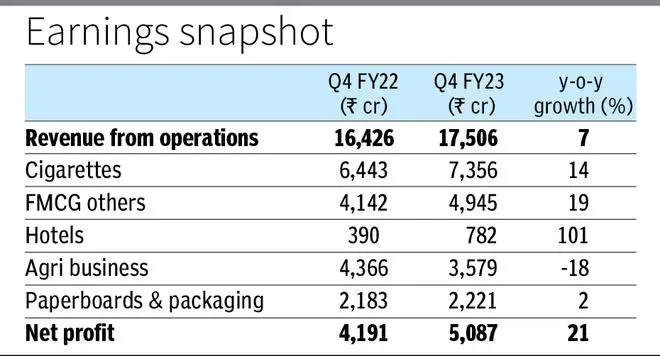

Kolkata, May 18 Riding on the back of an all-round growth from across various segments barring agri business, diversified conglomerate ITC Ltd registered 21 per cent rise in standalone net profit at ₹5,087 crore for the quarter ended March 31, 2023 as against ₹4,191 crore in the same period last year.

Revenue from operations on a standalone basis increased by seven per cent at ₹17,506 crore during the quarter as compared with ₹16,426 crore same period last year. The company beat the market estimates in terms of its Q4 profit buoyed by steady demand.

ITC board has recommended a final dividend of ₹6.75 and a special dividend of ₹2.75 per ordinary share of ₹1/- each for the financial year ended March 31, 2023. Together with the interim dividend of ₹6 per share paid on March 3, 2023, the total dividend for the year ended March 31, 2023 amounts to ₹15.50 per share, up from ₹11.50 per share in FY-22.

Read: NCLAT sets aside CCI’s six year old penalty on ITC

Segment revenue from cigarettes business grew by nearly 14 per cent at ₹7,356 crore (₹6,443 crore). Sustained volume claw back from illicit trade on the back of deterrent actions by enforcement agencies and relative stability in taxes has helped drive growth in the cigarettes business, the company said in a press statement.

ITC’s other FMCG business increased by 19 per cent at ₹4,945 crore (₹4,142 crore) during the quarter.

In respect of FMCG-others segment, EBITDA (earnings before interest, taxes, depreciation and amortization) stood at ₹658.96 crore for the quarter ended March 31, 2023, up from ₹374.69 crore last year. EBITDA for the year ended FY-23 was ₹1,953.97 crore (₹1448.97 crore). EBITDA margin during the quarter was at 36.1 per cent up by 385 basis points.

In the FMCG business, staples, biscuits, snacks, noodles, dairy, beverages, soaps, fragrances and agarbatti have been driving growth. Education and stationery products business has also been witnessing strong traction.

“Q4 segment EBITDA up 76 per cent YoY; margin expansion driven by multi-pronged interventions including premiumisation, supply chain agility, judicious pricing actions, digital initiatives, strategic cost management and fiscal incentives (including PLI),” the release said.

Revenues from hotels business grew by 101 per cent at ₹782 crore (₹390 crore) as RevPAR (revenue per available room) was well ahead of pre-pandemic levels. Q4 segment EBITDA margin was at 34.8 per cent (versus 8.1 per cent in Q4 FY22 and 23.1 per cent in Q4 FY20) driven by higher RevPAR, operating leverage and structural cost interventions, it said.

The revenues from agri business division was down by 18 per cent at ₹3,579 crore (₹4,366 crore) due to restrictions imposed on wheat and rice exports.

The paperboards and packaging division grew by around two per cent at ₹2,221 crore (₹2,183 crore) due to the impact of planned shutdown of pulp mills for capacity expansion. Softening of pulp prices, muted demand mainly in global markets and relatively higher base impacted the revenue growth on a year-on-year basis, it said.

For the year ended March 31, 2023, net profit increased by 25 per cent at ₹18,753 crore (₹15,058 crore) while revenue from operations grew by 18 per cent at ₹70,251 crore (₹59,746 crore).

The company’s scrip closed at ₹419.65, down by 1.87 per cent on the BSE on Thursday.

Published on May 18, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.