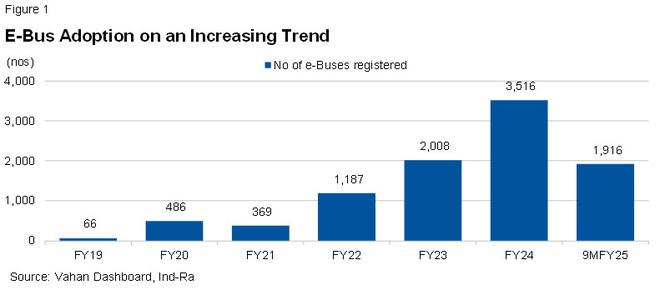

India’s electric bus sector is gaining momentum, with public transport authorities placing over 20,000 e-bus orders, driven by government initiatives and strengthened manufacturing capabilities, according to India Ratings and Research.

India’s electric bus (e-bus) sector is poised for rapid growth, with public transport authorities placing orders for over 20,000 e-buses, marking a significant boost for the industry. These orders reflect increasing momentum driven by government initiatives and stronger manufacturing capabilities, according to India Ratings and Research (Ind-Ra), which has maintained a Stable rating Outlook for e-bus projects for FY26.

The large e-bus order book underscores the need for original equipment manufacturers (OEMs) to scale up delivery capacity in FY26 and FY27 to meet timelines under concession agreements. However, challenges such as inconsistencies in measuring operational parameters and related contract deductions may require ongoing sponsor support.

“The government’s continuous efforts to boost e-bus adoption through various schemes have positively impacted the industry, with over 10,000 e-buses deployed as of December 2024,” said S Suryanarayanan, Analyst at Ind-Ra’s Infrastructure & Project Finance Group. He further noted that mechanisms like the Payment Security Mechanism (PSM) and a direct debit mandate for payment replenishment are crucial for ensuring the financial sustainability of these projects.

The proposed ₹3,435 crore Payment Security Fund (PSF), under the PSM, is expected to cover around four months of payments for 38,000 buses operating at 200 km per day at a ₹65 per km fee. The consistent implementation of PSM is seen as a game-changer for improving the bankability of e-bus projects and encouraging competitive pricing in future tenders, Suryanarayanan added.

Programmes such as FAME I and II, PM-eBus Sewa, and the Electric Drive Revolution initiative represent a combined outlay of ₹282.16 billion. While these policies have supported the deployment of thousands of e-buses, challenges remain in ensuring timely payments from public transport authorities (PTAs).

Convergence Energy Services Ltd (CESL) is set to play a key role in implementing PSM, ensuring sustainability through state governments’ direct debit mandates with the Reserve Bank of India.

Private sector adoption of e-buses, especially through leasing models, could further stimulate demand and help fleet operators overcome high upfront costs. “Private sector interest in e-buses could create an alternate demand for OEMs, reducing their reliance on balance sheets for growth,” said Divya Charen C, Associate Director at Ind-Ra.

Low operational costs are expected to drive the electrification of private bus fleets, although high upfront costs remain a major deterrent, as government schemes have mainly focused on PTA fleets. India Ratings suggests that financial intermediaries could act as asset-owning entities, leasing buses to private operators for a per-km fee or monthly rent.

This leasing model would help operators bypass high initial expenses, provide a steady cash flow stream for intermediaries, and support OEMs in scaling up production. Additionally, expanding heavy-duty public charging infrastructure is critical, as it will be essential for route planning and ensuring operational flexibility for both public and private e-bus fleets.

Published on January 21, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.