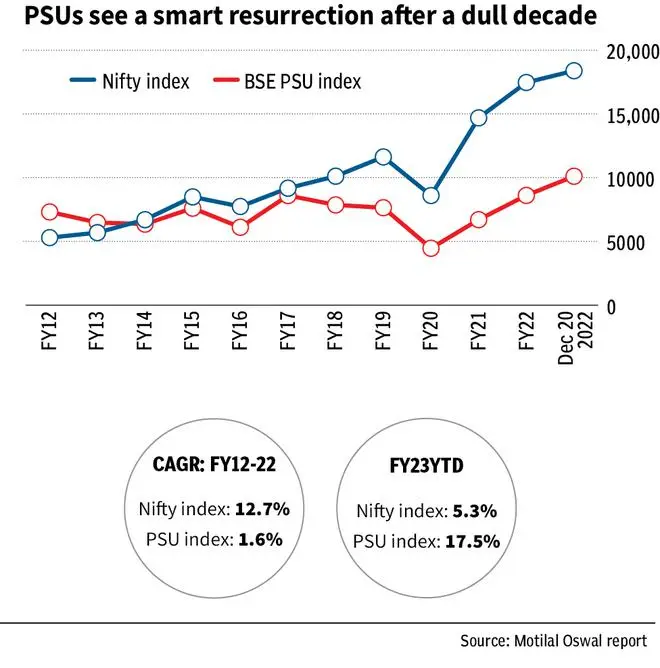

Indian PSUs have undergone a topsy-turvy journey in the last decade despite being formidable franchises with dominant market shares in many sectors. After years of underperformance, the PSU index has started outperforming benchmarks. Through the following 4 charts, we look at Indian PSUs’ journey over the past decade as well as their future prospects.

Most of the Indian PSUs are present in deep cyclical industries (Metals, O&G, and Financials) and thus have inherently volatile and cyclical profitability/market-cap performance. A large part of the FY12-22 decade was spent in cleaning up the balance sheets of Financials, which took its toll on the overall PSU profits as PSU Banks formed one-third of the profit pool of Indian PSUs. This coupled with several other macro disruptions kept the PSU profit pool suppressed over FY12-20.

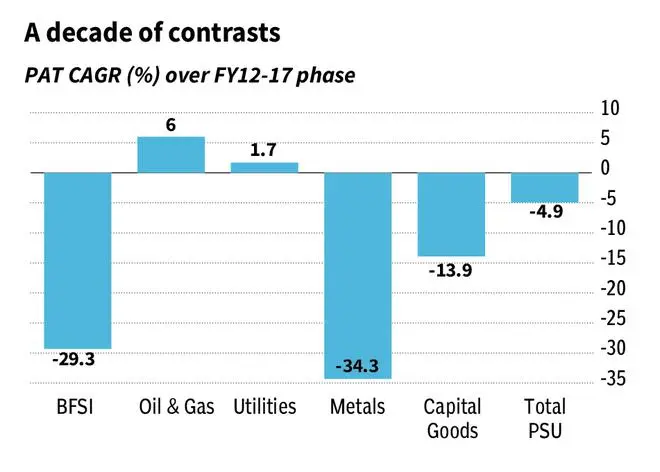

The PSU story is essentially of two halves: a) during the first half (FY12-17), profitability and market-cap performances were extremely tepid with overall PSU profits declining at 5% CAGR and BSE PSU index generating returns at 3.3% CAGR.

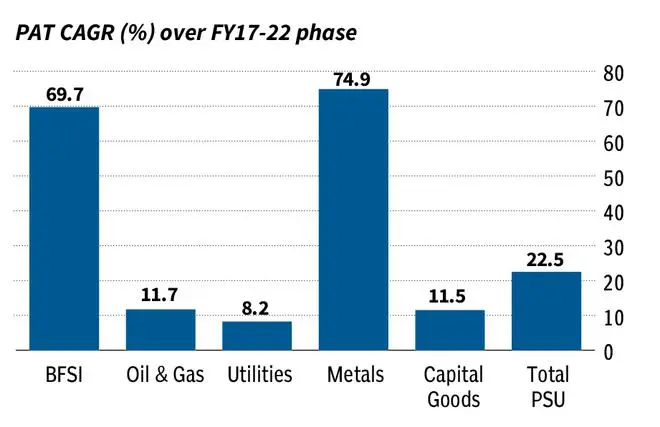

Over the second half (FY17-22), PSU profits expanded at 22% CAGR while BSE PSU index remained flat. Subsequently, PSU Index rose 17% post- Apr’22.

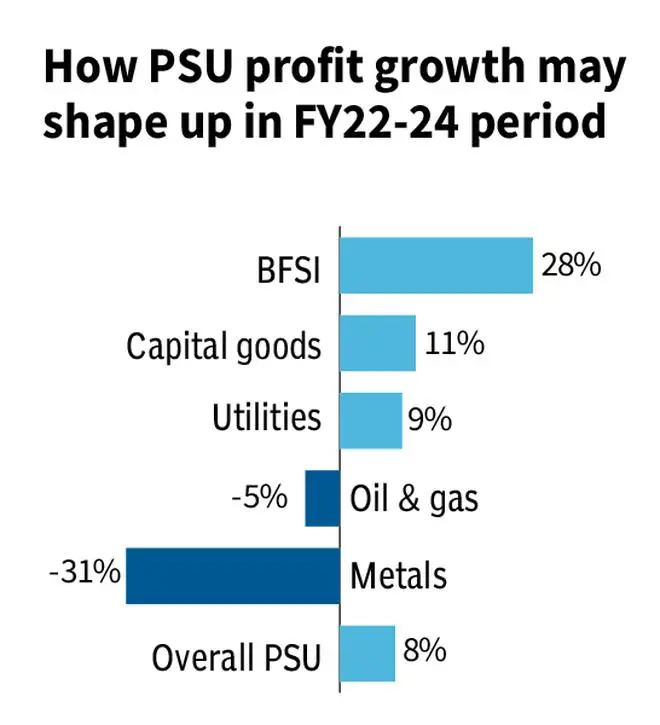

Looking ahead, the profitability of PSUs is shooting up across domestic as well as global cyclicals with turnaround in the fortunes of PSU Banks driving the overall trend. Higher commodity prices over the past two years have aided the P&L and balance sheets of Metals/O&G PSUs. The government’s emphasis on localization and make-in-India in Defence sector has catalyzed the improvement in fortunes of Industrial PSUs. Consequently, one may expect this recovery in PSUs’ contribution to both – profits and market-cap – to sustain

PSUs’ performance has deteriorated over the last five years. During FY17-22, the BSE PSU Index (flat) underperformed Nifty (13.7% growth). However, the profits of PSUs (at 22.5% CAGR) outperformed that of Private Sector (at 14.5% CAGR) over the same period. For FY23YTD, the PSU Index return (+17.5%) has outperformed the benchmark (+ 5.3%) handsomely

Published on December 27, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.