Indian equity markets have staged a remarkable comeback, with major indices now trading just 1-5 per cent below their September 24, 2024, peaks, following a swift recovery from early-March 2025 lows. The correction phase between September 2024 and March 4, 2025, was severe — the Nifty 100 plunged 17 per cent, while Nifty Midcap 150 and Nifty Smallcap 250 tumbled 21 per cent and 26 per cent,respectively. However, March 2025 marked a turning point and there has been a strong recovery since.

As most broader indices have recouped their losses, let’s examine the standout winners and notable laggards during this tumultuous nine-month journey from September 24, 2024, to June 27, 2025. During the period, Nifty India Defence gained the most - 31 per cent, followed by Nifty Financial Services Ex-Bank (11 per cent) and Nifty Bank (7 per cent). The biggest losers were Nifty Energy (-16 per cent), Nifty EV and New Age Automotive (-15 per cent), and Nifty FMCG (-15 per cent).

The returns in the chart below are for the period from the date of the respective indices peak in September till now.

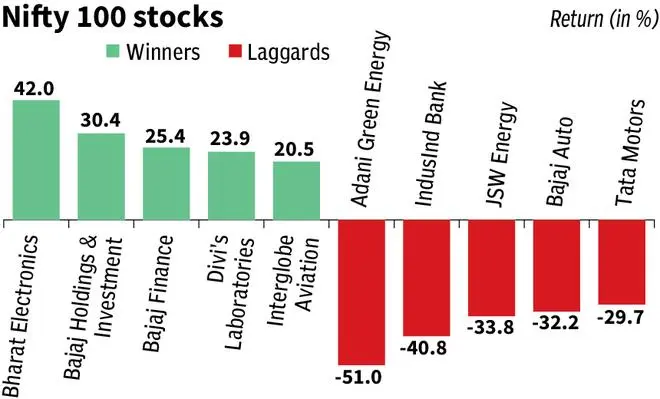

Large-cap segment (Nifty 100): Out of 100 large-cap stocks, only 28 managed to recover and post gains over the nine-month period. Defence and select financials led gains, while selective energy and auto stocks dragged the segment down significantly.

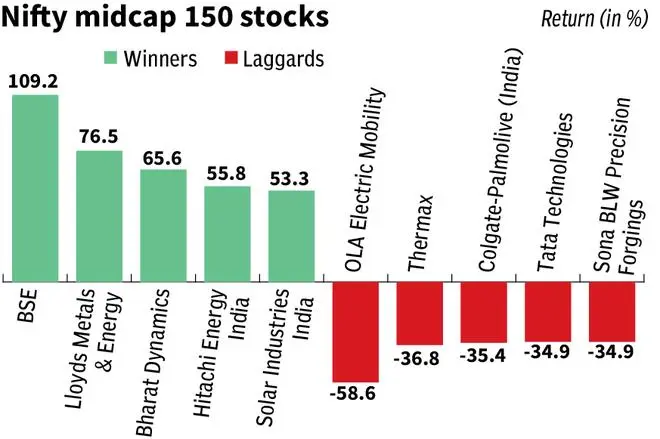

Mid-cap segment (Nifty Midcap 150): Roughly one-third of the 150 mid-cap stocks rebounded and ended in the green during the period. Mid-caps fared slightly better, with stronger recovery breadth. Select industrials and financial services helped lift returns, but the segment was weighed down by volatility in newer-age and consumption-linked sectors.

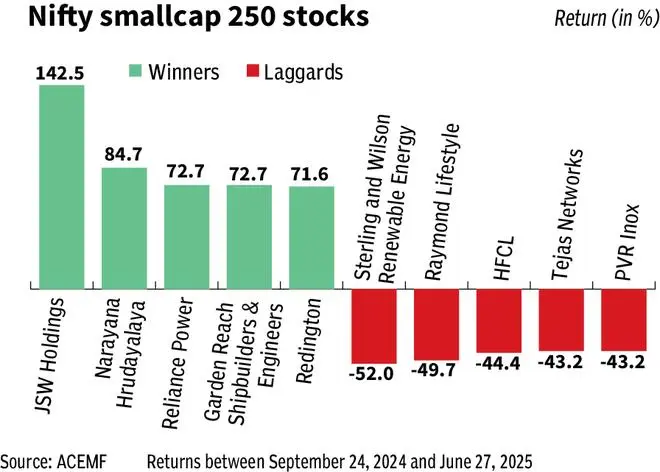

Small-cap segment (Nifty Smallcap 250): Among small-cap stocks, 85 out of 250 saw a rebound and closed higher by the end of the period. Strong recoveries were seen in manufacturing, and defence-related names drove performance in this segment. Select textiles, renewables and telecom equipment stocks witnessed the sharpest corrections.

Published on June 28, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.