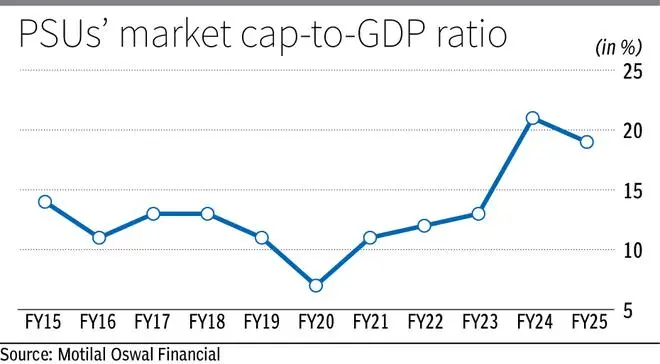

The growth comes after a decade-long stagnation between FY09–20, Motilal Oswal report noted | Photo Credit: iStockphoto

Once overlooked as underdogs, listed PSU companies have generated a wealth of ₹51 lakh crore in five years. The PSU market capitalisation has surged from ₹12 lakh crore in March 2020 to ₹69 lakh crore in June 2025, adding ₹57 lakh crore in five years, said a report from domestic brokerage Motilal Oswal Financial Services.

The growth comes after a decade-long stagnation between FY09–20, the report noted.

Public sector companies have bounced back sharply, registering compounded annual earnings growth of 36 per cent in earnings in the last five fiscal years, compared to an earnings CAGR of 26 per cent by their private peers. Despite a moderation in FY25, the core profit engine of PSUs remained intact. The recovery story of PSUs was anchored in balance sheet clean-ups, policy tailwinds and sector-specific structural shifts, said Motilal Oswal Financial Services report.

PSU market share rebounds to 15.3 per cent last fiscal from 10 per cent in FY22

After years of decline, PSUs have clawed back space in the overall market cap pool. Their share, which had slipped to 10 per cent in FY22, now stands at 15 per cent, thanks to a strong rally and profit growth.

Loss-making PSUs drag on the overall profit pool now account for just one per cent against 45 per cent in FY18, as the drag from chronic underperformers has faded.

In fact, FY25 was the fifth consecutive year of declining losses among PSUs.

Among specific sectors, the report said the contribution of BFSI in the overall PSU profit increased to 38 per cent last fiscal against just 7 per cent in FY20.

PSU banks, once weighed down by bad loans, have written off bad debts and are now leading the chart with clean balance sheets, improving NIMs and strong earnings visibility.

Capital goods PSUs clocked 28 per cent CAGR in profits over FY20–FY25 with increased defence and infra-led orders. HAL and BEL have emerged as institutional favourites, backed by execution and earnings consistency.

Despite weak earnings in the last fiscal, PSUs are expected to register a net profit CAGR of 10 per cent between FY25-FY27, aided largely by robust profit growth led by BFSI, Oil & Gas, and Metals.

The BSE PSU Index delivered 92 per cent gain in FY24, stayed flat last fiscal and is already up 8 per cent in FY26 year-to-date.

After a blockbuster year, FY25 acted was a consolidation phase, said the Motilal Oswal report.

Valuations of PSU stocks have corrected to 12 times forward price to earnings, down from the last July peak of 14 times. This valuation reset provides fresh entry points in companies with strong earnings growth visibility, it added.

Published on June 26, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.