SEPC Ltd (formerly known as Shriram EPC Ltd) has said that Dubai-based Mark AB Capital LLC has picked up a 26.48 per cent stake in the company for ₹350 crore. This is part of a restructuring of SEPC Ltd under the stressed asset provisions of the Reserve Bank of India, according to a statement.

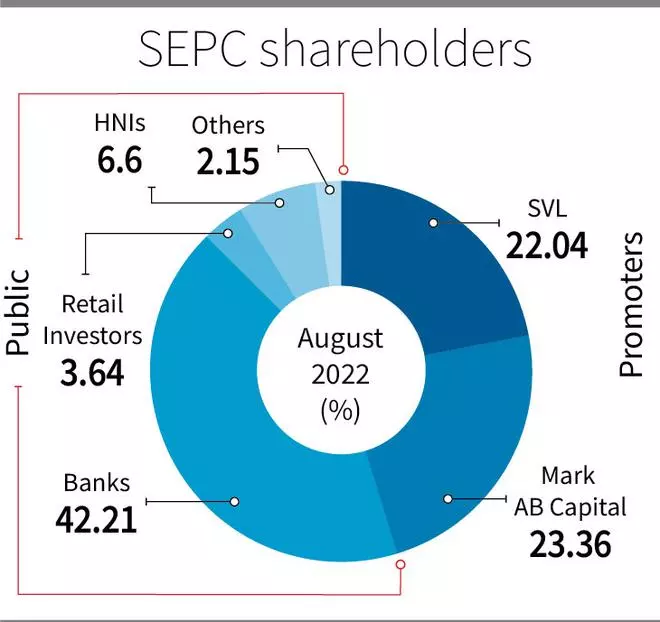

As a result of this, Mark AB capital becomes the promoter and the largest shareholder of SEPC Ltd. The existing promoter (SVL Ltd) will cease to be a promoter. As part of the rejig, the consortium of bankers has converted part of their debt into CCDs and NCDs.

A few days ago, the company informed the stock exchanges that its Board approved the allotment of 2,43,40,000 equity shares of ₹10 each on a preferential basis to Mark AB Capital as approved by the shareholders and the resolution plan approved by the lenders.

The Board of SEPC has been reconstituted and NK Suryanarayanan, who was non-executive non-independent director, has been appointed as the Managing Director for three years from September 24, 2022.

For 2021-22, SEPC Ltd had recorded a total income of ₹311.74 crore against ₹553.24 crore in the previous year on a standalone basis. The loss widened to ₹249.01 crore against a loss of ₹182.88 crore.

The company has been in the process of implementing a resolution plan under June 7, 2019, RBI Circular on Prudential Framework for resolution of stressed assets involving equity ₹350 crore infusion by Mark AB Capital to address the stress on cash flows and enable the company to bid for new projects.

The resolution plan was approved by the bankers on March 25. The revised consortium agreement – the master Restructuring Agreement - was signed on June 29. Fresh equity was issued to Mark AB Capital Investment LLC in tranches during June and July. With this transaction, Mark AB has become the promoter of SEPC Ltd.

As of March 31, 2022, the company’s order book was ₹1,197 crore.

Published on September 26, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.