The share of crop loan in total agriculture credit in Rajasthan and Uttar Pradesh has increased to about 77 per cent, up by 7-8 percentage points in last five years, whereas the national average hovered around 59-61 per cent share in last five years.

The other category under agriculture credit is term loan and its tenure varies according to the banks, depending on the scheme/purpose and repaying capacity of the beneficiary. Crop loan is a short-term credit extended to farmers with the repayment cycle extending to 1-2 seasons and credit up to ₹3 lakh is disbursed through the Kisan Credit Card (KCC), which is used by 7.36 crore farmers (based on operative KCC accounts data) as on December 31, 2023.

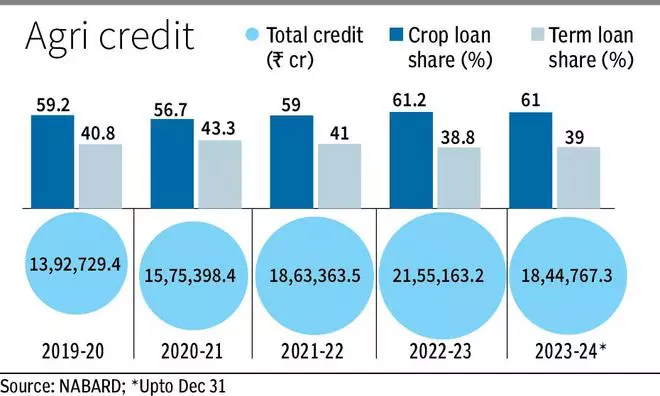

Banks have disbursed ₹18,44,767.32 crore under agriculture credit up to December 31 in the current fiscal, out of which ₹11,26,160.72 crore has been for crop loan and ₹7,18,606.60 crore was term loan, official sources said. The government has set the farm credit target at ₹20 lakh crore whereas the actual disbursal in the previous fiscal was ₹21.55 lakh crore.

Awareness

“This may be a result of the KCC campaigning and more penetration of the scheme. It is a fact that the penetration in both UP and Rajasthan has increased under KCC. Since the awareness level has increased the farmers, who had earlier not taken crop loan, have availed it now,” said a top government official.

According to official data, crop loans worth ₹86,424.62 crore were disbursed in Rajasthan during April-December of 2023-24, which is 77 per cent of over ₹1.12 lakh crore total farm credit reported in the State. The share of crop loan was over 70 per cent in 2019-20 out of ₹95,051 crore total agriculture credit disbursal.

Crop loans worth ₹1,00,365.54 crore were disbursed in Uttar Pradesh until December 31 in the current fiscal, which is 77 per cent of over ₹1.31 lakh crore total farm credit reported in the State. The share of crop loan was over 68 per cent out of ₹1.09 lakh crore total agriculture credit disbursal in 2019-20.

The share of crop loan in total farm credit disbursal in the State was also higher than the national average share (crop loan) in Haryana (69 per cent), Punjab (73 per cent) and Madhya Pradesh (69 per cent) this year, data show.

On the other hand, West Bengal has reported a significant jump in crop loan disbursal as its share in total farm credit has jumped from 24 per cent in 2029-20 to 42 per cent up to December 31 in 2023-24. Farmers have received crop loan worth nearly ₹22,000 crore this year, whereas it was ₹13,620 crore in 2019-20.

In the North-East, the crop loan share in total farm credit is low at 40 per cent, despite a quantum jump from the 18 per cent share in 2019-20. As much as ₹4,852 crore worth farm loan has already been disbursed in the region this year.

RBI mandates a priority sector lending target for banks, with 18 per cent allocated specifically for agriculture, and a 10 per cent sub-target for Small and Marginal Farmers (SMFs) for the FY 2023-24. Farmers get short-term crop loan at 2 per cent subsidised interest rates up to ₹3 lakh through KCC and further 3 per cent as prompt repayment incentive (PRI) if repaid in six months to one year.