‘Pioneers end with arrows in the back’. Corporate history is etched with examples of many companies that were pioneers in their field, but were outdone by few who followed their path. Yahoo-Google, Nokia/Motorola-Apple, Myspace-Facebook... the examples are many. It would be worth keeping the ‘Pioneers...’ quote in mind if you are amongst those planning to jump into the Artificial Intelligence (AI) boom.

The AI boom, well underway soon after the launch of ChatGPT, has found renewed fervour since the recent record-breaking results from AI chipmaker Nvidia. The AI wave has been a huge boon to top global tech stocks that only till few months back were licking wounds from the fiery tech slowdown. Their recent stock performance has been so strong that a chorus is emerging for what is now being called the ‘Magnificent Seven’ — the seven largest tech stocks that are well-positioned to capitalise on the anticipated AI boom.

Also read: How Nvidia turned out to be like Ayrton Senna on the Formula One circuit

While the AI launches of Microsoft, Alphabet and Nvidia are well known, the other Big Techs, too, are carving out their own path. For example, while Tesla is a car company, it is considered by many to be the leader when it comes to investments in self-driving technology, that can make it a leader in the AI space when it comes to launching robo taxis. Meta Platforms recently lifted the veil on its in-house bet on developing AI chips.

It’s different now?

However, when we analyse this development in the backdrop of the dotcom bubble at the turn of the millennium, there are three interesting lessons to take note of — one, as mentioned above, pioneers may not be the ultimate winners; two, valuation matters; and, three, the timing can be off.

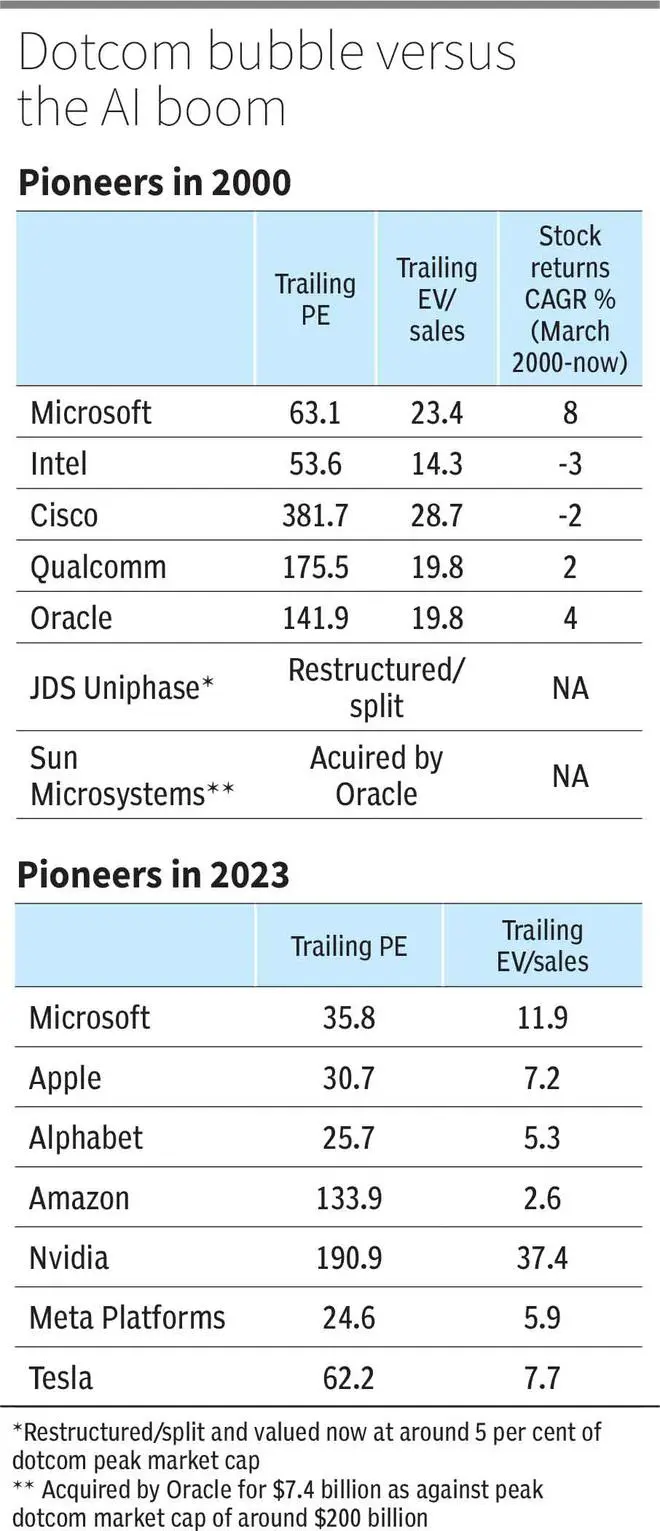

If investors had bet on the ‘Magnificent Seven’ (seven top tech stocks of Nasdaq 100) of the dotcom bubble during the frenzy then, they would have learnt hard lessons over the last two decades. Apart from Microsoft, no other company in the group has beaten the S&P 500 and Nasdaq 100 CAGR from March 2000 (the month in which the dotcom bubble peaked) till now. Even Microsoft has underperformed a Berkshire Hathaway that religiously stayed away from tech stocks then, ended up giving better returns of 10 per cent CAGR over the same period.

Further, software company Sun Microsystems was acquired by Oracle in 2009 at four per cent of its peak value during the dotcom bubble, and optical communications equipment and solutions provider JDS Uniphase had over a 90 per cent correction from its around $100-billion valuation. What is left of the company (after split into two companies) doesn’t even command a $5-billion valuation today.

Also read: 93% of Indian workers excited to use generative AI: Salesforce

Of course, nothing beats Cisco, which was considered the poster boy of the dotcom bubble. Cisco commanded the highest valuation amongst the Big Tech then and was even expected to be the first trillion-dollar company. But, today, it is just a shadow of its former self.

Secondly, a differentiator between the dotcom bubble and the current AI boom is that, barring exceptions like Nvidia, the valuations of the top tech companies are not as high now as it was then (see table). But this may be offset to some extent by the fact that the revenue growth of these companies was also much better then and this trade off needs to be factored and analysed.

For example, Microsoft’s EV/sales of 11.9 times is cheaper than its March 2000 multiple of 23.4 times. However, its three-year revenue CAGR of 14 per cent now pales in comparison to the 3-year revenue CAGR of 26 per cent then. Similarly, Nvidia’s PE of 190.9 may not be too different from Qualcomm’s 175 PE in 2000. However, Qualcomm’s revenue was exploding much more then with the three-year revenue CAGR of 69 per cent versus Nvidia’s 35 per cent now.

Long waiting game

Three, the waiting game may have to be played for long too. While many of the dotcom themes such as Software as a service (SaaS), on-demand videos, and e-commerce did play out as expected, they did so only 5-10 years later.

Finally, investors need to note that, unlike the dotcom bubble which triggered a long-term upcycle in tech spending and turned out to be a boon for Indian IT services companies, whether one can be optimistic of the rub-off effect on Indian IT service companies now needs to be examined. If AI can code, Indian tech will actually need to prepare for more disruptions to its business model.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.