With credit appetite reviving, companies and NBFCs, many with credit ratings of AA and below are now lining up public NCD (non-convertible debenture) offers. Currently, AA-rated corporate bonds offer yields of 8.8 to 9.5 per cent and A-rated ones offer 10.7 per cent to 11.3 per cent. These returns are at spreads of 170 to over 400 basis points over comparable G-sec yields. Therefore, these NCD offers may appear attractive to retail investors. But many of these entities — which lend to MSMEs and unsecured retail borrowers — carry high business risks.

To benefit from high yields available on corporate bonds rated AA and below, taking the mutual fund route makes sense. Both credit risk funds and medium-duration funds give you significant exposure to AA and below-rated bonds. SBI Magnum Medium Duration Fund is a good investment option in this space.

Unlike credit risk funds which exclusively own AA- and lower-rated bonds, SBI Magnum Medium Duration juggles between government bonds, AAA-rated corporate bonds and lower-rated bonds, based on opportunities in the market.

While maintaining a good allocation to AAA- or AA-rated securities, it does not venture much into riskier territory. This allows investors in the fund to benefit from the higher yields in corporate bonds without taking on too much default or liquidity risk.

In the last three years, SBI Medium Duration has taken active calls on the mix of bonds it owns, based on credit risk in the market as well as relative spreads on corporate bonds. In December 2020, when credit risks appeared high due to Covid uncertainties, this fund had parked a higher proportion of its portfolio in sovereign bonds (34 per cent) and AAA-rated corporate bonds (21 per cent), while exposures to AA plus and AA-rated bonds were at about 31 per cent.

The high sovereign exposures remained in place until early 2022. However, as Covid fears abated and corporate bond spreads have improved in a rising rate scenario, the fund has upped its allocations to corporate bonds and within them AA-rated securities. In its latest portfolio as of July 31, the fund had 26 per cent of its portfolio in government securities, 28 per cent in AAA bonds, 25 per cent in AA bonds, and 13 per cent in bonds rated below AA.

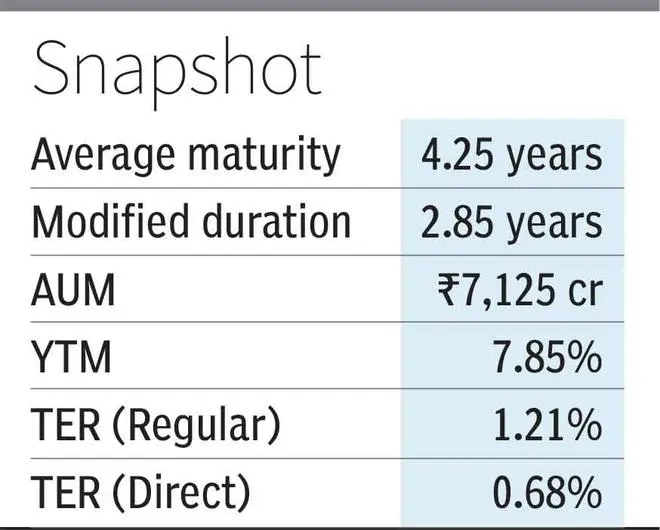

With rising rates and the changing mix of corporate bonds, the fund’s yield to maturity has improved from 6.22 per cent in January 2022 to 7.85 per cent by July 2023.

On duration, this fund has not taken very active calls. Between December 2020 and January 2023, when interest rates in India have swung between a low of 5 per cent to a high of 7.5 per cent, this fund’s average portfolio maturity has remained in a fairly narrow range between 2.7 years and 4.5 years.

The fund maintained fairly high maturity of over four years in December 2020 when rates were just poised for a climb. By August 2021, as interest rates began to normalise from Covid lows, the average maturity fell to 2.77 years. It has since elongated to 4.25 years by July 2023. High maturity at a time of rising rates contributes to significant return volatility.

In the last 10 years, this fund (regular plan) has averaged a healthy 8.7 per cent return on a one-year rolling basis. It has delivered a 10-20 per cent return over 40 per cent of the time over one-year periods, with a 5-10 per cent return about 35 per cent of the time. Given its portfolio maturity of four years at most times, the fund has seen significant volatility in its one-year returns. In the past decade, returns ranged from 1.7 per cent in its worst one-year period, to 20.7 per cent in its best year. But held over five years, the swings in returns tend to smoothen out. If held for five years, the fund’s minimum CAGR was 5.6 per cent and maximum at 11.1 per cent, with an average of about 9 per cent.

Investing in this fund at the bottom of a rate cycle can lead to poor short-term return outcomes. But with interest rates being close to the peak of this cycle, this risk is minimised today.

By end July 2023, SBI Medium Duration Fund managed ₹7,125 crore in assets. It is being managed by Dinesh Ahuja and Mohit Jain. Its regular plan charges total expense of 1.21 per cent annually, while the direct plan charges 0.68 per cent. Both are at the lower end of the category.

Published on August 26, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.