A view of the BSE building in Mumbai, Monday, August 26, 2019. The BSE Sensex jumped over 700 points afternoon session. Photo. Paul Noronha | Photo Credit: PAUL NORONHA

India’s stock and currency markets went into a tailspin on Friday since fear gripped traders of an impending global crisis triggered by the unprecedented interest rate hike scenario presented by the US Federal Reserve.

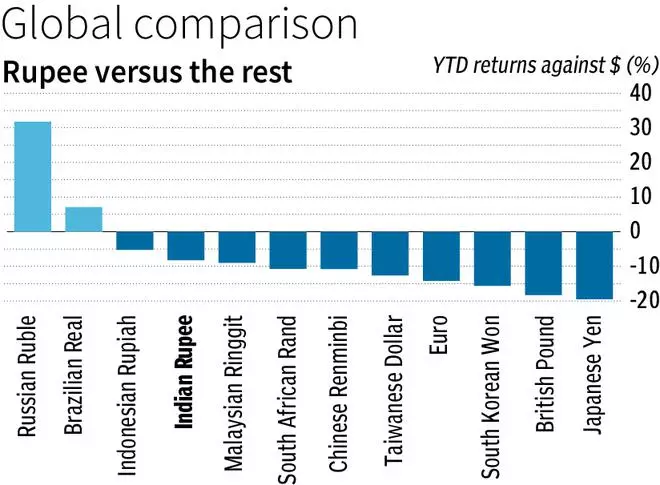

The rupee hit 81 against the dollar before closing at a new lifetime low of 80.99. Sensex and Nifty fell by 1.73 per cent as foreign portfolio investors (FPIs) and retail investors stepped up selling. Sensex declined by 1,020 points to close at 58,098. Nifty was down by 302 points at 17,327. Both the indices are close to breaking their key support levels indicating a further sharp fall, analysts said.

US Fed chief Jerome Powell has indicated an additional 2.25 per cent hike in key rates this year and another 0.25 per cent hike next year. Experts say Indian stock markets will catch up with US markets in the coming weeks. Key equity indices in the US are down 18-24 percent so far in 2022, while Sensex and Nifty have declined by less than 5 per cent from their highs.

Rohit Srivastava, chief strategist at Indiacharts, said, “Friday was just the beginning. Markets may see a repeat of 2001 and 2008 kind of Wall Street crisis. Then too, Indian markets kept rising for several weeks even as benchmark indices in the US were down sharply. The decoupling theory, which was the reason for rise in Indian markets, works only till markets catch up to the reality of quicksand, that is vanishing global liquidity.”

Srivastava says Nifty will test 14,500 levels by December. “Spike in India’s bond yield on Friday is a lead indication that the Reserve Bank of India (RBI) is way behind in raising interest rates. They will have to be more aggressive and when that happens, Nifty and Sensex will have no ground given that rupee would be in a free fall against the dollar.”

According to a Kotak Securities report, the USD-INR pair will trade in the 79-83 range for the rest of FY23 (and average around 80.2 in FY23E), with restricted RBI FX intervention. Meanwhile, India’s forex reserves declined $5.219 billion in the week ended September 16, to stand at $545.652 billion. Overall, the reserves have shrunk $61.657 billion since March-end, partly due to RBI’s intervention in the forex market to contain volatility in the domestic currency.

Baman Mehta, CEO, Darashaw, said, “We have repeatedly highlighted in our reports that Nifty sustaining above 17,116 on a weekly close basis is important. A failure to do so would complete the double top pattern which would give targets of around 16,300. The March low of 15,671 remains the key support on a monthly close basis. A monthly close below the same would trigger continuation of the medium-term down-move. On the other hand, a weekly close above 18,114 is important for the up-move since the June low of 15,183 to continue. However, absolute clarity that the Nifty being in a secular upmove and the low being significantly in place would only happen with a quarterly close above the October 2021 high of 18,604. Without the quarterly close above 18,604, the Nifty would be yet open to downsides in the medium-term.”

FPIs sold stocks worth ₹2,900 crore in the cash segment. They sold index futures worth ₹3,372 crore and stock futures worth ₹2,990 crore on Friday, according to exchange data. Retail investors were net sellers to the tune of ₹255 crore in the cash segment, data showed. After Thursday’s fall of more than 1.5 per cent, US indices were down by 1.4-1.6 per cent on Friday. India’s benchmark bond yields jumped to 7.39 per cent from 7.23 per cent in just a day.

Published on September 23, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.