“Only thing we have to fear is fear itself.” — Those were the famous words of former US President Franklin D Roosevelt during the times of despair of the Great Depression in the 1930s. Today, when it comes to exuberance in global and domestic stock markets, it is the exact opposite — “the only thing to we have to fear is the absence of fear”.

With markets crossing hurdle after hurdle in the last few years with panache — whether it be high inflation/interest rates/valuations or recession risks in developed markets, it does make one wonder whether ‘stocks have reached what looks like a permanently high plateau’ as infamously mentioned by economist and investor Irving Fisher in September 1929!

While earnings and economic growth continue to provide a case for optimism, on the contrary, the unfinished task of taming inflation, high interest rates and recession risks in developed markets provide a case for caution.

Domestically, flows into equity are at record levels, reflecting investor confidence while, at the same time, the market regulator is worried about froth in small-cap stocks. RBI is concerned about the scorching pace of credit growth that can cause problems later. Even amongst the analyst community, which typically has a bullish bias, there has been a sell side brokerage which has warned of excesses in the stock markets and withdrawn its rating for mid and small-cap stocks. While these worries prevail, earnings growth so far has remained robust.

Which stand should one take? How should investors deal with theses market paradoxes?

Effectively dealing with such contrarian indicators is what separates investing legends from an average investor. As investors crush their brains in trying to figure it out and invest wisely, at bl.portfolio we decided to pick four all-weather lessons from four investing legends that we can apply to manage the current phase of markets wisely.

By following and effectively implementing their advice, one will be better positioned to play the markets comfortably irrespective of whether markets continue to trend up or down, melt-up or crash.

Anytime you make a portfolio change, start by accepting that you are guaranteed to have regret. If you sell some of your holdings and the market goes up, you’ll regret having sold anything. If you sell and the market goes down, you’ll regret not having sold more. If you don’t sell and the market goes up, you’ll regret not having bought. John Hussman, President, Hussman Investment Trust

John Hussman, President, Hussman Investment Trust

John Hussman is a veteran investor, fund manager who has seen many cycles. He became famous for his successful calls and maneuvering of the dotcom bubble of 2000 and housing bubble of 2007. Just three days before the dotcom bubble peaked on March 10, 2000, he published a note warning that ‘valuations will begin to matter with a vengeance’ and based on his valuation analysis, warned of potential 65 to 83 per cent decline in technology stocks (Nasdaq 100 fell 83 per cent from its peak during the 2000-2002 bear market).

As investors, we all need to assess our asset allocation and risk exposures and manage our portfolio according to prevailing market circumstances — such as valuation, fundamental outlook, market sentiment etc — as well as according to our personal circumstances — ie age until retirement, financial goals, risk tolerance, job security, etc. Diligently doing this assessment is crucial in managing risks and successfully manoeuvring market cycles.

In right-sizing our investment exposure in dealing with these constraints, John Hussman recommends beginning with the acceptance that whatever you do, there will be regret and ‘If you begin by accepting that there will be regret of one form or another, you won’t feel paralysed, and you’ll consider more possibilities than you might otherwise.’

All investors, including the most successful ones, experience regret. Warren Buffett himself has said he was ‘too dumb’ in not buying Amazon early. So, rest assured, whether you turn out being an average investor or a successful investor, you will have regrets. You have to bear in mind that not one person can know for sure where the markets are headed in the next 1-2 years.

If you understand this and approach investing, regrets will not weigh you down or impact your decision-making, and it is more probable that you will end up as a successful investor rather than average.

The only regret you must avoid is the regret of not following a disciplined process and falling prey to entrenched biases. That is entirely in your hands.

If margins and multiples are both at record levels at the same time, it really is double counting and double jeopardy — for waiting somewhere in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.Jeremy Grantham, Co-Founder of GMO

Jeremy Grantham, Co-Founder of GMO

In our bl.portfolio edition dated January 28, 2024, we had highlighted how misjudging the compounding impact of changes to variables is what results in extreme wealth destruction. The variables, when it comes to stock price, are the EPS and the PE ratio (EPS * PE equals stock price). The risks that can prevail during good times when fundamentals are strong - profit margins are high resulting in high EPS, and investing euphoria resulting in high PE — is what Jeremy Grantham warns us to be wary of.

For example, at the end of December 2007, when the S&P was hovering at its then all-time highs of around 1500, it was trading at a trailing PE of 16 times. By March 2009, its PE had fallen by 30 per cent to 11 times. So, the index fell by around 30 per cent? No! It fell over 50 per cent as lower PE multiple on declining earnings pummelled the index. Operating margins were at cycle-highs (13.5 per cent) and it cracked more than 300 basis points from there, resulting in significant earnings decline.

Is there a similar risk in India now? Here are the facts — in the case of Nifty 50, Bloomberg consensus estimates indicate EBIT margin of nearly 18 per cent in CY24, versus 15.3 per cent in CY23. Prior to now, 17 per cent margin was last achieved in CY2007, after which margins were largely range-bound at 12-14 per cent during CY10-20. Will the current peak margins sustain? Apparently there is no risk round the corner barring a global event. However, the unknown risk is what should keep investors cautious when both margins and PE multiples (barring Covid-impacted 2021) are around peak levels.

You can do a scenario analysis by changing these variables to see how your stocks may perform under different circumstances in the future. According to Jeremy Grantham, ‘profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism’. The reason being that in capitalism, high margin/profitable businesses will attract more players and competition, resulting in decrease in margins over the medium to long term.

So, if you have stocks in your portfolio that are trading at peak PE multiples on peak profit margins, and good long-term returns are predicated on both these variables sustaining for the long term, then maybe it is time for you to reassess. While in good times these may be fine, the variables can change quickly when the tide turns.

There is this maxim in the markets – ‘stocks move up the stairs and come down the elevator.’ The double jeopardy stocks are most prone to take the elevator on down journey.

So, while you may stay invested in the markets, avoid the double-jeopardy stocks.

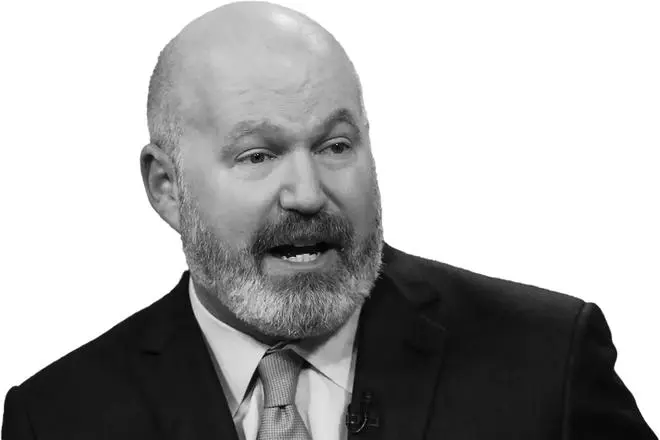

Predicting the future is harder than misremembering the past. You’ve got to guess at worst cases. No model will tell you that. I’m fond of pointing out the obvious – that the worst case wasn’t the worst case until it happened, so you can’t always assume the worst case going forward is the worst we’ve ever seen. One rule of thumb is double the worst that you have ever seen.Cliff Asness, Co-Founder of AQR Capital Management

Cliff Asness, Co-Founder of AQR Capital Management

AQR is a pioneer in quant investing and one of the largest in the space today, with over a 20-year-track record. Having set up shop during the dotcom bubble phase, Cliff Asness has experience in perils of trying to predict limits of markets excesses on either side of the spectrum. He advises in following this rule of thumb of doubling the worst case scenarios that you have seen. He suggests this more as a guideline.

Stress test is the new game in town with recent weeks’ news dominated by mutual funds’ stress test results for small and mid-cap funds. Individual investors can do their own stress tests to determine the strengths and risks in their portfolio. Let’s say you are an investor who entered the markets during the Covid-19 bear market; post that the worst correction you might have seen would have been the 19 per cent correction in Nifty in mid-2022, from its peak levels in October 2021. Can you withstand a correction twice —let’s say in the region of 30-40 per cent or even 50 per cent? Can you also deal with a longer recovery timeline?

Analysing on these lines can help you prepare for worst-case scenarios and respond in a positive way, if and when such corrections play out.

Like in the case of mutual fund stress test, if the worst case scenarios you forsee on applying this rule of thumb is alarming to you, it does not mean you will have to immediately unwind your investments. You only need to resize your portfolio to reduce the risk. Or you may choose to maintain your portfolio as it is, but be cognizant of risk and be open to the outcomes.

At Berkshire, we have found little to do in stocks during the past few years. During the break in October (1987), a few stocks fell to prices that interested us, but we were unable to make meaningful purchases before they rebounded. Mr. Market will offer us opportunities — you can be sure of that — and, when he does, we will be willing and able to participate.Warren Buffett, Annual Letter to shareholders in 1988

Berkshire Hathaway Chairman Warren Buffett

In 1987, the Dow Jones had crashed 22.6 per cent in one single day on October 19. But the rebound was quick too. Hence, Buffett could not buy bargains as he would have preferred, But rather than lamenting on the missed opportunity he was certain that markets will offer opportunities again in the future.

This has a lot of relevance in current times, especially for investors who may have missed some of the best parts of the current bull market. Should you get in now or should you wait for corrections?

Market history indicates deep corrections are endemic every few years. It’s just that one must have the patience to wait for it, however long it takes. In this case it means waiting for deep corrections, not the typical 2-4 per cent correction these days which results in a humorous clamour for ‘buy the dips’. Investors must have the patience to wait for real dips — corrections that are painful like it played out in mid-2022, especially in the technology stocks.

The second important thing is to have the war chest ready to invest when the opportunity presents. Similar to the ‘do not bet against India’ theme today, Buffett many times has said ‘never bet against America’. In believing in that he didn’t deploy all his cash, but used it wisely to buy only when good opportunities were presented to him.

As Buffett also said in his 1987 newsletter, ‘Volatility caused by money managers who speculate irrationally with huge sums will offer the true investor more chances to make intelligent investment moves. He can be hurt by such volatility only if he is forced, by either financial or psychological pressures, to sell at untoward times.’

The point here being, the only way you can lose out is by not having sufficient cash to invest and capitalise on these opportunities when they knock on your door.

Published on March 30, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.