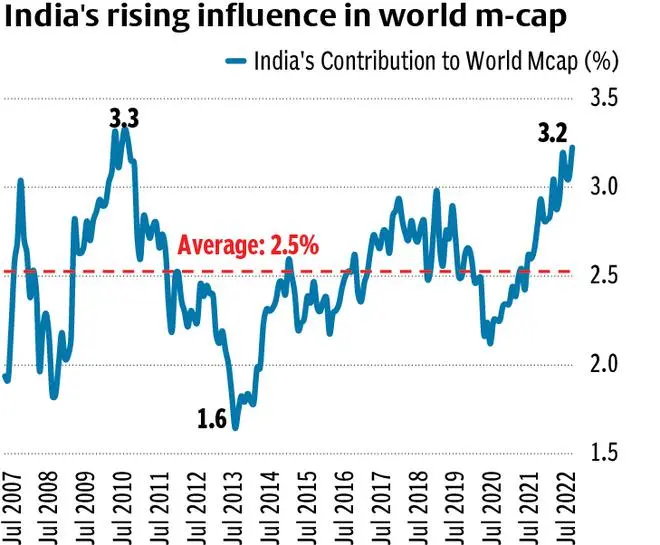

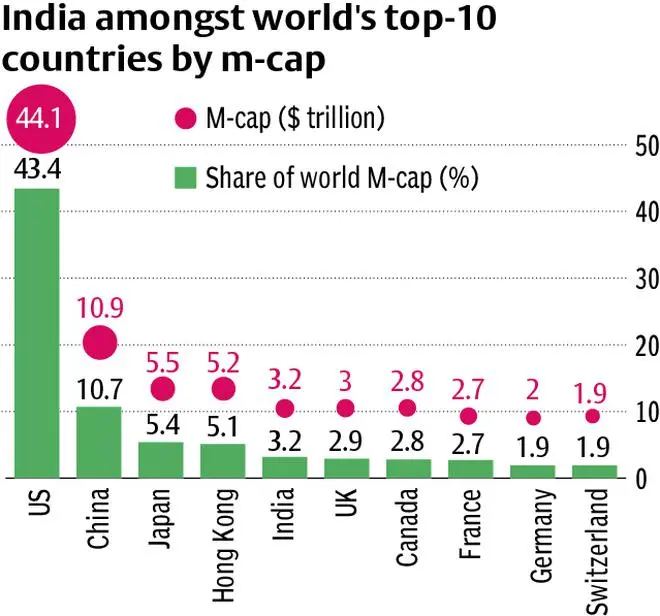

The Indian stock market has gained prominence on the world stage, with current contribution to world m-cap at 3.2 per cent, up 70 basis points from long-term average of 2.5 per cent. While India figures in the top-10 equity markets, at $3.2 trillion it is still behind US, China, Hong Kong and Japan.

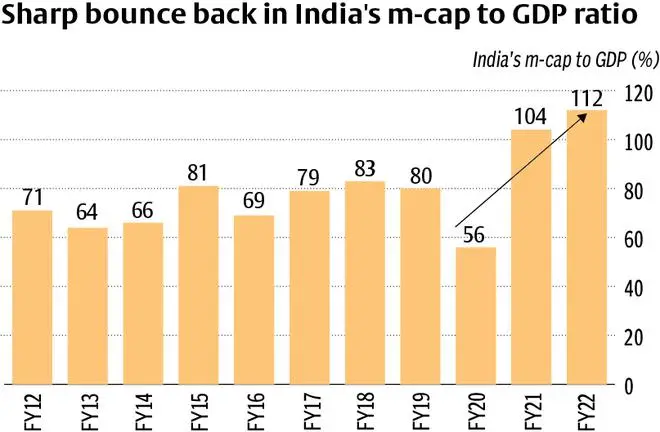

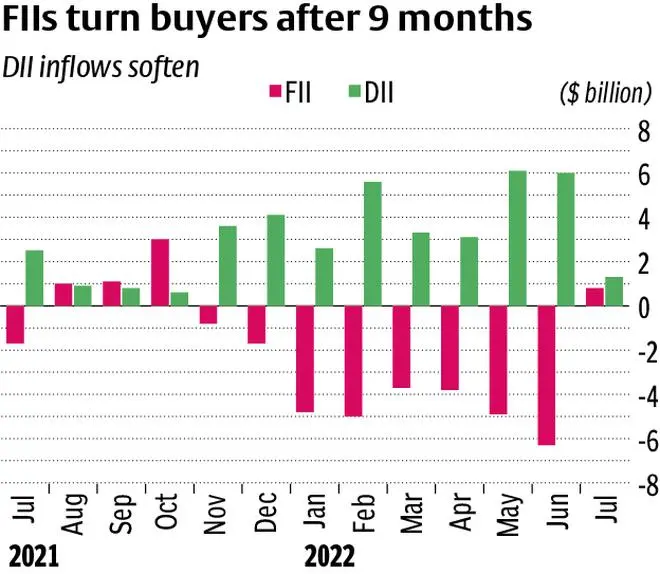

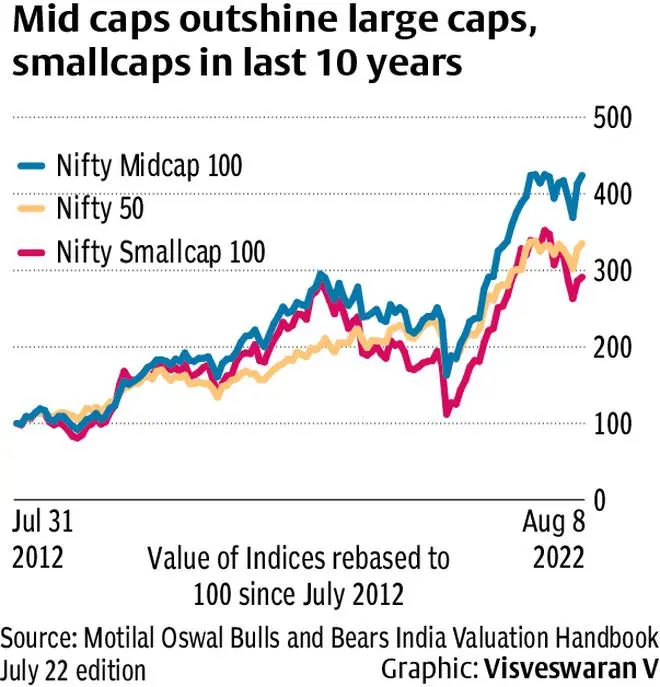

From a valuation perpsective, the m-cap to gross domestic product (GDP) metric indicates India is back at 100 per cent levels, after slipping to 56 per cent in FY20. After a hiccup in early part of CY22, Indian stocks have regained form, with Foreign Institutional Investors (FII) turning net buyers after nine long months. Interestingly, smallcap stocks that are often a high-risk and high-reward game have belied expectations in the last 10 year period. It’s actually midcaps and largecaps that have done much better. Here is a closer look.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.