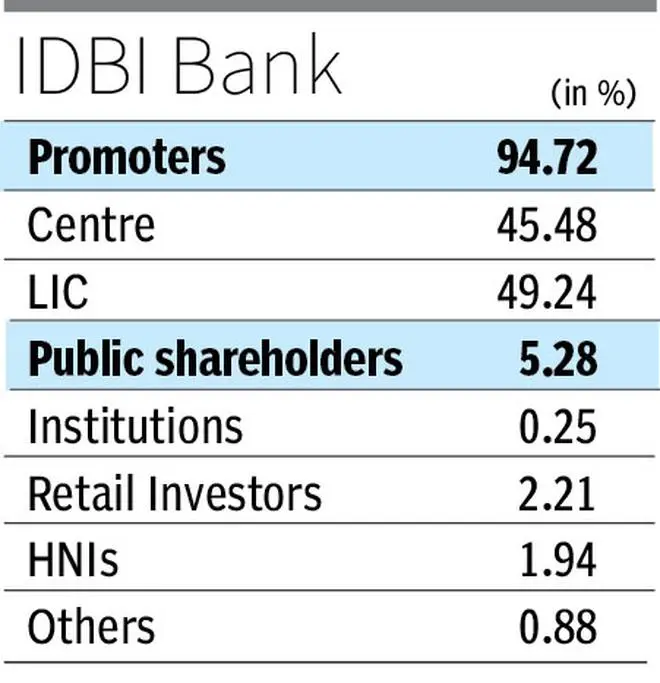

As on March 31, 2022, LIC holds 49.24 per cent, while the Centre holds 45.48 per cent in IDBI Bank. Pursuant to the strategic disinvestment of IDBI Bank, it has now been decided that the Government will sell 30.48 per cent and LIC wll sell 30.24 per cent “aggregating to 60.72 per cent of the equity share capital of IDBI Bank, along with transfer of management control in IDBI Bank,” said Preliminary Information Memorandum (PIM), issued by Department of Investment & Public Asset Management (DIPAM) on Friday.

A private sector bank, a foreign bank, a Non-banking Financial Companies (NBFC) an Alternative Investment Fund (AIF) or a fund/investment vehicle incorporated outside India can bide for the bank either solely or in consortium. Maximum number of participants in consortium can be four. The bidder should have a minimum networth of ₹22,500 crore or $2.85 billion. It must have reported net profit in at least three out of the last five financial years. EoI can be submitted till December 23.

“Large industrial/corporate houses and individuals (natural persons) shall not be permitted to participate in this bidding process for the transaction, either on its own or as a part of a Consortium,” PIM said. FDI norm for private bank will be applicable (74 per cent through approval route, 49 per cent under the automatic route and at all times, at least 26 per cent of the paid-up capital of the bank is required to be held by residents).

The entire process will start with submission of EoI by interested parties followed by short-listing of Qualified Interested Parties (QIPs). Shortlisted entity will go for fit and proper assessment and security clearance and those getting through these two process will get Request for Proposal (RFP). These entities will be required to make the financial bid. Prior to opening of financial bid, but after the submission, the government will set the reserve price based on which bidder will be selected.

The selected bidder will be required to make an open offer to public shareholders of IDBI Bank without any condition or on any minimum level of acceptance. It will also be required to hold and lock-in, either directly or through an Investment Vehicle/NOFHC (as the case may be), at least 40 per cent equity of IDBI Bank, at all times, for a period of five years from the date of acquisition of stake.

Published on October 7, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.