The delay isn’t random; it’s driven by how foreign investors assess risk and timing.

Foreign money inflow is a key factors that gauge the strength of the market rally. Foreign Portfolio Investors (FPIs) hit the headlines when they buy or heavily sell Indian equities. Consistent buying from the FPIs coupled with a rally in the benchmark indices (Nifty 50, Sensex) can be one good convincing factor to pull the retail investors into the market.

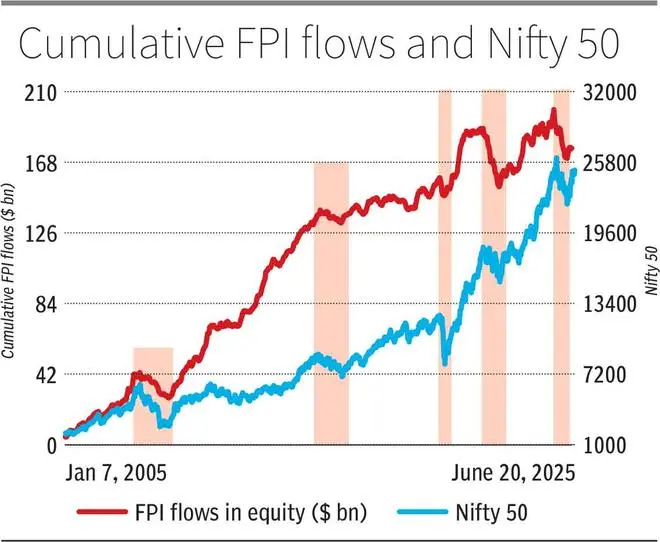

But after a correction, if you wait for a confirmation signal from the FPIs, you’ll end up boarding the bus late, getting a back seat and missing the front row. That’s what an analysis of 20 years of data shows. The Nifty 50, India’s popular equity benchmark, typically bottoms out first, while FPIs enter the market with a lag after some of the upmove has already played out.

To understand this better, we took the cumulative FPI flows (since 2005) into the Indian equity segment and compared the same with Nifty. For instance, in 2021-2022, Nifty fell from around 18,600 (October 2021) and bottomed out around 15,200 (mid-June 2022) before moving up. But the FPIs continued selling Indian equities until mid-July before returning to India. There was a net outflow of about $7 billion from mid-June, when the Nifty actually bottomed out, to the mid-July period.

Even during periods of major crises like the Great Financial Crisis (GFC) of 2007-2009 and Covid-19 downturn, the pattern remained the same. In GFC, Nifty bottomed out in October 2008. Thereafter it stayed flat/range bound until March 2009 before witnessing a fresh rally. Even during this period of consolidation, the FPIs sold about $5.8 billion (From October 2008 to March 2009).

The delay isn’t random; it’s driven by how foreign investors assess risk and timing.

Bajaj Broking Research says the FPIs often wait for confirmation of stability before re-entering and that delay creates a lag between the market recovery and FPI inflows.

Shrikant Chouhan, Head Equity Research, Kotak Securities, says, “FPIs do not wait when they sell. But they need some strong support and convincing factors to come back and buy. They do not buy just because the market is doing well.”

The Nifty has climbed from around 22,000 in early March this year to about 25,100 now. The FPIs are also coming back into India, once again after a lag. What has triggered their comeback now? Harsh Gupta Madhusudan, Fund Manager- PIPE, Ionic Asset, says, “Right now the dollar cycle is turning and so the FPIs are coming back.”

According to Bajaj Broking Research, increasing global risk-on sentiment coupled with the dollar weakness is also encouraging the capital rotation back into emerging markets, including India.

The escalating Israel-Iran conflict, and lack of full clarity prevailing over the tariffs levied by the US are some of the major uncertainties that the market is encountering now. Will the FPI inflows sustain under such uncertain circumstances? Experts believe that the FPIs may tread with caution. ”FPIs may not take aggressive call for two reasons. One, the valuations are quite expensive now. Secondly, the FPIs would wait until the July 8 deadline to get a clear picture on the US tariffs front”, says Shrikant. The 90-day pause in US President Donald Trump’s “reciprocal” tariffs will end on July 8. “If the clarity emerges earlier than the deadline or if the geopolitical tensions ease, then the FPIs may take active interest little early also”, adds Shrikant

However, data shows that once the FPIs come back, they stay put for the long term. So, the recent reversal seen in both the Nifty and FPI flows may sustain for long. “The Indian bull market has more space to run. The corporate profit to GDP cycle is best in the middle and the debt-to-equity cycle is at a very early stage. So, the FPI flows will be for a long-term phenomenon and not for the short-term” says Harsh.

Published on June 21, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.