The 250 stocks of Nifty LargeMidcap 250 Index are the combination of the universe of stocks forming part of Nifty 100 Index and Nifty Midcap 150 Index | Photo Credit: iStockphoto

With passive investing gaining ground, asset management firms, both old and new, have relied on index fund and exchange-traded fund launches in recent times. The newest member of India’s MF industry, Zerodha Fund House, has launched two new funds: Zerodha Nifty LargeMidcap 250 Index Fund and an Equity Linked Savings Scheme (ELSS) variant - Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund. The new fund offer period for both schemes ends on November 3, 2023. The index funds offer a play on a combination of large and midcap stocks if you feel actively managed funds can’t do the job efficiently. Should you go for the Zerodha index offerings? Here is a lowdown.

The Nifty LargeMidcap 250 Index is among the baskets which does not have many funds tracking it. Apart from Zerodha Nifty LargeMidcap 250 Index Fund and the ELSS variant, there is only one more: Edelweiss NIFTY Large Mid Cap 250 Index Fund (launched in December 2021). The Edelweiss offering has an expense ratio of 0.14 per cent (direct plan). Zerodha Fund House funds will only have direct plans. Investors should wait and watch to see what expense ratio Zerodha charges.

The Nifty LargeMidcap 250 Index aims to reflect the performance of the large and midcap companies listed at NSE, with 50 per cent weight allocated to each segment. The 250 stocks of the Nifty LargeMidcap 250 Index are the combination of the universe of stocks forming part of the Nifty 100 Index and Nifty Midcap 150 Index.

The index rebalances itself to reflect a 50:50 ratio of large and midcap exposure every quarter.

The Nifty LargeMidcap 250 index which provides exposure to both large and midcap segment in a single index. The 250 stocks of the Nifty LargeMidcap 250 Index cover approximately 84 per cent of the full market capitalization of NSE stocks. Given the higher number of stocks (250), the index also provided higher coverage compared to Nifty 50 (59 per cent), Nifty 100 (69 per cent) or Nifty 200 (82 per cent).

Given the larger number of stocks, the Nifty LargeMidcap 250 Index also has a larger number of sectors (20). The largest sectors in the index are the Financial Services, IT and Capital Goods sectors. The combined weight of the top-4 sectors in the Nifty LargeMidcap 250 index is 52 per cent, which is less concentrated than the Nifty 100 index and the Nifty Midcap 150 indices. Note Nifty LargeMidcap 250 Index has higher exposure to the Healthcare, Capital Goods, Chemicals and Consumer Services sectors than the Nifty 100.

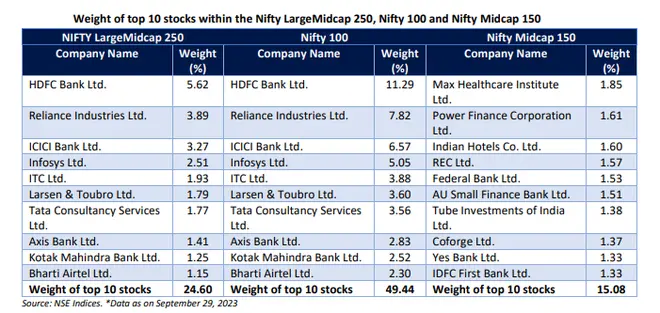

However, the top 10 stocks (by weight) for Nifty 50, Nifty 100, Nifty 200 and Nifty LargeMidcap 250 are identical. All the indices have the same top-10 stocks, viz. HDFC Bank, RIL, ICICI Bank, Infosys, ITC, L&T, TCS, Axis Bank, Kotak Mah. Bank and Bharti Airtel. What differs is the weight of each stock. For instance, HDFC Bank is 5.6 per cent in Nifty LargeMidcap 250 but accounts for more than the double allocation in the Nifty 100.

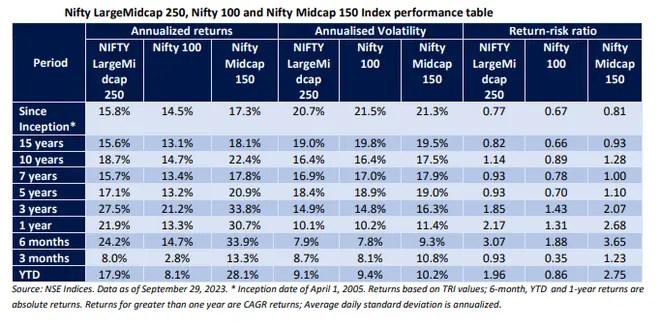

Returns analysis (see below) of the Nifty LargeMidcap 250 across different periods shows that it has done better than the Nifty 100 but has lagged behind the Nifty Midcap 150. This shows the balance between largecaps, midcaps and a combo of the previous two. During phases of midcap outperformance, such as the one we are currently witnessing, the Nifty LargeMidcap 250 would look great. But when midcaps perform poorly, performance shall be dragged down given the 50 per cent allocation.

However, the annualised volatility of Nifty LargeMidcap 250 is not necessarily higher than Nifty 100. In fact, volatility of the Nifty LargeMidcap 250 index has been slightly lower than both the Nifty 100 and Nifty Midcap 150 Index across the long-term horizon period of 5, 7, 10, and 15 years.

Investors need to understand that Nifty LargeMidcap 250 can clock negative returns in certain periods (as seen in 2008, 2011 and 2013) when markets also fell. Being a combination of large and midcap stocks, the Nifty LargeMidcap 250 Index has historically provided a shield against the underperformance of large caps vs midcaps or vice versa. In 2018, the Nifty Midcap 150 Index delivered a 12.6 per cent return, whereas the Nifty LargeMidcap 250 Index delivered a lower (-5.2 per cent) loss.

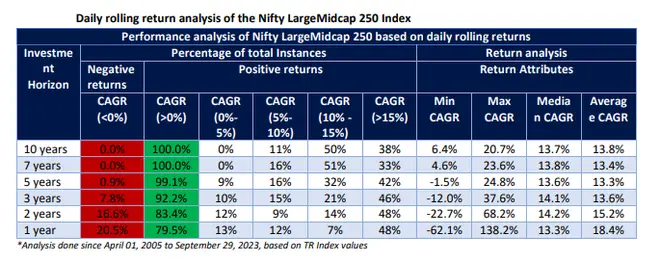

The Nifty LargeMidcap 250 index delivered positive returns 79-93 per cent of the time over horizons of 1, 2 and 3 years, based on daily rolling return analysis. As the investment horizon increases, the extent of positive returns approaches 100 per cent.

Being a fit between the Nifty 100 and the Nifty Midcap 150 index, the Nifty LargeMidcap 250 index has historically witnessed returns between the Nifty 100 and Nifty Midcap 150 index. If you want exposure between these baskets, the Zerodha Nifty LargeMidcap 250 Index Fund is an option.

The ELSS variant (with a 3-year lock-in) is for those wanting to save tax under the old income tax regime (Section 80C).

Edelweiss NIFTY Large Mid Cap 250 Index Fund has a tracking error of 0.08-0.09 per cent compared to the Nifty Large Midcap 250 TRI index. If the Zerodha funds can achieve lower tracking errors and charge lower expenses, that would make it a worthy investment.

Published on October 25, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.