That India is surrounded by less-than-friendly neighbours is reason enough for the country to be on guard. World over, economic might is supported with defence prowess for aspiring or established superpowers.

India is the third largest military spender in the world with such expenditure accounting for 2.15 per cent of the total GDP (Gross Domestic Product), according to the Make in India website.

India’s defence manufacturing segment has had a good run over the past 5-7 years, with more focus on making equipment domestically, and also drive exports to other countries.

Stocks dependent or focused on the defence segment have delivered well in recent years.

In this regard, HDFC has come out with a new Defence Fund to play the theme. The new fund offer will be open from May 19 to June 2.

Also read: Why you should invest in HDFC Hybrid Equity Fund now

Should you invest in the NFO? Here’s what you must know before making your decision.

Under the defence segment, there are a whole host of companies engaged in making equipment, explosives, aerospace, ship building and other allied services.

India has embarked on a self-reliance journey in its defence manufacturing. There are some key factors to note with regard to the segment and companies therein. The Make In India Defence section carries important data points.

India still accounts for only 1-2 per cent of the total global arms exports market of $200 billion, giving ample scope for improvement.

Given the promise that the segment holds, HDFC Defence Fund, the first of the type to be rolled out, looks to bet on companies that would benefit from the thrust on local defence manufacturing.

The fund would look to invest 80 per cent of its portfolio in companies that derive at least 10 per cent of their revenues from the defence segment. It would be benchmarked against the Nifty India Defence Index TRI.

With the above investment criteria, the universe would comprise 21 stocks. Of these 18 are small caps, 2 are large caps and one is a midcap.

Also read: HDFC Multi Asset Fund: Should you invest?

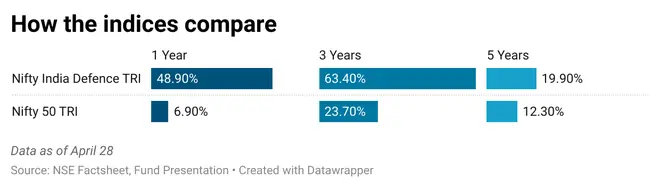

When back-tested data as of April 28, 2023, is taken, the Nifty India Defence Index TRI has outperformed the Nifty 50 TRI over one, three and five-year timeframes.

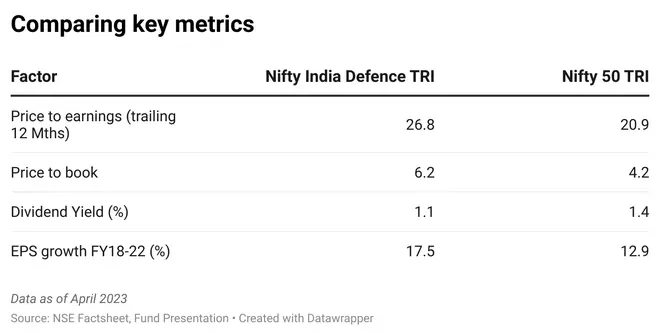

The earnings (EPS) growth in FY18-22 has been 17.5 per cent annually for the defence index, while the Nifty’s earnings grew at 12.9 per cent over this period.

Interestingly, the Nifty Defence index’s factsheet as of April 2023 indicates that there is a correlation coefficient of 0.58 over the past five years with the Nifty 50, indicating a moderate correlation. Thus, their movements are not that much in sync.

The defence index is more expensive on the basis of the P/E multiple though.

For retail investors convinced with the defence theme, it may not be possible to identify the best stocks to play the theme. Therefore, investing via a theme fund may serve the purpose. The theme itself is quite resilient as defence expenditures are generally steady.

Since HDFC Defence Fund is the first such offering, investors with a high-risk appetite can consider parking small SIPs in the scheme for diversification in their satellite portfolio, if they have a surplus after investing in core diversified schemes.

However, a horizon of 5-7 years may be needed to make fruitful gains.

Published on May 18, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.