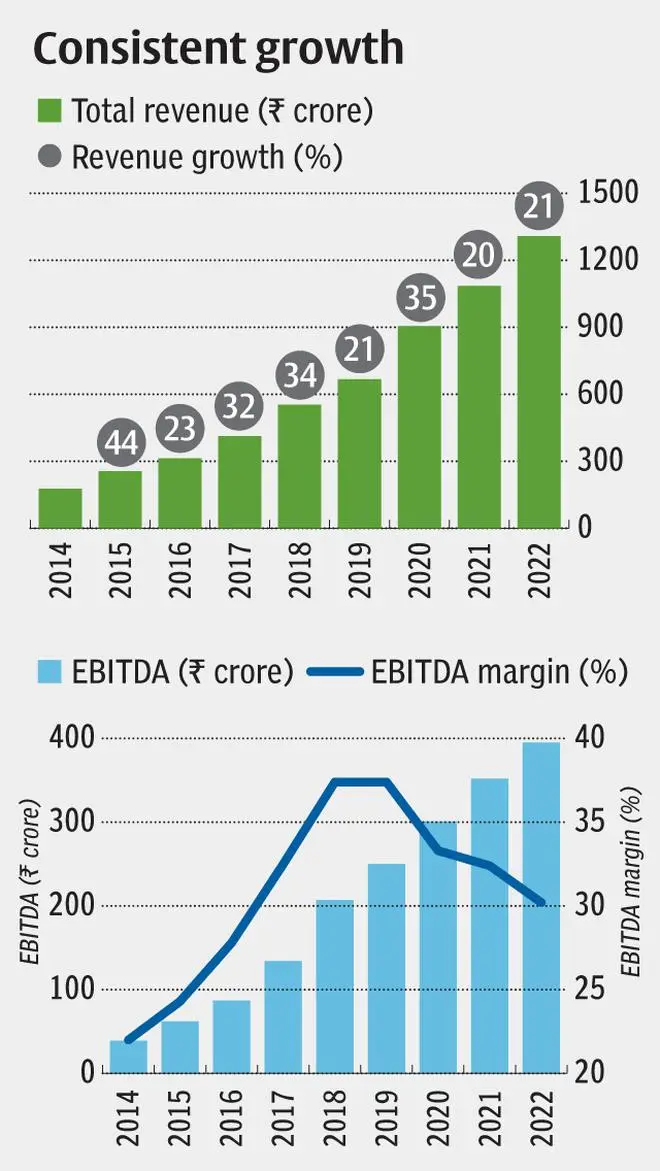

At BL Portfolio we had recommended a buy on the shares of Caplin Point Laboratories in January 2021. The stock has returned 40 per cent since and is now trading at ₹712 per share as the company has sustained its high revenue growth (21 per cent in FY22) with stable EBITDA margins of 30 per cent.

In the short to medium term, the company’s growth prospects in Latin American countries (base business) will be driven by portfolio expansion and by geographic expansion in the longer term. The company’s cautious entry into the US market with its sterile (injectables) portfolio has good growth potential from new products and product lines.

With the stock having cooled off around 20 per cent year to date driven by broader market correction, we now recommend investors accumulate the stock. Caplin is currently trading at 16 times FY23 earnings (Bloomberg). This captures the value in current business but does not appear to factor in upside potential from new growth investments.

The investments in additional sterile capabilities for regulated markets, capacity build-up in Latin American markets and API backend addition have more than two-year commercialisation outlook and hence cannot be immediately valued. But the capex (internally funded) can be a value generator for the company.

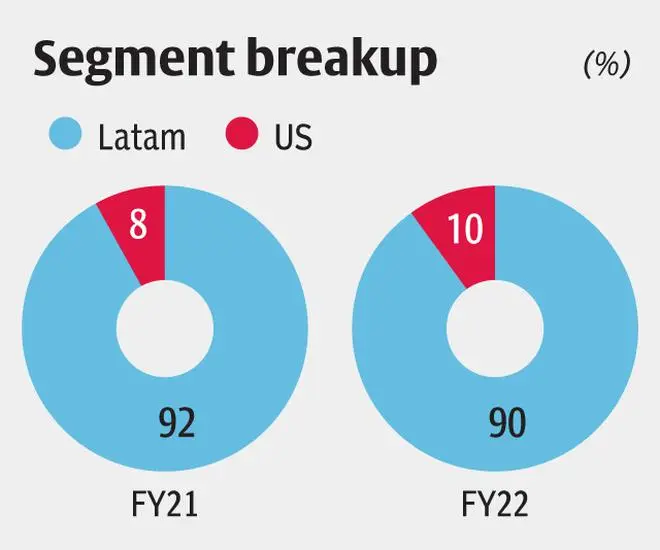

Caplin Point established a strong base in Latin American countries of Guatemala, Chile, Peru, Colombia, and Costa Rica generating 90 per cent of its revenues and at a CAGR of 28 per cent in the last eight years. The differentiated business model where Caplin reaches out to distributors or retailers (85 per cent of sales) and institutions (15 per cent) aided the stronghold of the company.

The company derives 25 per cent from branded products, but with its strong reach to therapeutic doctors (CNS, CVS and other injectables), presence across the supply chain and long-time presence in the markets, Caplin generates customer stickiness and hence pricing power in these regions.

Caplin is developing oncological oral solid dosages facility (₹130 crore) in Tamil Nadu, which will later include injectables as well, aimed at these markets. The sterile product basket developed for US business will be introduced across other regions as well.

This will add to the estimated 13-15 growth which can be sustained in its existing business which benefits from pricing power and new product introductions. .

Caplin is now targeting larger markets in Latin America and elsewhere, but these markets could open only slowly for Caplin. Starting from Mexico and Brazil which are the largest markets in Latin America the company is also exploring Russia and CIS countries (even with the ongoing war), eastern Europe, and finally western Europe with its portfolio.

These markets rank high on size but also rank high on regulation and competition compared to Caplin’s base business. But the portfolio, including US FDA compliant products, will be leveraged (even if slowly) across these regions.

Securing a strong base in Latin America, Caplin chose sterile injectable portfolio to enter US market. Supplying mainly to partners who commercialise the products, Caplin generated ₹121 crore of sales (10 per cent) in FY22 (44 per cent YoY growth) with 15 products commercialised.

Three more products are at approval stage and Caplin plans for 12 more filings in FY23 which should drive significant new product growth apart from base products. Combined, the sterile portfolio (limited competition), contribution from new products and institutional selling, the growth in US has been strong at 35-40 per cent in the last two years, overcoming price erosion haunting other companies. With a larger portion from new product introduction, the sales growth can sustain for US business.

Caplin is stretching further into sterile space for US. With an outlay of ₹220 crore, it will supplement its three injectable lines with one more ophthalmic line in Phase 1 which is nearly completed. In phase 2, the company will add one line each in pre-mixed bags, lyophilised injectables and prefilled syringes.

Operating in generic space, Caplin can avoid excessive erosion by focussing on sterile injectables with differentiated delivery or formulations mentioned above. The partners catering to hospitals primarily has generated strong traction for the company with good visibility as well (orders worth ₹160 crore in FY23). The company is eyeing its own front end in next two years by which time it should have accumulated around 50 products supporting the investment.

Owing to a high base and and gestation period for new investments (around two years), the consensus estimates appropriately expect 14 per cent revenue CAGR in next two years, lower from 28 per cent earlier. The margins have declined 400 bps from 35 per cent in FY17-20 as R&D and filing costs for regulated markets have impacted margins, even as US business’ gross margin profile is similar to rest of the business.

Higher employee costs (setting bases in other emerging markets) and continued product development costs will keep margins flat, offsetting operating leverage in the short term.

The valuation at 16 times seems fair for existing businesses considering the lower growth path Caplin may assume in the short term. For long-term investors, the upside potential in stock comes from its new investments. This optionality makes the risk-reward favourable.

The Oncology facility or the Phase 2 of sterile facility and even the proposed API backend addition (₹100 crore, expected to be inorganic) will need 2-3 years to be commercialised and generate significant earnings. Caplin has around ₹600 crore of net cash equivalents on balance sheet intended to finance the expansion. The company has a good balance sheet with net cash at around 10 per cent of its current market cap..

Published on July 2, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.