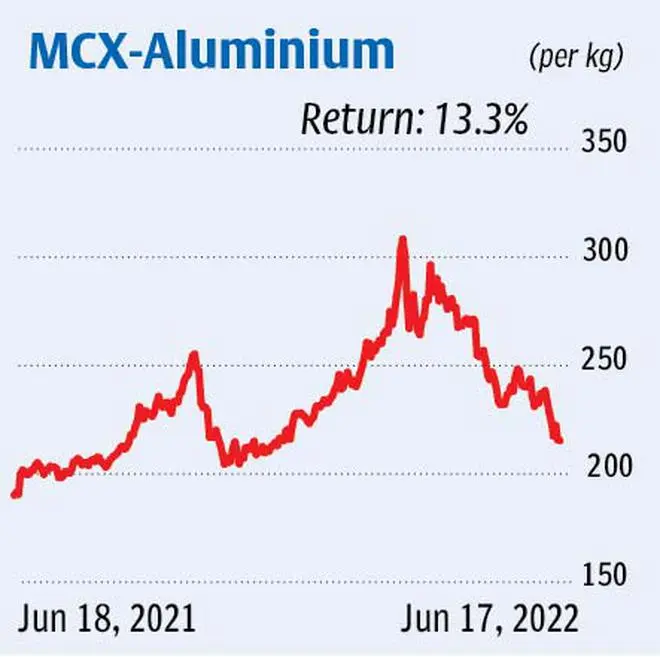

The aluminium futures on the Multi Commodity Exchange (MCX) witnessed a bearish trend reversal in early March after making a high of ₹325.4. Since then, it has been on a decline although there were a couple of corrective rallies.

The latest leg of the downward price swing began about a month ago at around ₹250. We have been suggesting short positions since then with a potential target of ₹200, a considerable support level.

Currently trading at around ₹214, the contract is approaching this base from where there could be a bounce. So, traders can exit the shorts when the price falls to the price band of ₹200-205. Maintain stop-loss at ₹225 for these positions.

A rally on the back of the support at ₹200 can take the contract to ₹225. A move past this level can lift it to ₹242 where the 50-day moving average lies currently. A breakout of ₹242 is less likely and the contract can start consolidating thereafter.

On the other hand, if the support at ₹200 is invalidated, it can turn the medium-term trend bearish and there can be a swift fall to ₹186, its nearest support level. Subsequent support is at ₹178.

Overall, our recommendation is to liquidate all the shorts when the price falls to ₹200. Fresh trades thereafter can be decided based on how the contract reacts to the support at ₹200.

Published on June 20, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.