AI is transforming the world, or at least the financial world. When it comes to the US markets in 2023, AI was literally the only game in town. Cumulatively, the AI-powered ‘Magnificent Seven’ stocks have added $5 trillion in market-cap in the last one year as against the S&P 500 adding around $7.25 trillion in the same period, implying that the rest S&P 493 has not created much value at all in aggregate over the last one year.

As investors continue to clamour for their pie of the Magnificent Seven stocks, here are five things to know before you place your bets on them.

A good business is like a strong castle with a deep moat around it. I want sharks in the moat to keep away those who would encroach on the castle – Warren Buffett

The Magnificent Seven stocks’ market cap represented around 20 per cent of S&P 500 market cap when markets were at their pre-Covid highs in January/February 2020. Today, they represent 30 per cent of S&P 500 (and around 50 per cent of the Nasdaq), reflecting the highest level of dominance of a few technology stocks since the dotcom bubble.

Out of the top 7 companies at the peak of the bubble then — Microsoft, Intel, Cisco, Qualcomm, Oracle, JDS Uniphase and Sun Microsystems — Microsoft managed to retain its dominance as a Big Tech; Besides, Intel managed to dominate the PC and later the datacentre computing landscape for a long time till AMD turned the tide from around 2017. Similarly, Qualcomm continued to remain market leader in mobile processors and also got a royalty on virtually every smartphone sold in the world. Thus, their moats were strong (except in the case of JDS Uniphase and Sun Microsystems). Their dominance withered only after a decade or more, as competition from SaaS companies for Oracle, and commoditisation of products, as in the case of Cisco’s routers, impacted their business prospects.

Today, the dominance is even mightier. The moats of the Magnificent Seven are very strong not only in the respective businesses they dominate but also in AI.

When it comes to AI, data is not just the new oil, but new lithium as well! Further, training large language models requires not just vast amounts of data but also lots of financial resources. The Big Techs of the Magnificent Seven today have unparalleled benefits of scale and troves of data acquired from millions of customers over decades and have deep pockets too. This makes it difficult for a new entrant to compete and counter with alternatives in the existing scheme of things. A case in point is Open AI requiring investments from Microsoft to commercialise ChatGPT.

Microsoft, Google, Meta, Amazon, Tesla and Apple have wide lead over the nearest competitors here. To be clear, the companies currently claim to have built their large language models only using publicly available data. But the boundary lines are vague and it may be a just a matter of time when private user data too is employed to make the AI models better. For example, while Tesla is a late entrant to this data treasure field, millions of Tesla cars around the world have, for years, been sending back critical vehicle and user data, including all important data from the camera suite. This private user data is crucial to develop full autonomous vehicles and robotaxis.

While Nvidia may not have the data advantage the others in the pack have, it has created a huge moat with its first-mover advantage and dominance of the large language model (LLM) training ecosystem. According to various estimates, Nvidia’s market share in AI chips is anywhere between 70 and 90 per cent, making it a near monopoly as of now. Even if competing GPU chips, which are core to LLMs, hit the markets this year, Nvidia’s dominance may sustain because of its first-mover advantage and software API linked to its AI GPU chips. As LLM training models are developed on this, the cloud companies who provide the infrastructure also need to invest only in Nvidia chips to ensure compatibility. This creates a loop - as cloud companies invest heavily in Nvidia based infrastructure, new LLMs are also developed primarily on this.

Bottom line: The Magnificent Seven stocks have strong moats driven by a combination of core competency in technology, data advantage and financial muscle power.

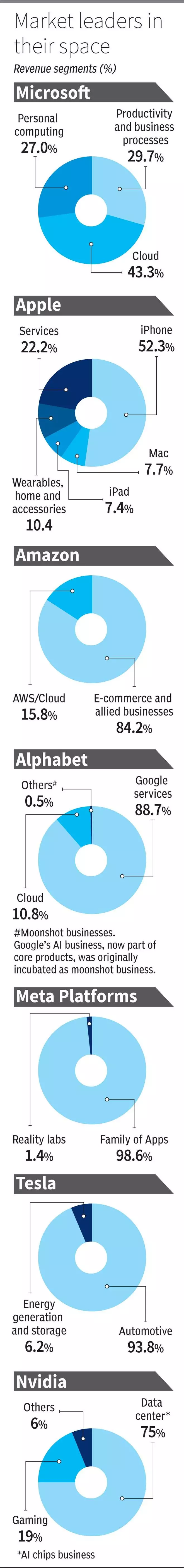

AI could be the future, but a bridge is required till a successful transition to being AI companies happens for the Magnificent Seven. The fact is that AI still largely remains an unprofitable cash-guzzling business and may remain so for a while. In fact companies dominating the cloud business like Amazon, Microsoft and Google are largely subsidizing their AI offerings for customers. However, the bridge to a lucrative AI business is their current lucrative business. Each of these companies globally dominate businesses from which they derive significant revenue.

The combined revenue of the Magnificent Seven adds up to a staggering $1.75 trillion, with operating profits totalling up to a little over $400 billion. Microsoft and Amazon dominate the global cloud business with a combined market share over 50 per cent. Further Microsoft and Amazon have for decades been the leaders in other segments as well from which they derive significant revenue. Alphabet and Meta dominate the global digital advertising market with an estimated 55-65 per cent market share. Recently Apple displaced Samsung as the leader in global smartphone market, with its 20 per cent market share in that space. While Tesla was recently displaced by Chinese rival BYD as the world’s largest seller of EV vehicles in terms of units sold, when it comes to revenue and profits Tesla remains the global leader.

Much of the leadership of Magnificent Seven companies is likely to sustain for the foreseeable future which will keep them in investors spotlight even without factoring AI.

The year 2022 was brutal for Meta. The stock crashed by 40 per cent in the first two months of the year after Meta said that Apple/iOS privacy changes would impact its targeting advertising of Facebook/Instagram users on Apple devices. Then, by November 2022, the stock had crashed a near 80 per cent from peak as its relentless investments in AI and Metaverse crushed its operating margins. Fast forward to today — the shares have rebounded a staggering 450 per cent in 14 months.

A key factor that drove this rebound was its investments in AI paying off. These investments made it possible to work around the iOS privacy changes, boost its revenue and also improve efficiency in its operations.

Such AI capabilities may not be exclusive to Meta, and it is quite likely each of the Big Techs is already harvesting the benefits of AI in their internal operations.

This apart, their distinctive capabilities in large language models — Alphabet-Gemini, Meta -Llama, Microsoft-OpenAI — are well known. Amazon is working on an LLM called Olympus. Meanwhile, Tesla is investing heavily in its Dojo supercomputers focussed on computer vision video processing and recognition that will form the base for its full self-driving cars and robotaxis.

Among the Magnificent Seven, except Apple, the rest have given enough indications on their AI path. Technological developments apart, the monetisation path is also clear, like AI boosting cloud business and subscription business revenues for Microsoft, Amazon and Google; or using AI to boost user experience and boost ad revenues in the case of Google and Meta.

Google, Amazon, Meta and Microsoft are also developing their own AI chips to reduce dependency on Nvidia. On the other hand, Nvidia is foraying into cloud services. Thus, the AI path is witnessing rapid growth and changes, and investors can bet there will be many twists and turns along the way as each company’s AI capabilities evolve and new monetisation opportunities may emerge.

In the case of Apple, which has been tightlipped when it comes to AI, investors are giving the company the benefit of the doubt given its technological prowess. The only hint Apple has given on its AI plans is that it may have something to announce later this year.

The AI opportunities are immense and the journey is just starting. When Steve Jobs launched computers, he gave the analogy of how it was a ‘bicycle to the mind.’ This was in reference to a research which showed that humans ranked poorly amongst all species in ‘efficiency of locomotion’. However, when humans developed a bicycle, they moved to number one spot. Thus if computers were equivalent of bicycles to improve productivity, AI could represent a ‘Concorde to the mind’ when it comes to possibilities that humans can achieve. This will most likely result in sharp jumps in productivity and wealth creation.

Generative AI will impact the way the world functions in two ways as explained by Jensen Huang – the founder and CEO of Nvidia; one is when AI meets the digital world and other is when AI meets the physical world. The likes of ChatGPT and Gemini/Bard represent AI in the virtual world. Tesla’s Robotaxis concept is an example of AI in the physical world.

As themes develop, while current Magnificent Seven will continue to prosper given their moats, new leaders will also emerge in new areas of AI, just as Google and Amazon mushroomed during and after the dotcom bubble. In a future edition, we shall cover emerging opportunities and companies with potential in the AI space at bl.portfolio.

At the same time, investors also need to be cognizant of risks. To begin with, already there is debate whether the Magnificent Seven must be rechristened to Spectacular Six or Fabulous Five after Apple and Tesla have underwhelmed in the last one year.

Further, there is also an emerging risk that Big Techs are becoming too dominant and AI will only accelerate that view. The clamour against their clout and control too can rise sharply along with rise in AI. Hence, there is always the threat of regulatory action that can create speed bumps in their progress. Deepfakes and how the labour markets can get impacted are a few other examples of big risks. This and many other unknown risks are lurking. To this extent the AI euphoria may have got ahead of fundamentals at this point in time. Investors need to factor these before placing their bets.

As mentioned above, five out of the seven top tech companies at the peak of the dotcom bubble retained their moats and their business continued to grow. But did it turn out well for the investors? Not at all.

If investors had bet on the ‘Magnificent Seven’ (seven top tech stocks of Nasdaq 100) of the dotcom bubble during the frenzy then, they would have learnt hard lessons over the last two decades. Apart from Microsoft, no other company in the group has beaten the S&P 500 and Nasdaq 100 CAGR from March 2000 (the month in which the dotcom bubble peaked) till now. Some of them turned out to be utter wealth destroyers.

Bottomline – business growth is important, but valuation at which you buy is important as well.

At the same time, while valuations are not frothy now as during the dotcom bubble, most of them are not cheap as well. But this also comes with a catch. The growth too, with the exception of Nvdia, is not as as great as it was in the run up to the peak in 2000.

Another factor to keep in mind is that the valuation levels for these companies will vary, given their businesses are different.

For example, Meta and Alphabet are more dependent on ad revenues, which is highly cyclical, whereas cloud and subscription dependent businesses of Amazon and Microsoft tend to be more resilient during downturns.

However, overall, on a risk-reward basis, at present Alphabet appears to offer the best play on AI at current valuations.

At bl.portfolio we had recommended a buy on Meta Platforms in February 2022 and doubled down on our call to buy the stock when it hit rock bottom in November 2022. Following multi-bagger returns since then, we will be reviewing our call shortly.

In case of other companies, investors can wait for cheaper entry points. Over and above current fundamentals that can justify a certain value, there is the AI story that has added a lot of premium to the stocks. What is the right premium, is left to each investor’s judgement.

Published on February 10, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.