Federal Bank is one of the ‘younger’ old private-sector banks which has been in existence for 76 years. Yet, its MD & CEO, Shyam Srinivasan never liked the badge of an old private bank. To break the shackles, in FY18 he decided to change three important aspects regarding the bank – increased use of digitalisation to grow the balance sheet, build a retail-heavy granular deposit base and break the perception of being a Kerala-based bank.

With nearly 88 per cent of digitally sourced transactions, at par with top three private-sector banks, share of retail deposits at 94 per cent, which is the best in the industry, and new branches opened outside its home state (though Kerala continues to account for 50 per cent of the bank’s business), Federal Bank is among the few south-based banks which has earned its presence and perception of being pan-India bank by ticking the right boxes.

Priced at 1.2 times its FY23 estimated book, the lender is at an interesting juncture in terms of capturing growth in the banking sector. While there are some asset quality issues which could crop up, they would largely be contained to the restructured book. Therefore, with much of the pandemic related woes addressed and the bank back to the one per cent return on asset (ROA) trajectory, the downside risk seems priced in. We recommend investors with long -term horizon to buy the stock.

About five years back, Federal Bank ’s retail business was spilt between gold loans, home loans, loan against property and unsecured loans. Today, it has made inroads into the credit cards, though partnership with One Card, auto loans including commercial vehicles and used cars and has a more structured personal loans business. Likewise, the share of corporate advances to below investment grade entities has fallen from 17 per cent in FY17 to 11 per cent in FY22 and the share of A and above rated loans have risen from 70 per cent to 78 per cent during this period. The underwriting standards for SME loans have also seen a similar improvement for the bank.

Overall, while there hasn’t been a massive change in the composition of Federal Bank’s loan book, its granularity has improved, with the share of retail (including agri) loans increasing from 40 per cent in FY17 to 46 per cent in FY22. The share of corporate loans is near about 36 per cent and the share of SME loans shrunk from 24 per cent in FY17 to 18 per cent in FY22.

Continued investment in digital partnerships have helped the bank build a full-stack product offering like any large private-sector bank and this is what positions Federal Bank growth ready.

While the bank’s CAGR loan growth in FY19-22 period was 6 per cent and lagged compared to the top five private-sector banks, in Q1 of FY23, with much of the pandemic related pain behind the bank, it grew advances 16 per cent, largely driven by retail loans. The bank has guided for mid to high-teens growth, in-line with what large banks anticipate in the FY23. Its leadership in the inward remittances space with over 22 per cent market share positions the bank attractively to capture this business as well.

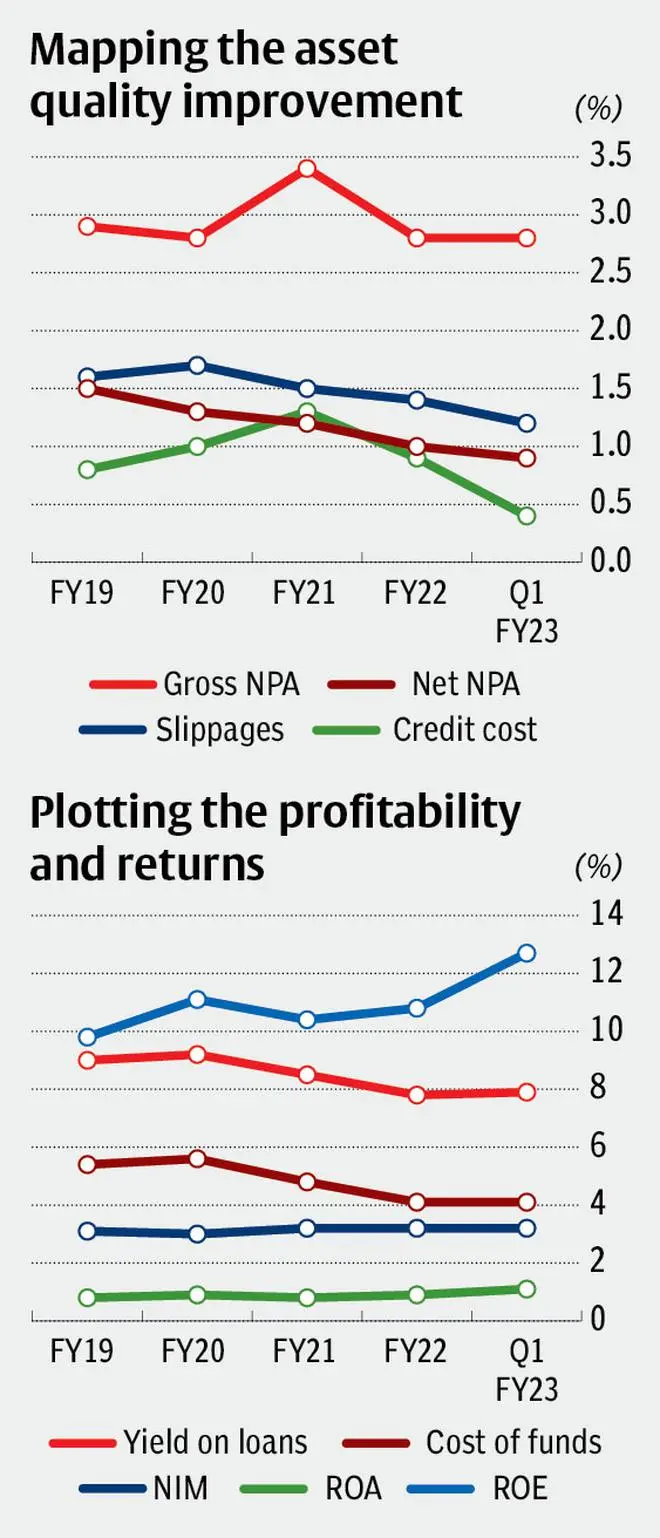

This should translate to improved quality of earnings. In Q1 of FY23, Federal Bank’s RoA (Return on Assets) improved to 1.1 per cent (from 0.9 per cent in FY22) and this trend could continue, led by a drop in provisioning cost, down 51 per cent in Q1 of FY23 and 26 per cent in FY22. But the tough part could be with respect to increasing the profitability or net interest margin (NIM). At 3.2 per cent in Q1, Federal Bank ’s NIMs were flat, whether sequentially or year-on-year, and this is because the 90 bps repo rate hike till Q1 wasn’t fully pass on to customers. With 140 bps now absorbed and the hikes likely in the coming months getting reflected, NIM may improve a bit.

That said, unlike large private-sector banks at four per cent NIM, Federal Bank may not see such high margins soon, as about 40 per cent of its retail book is still in the nascent stages of being built. With yield on loans having come off significantly in the last two years and cost pressures building up slowly, the room for NIM expansion is narrow. That said, with cost to income ratio over 50 per cent and NIM at over three per cent if the bank can manage to cross the 1 per cent RoA threshold, its a testimony to the quality of its loan book.

Slippages in Q1 were elevated at ₹444 crore and came largely from retail loans. However, bulk of the slippages are coming from the restructured book at ₹3,366 crore (2.2 per cent of total advances). However, since this portfolio has a provision coverage of 66 per cent, the impact of stress may not be very material. As is with most banks, Federal Bank is also seeing an easing of asset quality issues with gross and net NPA ratios falling to 2.7 per cent 0.9 per cent per cent respectively (see table). Shrinking pool of stressed loans and easing NPA ratios should help the bank in FY23.

Shyam Srinivasan has been the face of the bank since 2010 and turned around its fortunes significantly. He is expected to remain as MD & CEO till September 2024, post which the bank will have to scout for a new chief. The bank has a strong leadership team at present and is well-equipped to find a replacement for Srinivasan internally. This should offer comfort with respect to leadership, business and operational continuity for investors.

Published on August 27, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.