Curated stock portfolios are a mix of stocks that reflect an investment idea

With the equity market continuing to deliver good gains, retail investors with a high appetite for risk are beginning to look at curated stock portfolios as their next wealth creation tool. These portfolios fall somewhere between the mutual fund (MF) universe, where minimum investment is ₹500, and the Portfolio Management Services (PMS), where entry ticket size is ₹50 lakh. Typically, this product offering is a pre-designed basket of stocks that is monitored and tweaked by an expert and orders are transacted on broker platform; but the final decision-making lies in the hands of the individual investor.

The new investing route offers potentially higher returns, access to the vintage of celebrated fund managers, lowers risk compared to self-researched equity investing and opens up a world of unique portfolios. On the flipside, selecting the right basket/portfolio is often a leap of faith, less-regulated nature of these emerging portfolios means information/data presentation still has some miles to go, pricing for the best managers is at a premium for small investors, and portfolio churn is potentially higher due to frequent sells and buys. Here is a detailed look at the pros and cons of curated stock portfolios.

#1 Higher returns

Curated portfolios show higher historical returns than many competing products. This is one of the main reasons small investors are attracted to them. Investors who put money in the best performing stock baskets, called smallcases, on the smallcase platform have generated 70-140 per cent return in the last one year.

Compare these returns to the 10-40 per cent average gain by equity mutual funds across various categories in the last one year. Stock picking is just one of the factors why curated stock portfolios seemingly generate higher returns. The other reasons are portfolio concentration (lower number of stocks), swifter portfolio changes and, in general, higher risk-taking.

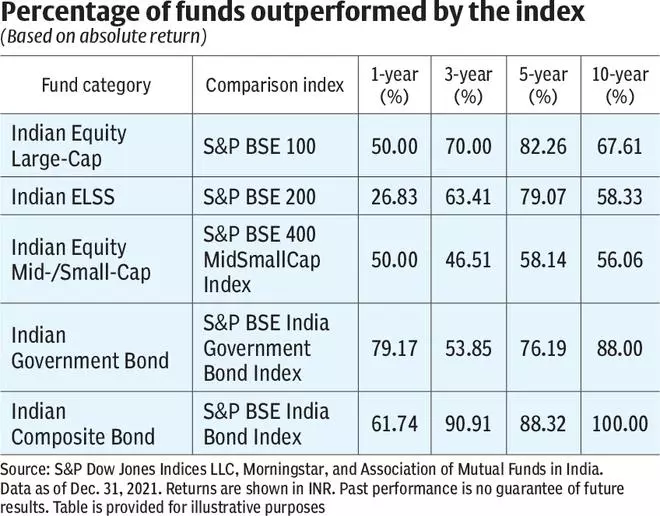

Actively-managed mutual funds, which still are the best investment avenue for first-time retail investors, are constrained on many parameters such as prudential caps on stock/sector limits, narrower liquid investment universe and lower manoeuvrability on account of larger asset size. This can partly explain why the percentage of fund outshine by passive indices is on a rising trend. For instance, 60-80 per cent of large-cap, ELSS (tax-saving) and mid-/smallcap funds have been beaten by the index in 5-year period, as per SPIVA India Scorecard. The numbers are similar for 10-year period, showing that alpha generation over the long term isn’t too great.

#2 Celebrated fund managers

Some of the best fund managers have set up their own portfolio management firms. The curated stock basket landscape offers these managers the opportunity to sell their offerings directly to investors, without going through the MF route. Also, some fund managers have made a name for themselves in the investing world and currently curated stock baskets are among the ways to get access to their expertise as ‘investment advisor’.

Smallcase and WealthDesk provide the infra that allows integration with all the popular stockbrokers. So, when you invest in a particular basket of stocks, the trading will happen on your broker platform. You can, for a fee, for instance, access Deepak Shenoy’s Capitalmind Momentum strategy in smallcase or Capitalmind’s Allcap Momentum on Paytm Money powered by WealthDesk. You can tap into Devina Mehra-led First Global Finance’s FG-HUM offering. Emerging PMS players such as Aurum (Jiten Parmar), Negen (Neil Bahal), Piper Serica (Abhay Agarwal) and Tamohara (Sheetal Malpani), amongst others, also offer stock baskets. Many of the equity investing brains have made a name for themselves in the mid/small-cap stock space, an area of great interest for retail investors.

Full-service brokers such as ICICI Securities (ICICIdirect) have tied with the masters of the street such as Shailendra Kumar (Narnolia), E A Sundaram (o3 Bhuvi Advisors), Pankaj Murarka (Renaissance), Rajesh Kothari (AlfAccurate), Vikas Khemani (Carnelian) and Sunil Singhania (Abakkus). Here you can invest into curated baskets advised by them by subscribing to various portfolios. These experts could be available on other platforms as well.

#3 Better than DIY investing

The Sensex/Nifty is up 22 per cent over one year, with mid-cap and small-cap indices having done even better. Such phases in markets attract many new investors, with more than 8 crore demat accounts now there. But, the life of a Do-It-Yourself (DIY) stock investor hasn’t been easy. For every multi-bagger stock out there with massive returns, there are stocks such as Strides Pharma down 58 per cent in 1 year, Dilip Buildcon (down 47 per cent), Vaibhav Global (down 42 per cent), Neuland Labs down (41 per cent) and Ujjivan SFB (down 38 per cent). And, this is just Group A stocks! Stock-picking is tough, especially when retail investors trade. In fact, less than 1 per cent active traders are able to beat bank fixed deposits, as per Zerodha, the country’s largest stock broker. Curated stock portfolios take the stress away from DIY stock investors, be it the experienced ones or newbies.

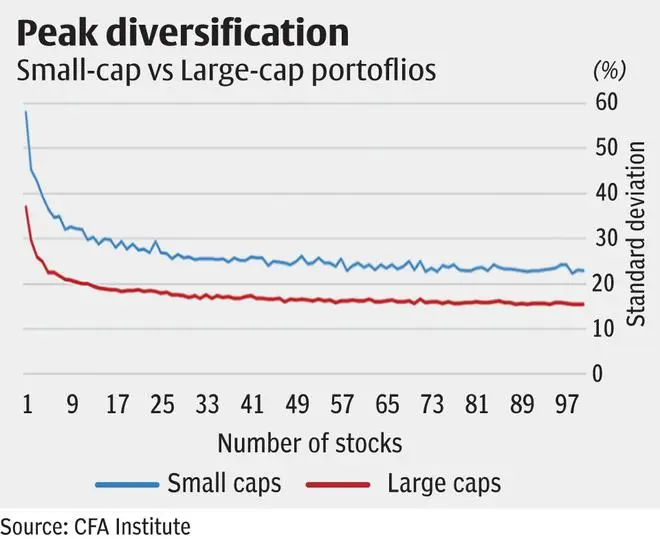

First of all, the risk in buying 1-2 stocks is much higher than buying 10-20. Diversification effect kicks in with a large number of portfolio constituents. According to research, 15 stocks are needed for a well-diversified large-cap portfolio while peak diversification for small-cap portfolios is 26 stocks, as per CFA Institute data.

Second, DIY stock investors often can’t handle volatility. They may end up picking the best of stocks, but without guidance and experience, they can sell these winners much early. For instance, 80 per cent stocks that lost at least one-third of value in February-March 2020 have at least doubled since then!

Thirdly, relying on tips, social media ‘advice’ and blindly following prominent investors after they created a stock position does not help. With only one-fourth of the country’s population actually financially literate as per a National Centre for Financial Education survey, curated stock portfolios are a good way for those who want an alternative to MFs.

#4 Unique plays

Curated stock baskets open a world of possibilities to investors beyond the usual hoi polloi in the investment arena. Unique approaches and portfolio strategies, which hitherto could be accessed only by the HNI and affluent investor community, are now available at your fingertips.

There are stock baskets that act like long-only event-based hedge funds in small-caps. There are portfolios that are completely AI-driven in approach. While momentum funds are being launched or have been around for some time, defensive momentum-based portfolios are now available as curated baskets.

In terms of themes, stock baskets have numerous options. There are portfolios built to leverage rising rural demand, the great Indian middle class, electric mobility, green energy, affordable housing, metal, energy, defence, bullet train ecosystem, etc. Only a few of these options are available in the MF space. While many of these thematic plays do not lend themselves to a larger fund category, still they are an option for investors who want to bet on them through curated portfolios.

Sectoral stock portfolios such as realty, insurance, PSU financials or conglomerate-based baskets such as HDFC and Bajaj are also interesting options for some investors. Do remember, most of these baskets are highly risky due to excessive sector or group concentration.

#1 Selecting the right basket

Choosing the right stock basket is tough. On BSE, 3,900 companies are available for trade. There are 365 open-ended equity funds in the MF arena. There are 224 curated portfolios (including broker managed) called WealthBaskets on WealthDesk platform, and 250+ smallcases on smallcase platform. With such a plethora of choices, homing in on the right one is challenging. Also, many stock baskets have come into being only over the last 2-3 years. Hence, it is important to see how they perform over an entire cycle.

Do note, many curated stock portfolios, especially thematic and sectoral plays, are far more risky than a diversified fund. Excessive stock concentration is a double-edged sword. Similarly, high sectoral exposure or allocations can backfire if something untoward happens in the sector/industry. One must consult a financial advisor before taking sizeable positions in curated portfolios.

#2 Less-regulated space

On paper, the curated stock portfolio space has players that are regulated by SEBI. But unlike AMCs, MFs, PMSes or AIF vehicles/structures regulated by SEBI, a curated stock basket is a confluence of brokers, investment advisors, research analysts and platforms. Hence, the industry operates on best practices but there are no guidelines for how the curated basket space should operate.

The lack of MF-like regulation means that there is still some miles to go in terms of industry standards such as data/return representation, wider availability of information useful for investors or advisors. While platforms such as smallcase and WealthDesk have some information such as portfolio literature, factsheets and methodology, there is no one integrated standard for these. This means certain leeway could potentially be taken. With returns being the first thing investors check, there is a need for apple-to-apple comparisons. Without the same standards, assessment and analysis become difficult.

Also, since the financial decision is in the investor’s hands, individual return experience can greatly vary from published gains in portfolio literature due to holding period, acceptance of all portfolio changes, etc.

#3 Best managers at a premium

You can access the free curated stock baskets to save on the access/subscription fees. But they are plain-vanilla portfolios bereft of any star fund manager touch. Star fund managers are one of the reasons many investors are looking at curated stock portfolios. But, they come at a price. Sunil Singhania-led Abakkus smallcases require a minimum ₹5 lakh investment and access is available for 2.5 per cent of investment value (₹12,500 on 5 lakh), plus a one-time fee on smallcase. Access to Deepak Shenoy-led Capitalmind’s momentum based portfolios is available for ₹12,000-13,500 a year. Some curated portfolios of PMSes also have similar rates (2-2.5 per cent).

One can argue that the 2-2.5 per cent rate may be comparable to the expense ratio limits for equity mutual funds, but here is the thing: as mutual fund size rises, expense ratios fall. In the case of curated stock portfolios, this does not seem to be the case. In case of MFs, portfolio management is involved as well, not just stock idea suggestions. We also noticed that flat fees for some baskets are in the range of ₹20,000-30,000/year. The effort put in to select a group of stocks is same irrespective of one investor or 1,000 investors. On the other side, if the returns from curated portfolios are outsized, the price you pay will not hurt one bit.

#4 High portfolio-churn potential

Portfolio churn is potentially higher due to frequent sells and buys in curated stock baskets. With many stock baskets relying on quantamental techniques or technical analysis for stock selection, weekly or monthly rebalancing is a fact for some baskets. This would mean you would have to incur associated buying and selling costs and tax implications. In domestic equity, long-term capital gain tax rates are only applicable when holding period is more than 12 months. Any smaller holding periods mean short-term capital gain tax rates.

A consistently high portfolio turnover only indicates the fund manager is chasing momentum stocks, which are a riskier bet but can also give higher returns. High portfolio turnover could be on account of many reasons, such as market condition, strategy mandate, house philosophy, etc. Prudent stock-picking is required to stay ahead of the curve. And, there is no way of knowing how future returns will be. So, curated stock portfolio investors will have to live that journey.

Published on April 16, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.