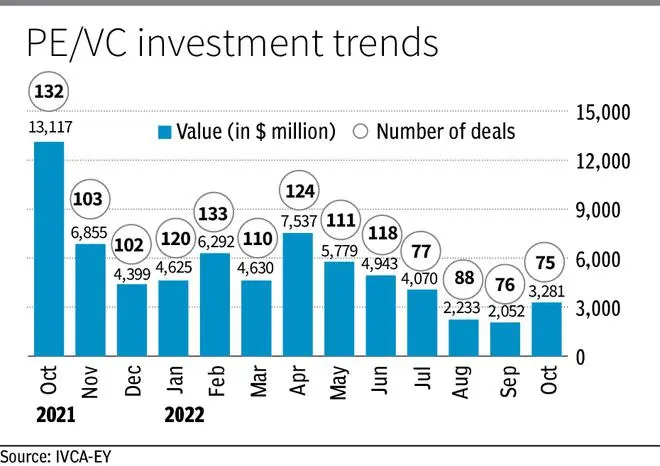

Private equity (PE) and venture capital (VC) investments in October 2022 came in at $3.3 billion, which was 60 per cent higher than the level in September 2022, bolstered by the large $960 million Bain Capital - CitiusTech deal.

However, on a year-on-year(y-o-y) basis, the total PE/VC investment for the month under review was 75 per cent lower than the record $13.1 billion investments seen in October 2021, on the back of large deals, the latest IVCA-EY monthly PE/VC roundup for October 2022 showed.

The largest deal in October 2022 saw Bain Capital invest $960 million in CitiusTech for a 40 per cent stake.

In terms of the number of deals, October 2022 recorded 75 deals, a 43 per cent decline y-o-y (132 deals in October 2021) and at par with deals in September 2022.

Investment momentum

Inflation woes, recession fears, the rising cost of capital and elevated levels of uncertainty driven by geopolitical tensions have weighed down the PE/VC activity in 2022, globally as well as locally. In India, the investment momentum, both in terms of size and number of deals, has slowed down considerably.

October 2022 recorded six large deals (deals of value greater than $100 million) aggregating $2.2 billion, a sharp drop from the 24 large deals worth $11.3 billion recorded in October 2021. The previous month had recorded just four large deals worth $906 million.

By deal type, growth investments were the highest in terms of value in October 2022 at $2 billion across 13 deals, compared with $1.7 billion invested across 13 deals in October 2021 and $502 million invested across 16 deals in September 2022. Startup investments recorded $583 million across 46 deals in October 2022 compared to $4 billion recorded across 100 deals in October 2021 and $938 million invested across 43 deals in September 2022.

Buy-outs recorded $472 million across four deals in October 2022 compared with $6 billion across six deals in October 2021 and $81 million across three deals in September 2022.

Vivek Soni, Partner and National Leader, Private Equity Services, EY said, “October 2022 recorded $3.3 billion in PE/VC investments, 75 per cent lower than the investments in October 2021, which was a record month. After being on a declining trend for the past five months, PE/VC investments have recorded a sequential uptick in October 2022, a 60 per cent increase.”

October 2022 recorded 15 exits worth $1.6 billion, a significant improvement over the previous month that recorded $653 million across 24 deals.

Growth rate

Healthcare was the top sector in October 2022, with $977 million in PE/VC investments across three deals. The second largest sector was financial services, with $216 million recorded across 13 deals. Traditionally, favourite sectors like technology and e-commerce recorded ~90 per cent y-o-y decline in PE/VC investments.

Many investors are now focusing on value plays, a marked shift from last year, when growth was the primary focus. While many startups have already embarked on the path of conserving cash, growth rates are expected to be negatively impacted.

“We are projecting an uptick in consolidation / M&A within the start-up space in the coming months. On the PE side, valuations or the bid/ask spreads continue to be the main factor slowing down deal closure activity. Over the next 3-4 months, we expect this situation to improve as sellers and investors alike find equilibrium. The Indian economy continues to outperform relative to other emerging markets and while there maybe short-term volatility, the PE/VC community continues to be sanguine about India’s long-term growth prospects”, Soni added.

2022 has emerged as India’s best year for PE/VC credit investments, recording $3.2 billion. Credit investments in 2022 to date are ~5 per cent higher than the previous high record in 2019.

Four sectors — financial services, real estate, infrastructure and e-commerce, have accounted for almost 80 per cent of all credit investments between 2017 and 2022 (January-October).

Fundraise

October 2022 recorded total fundraise of $2.2 billion, compared with $70 million raised in October 2021. The largest fundraise was by Motilal Oswal, which raised its fourth fund of $549 million, all raised from domestic high net worth individuals (HNIs) and family offices.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.