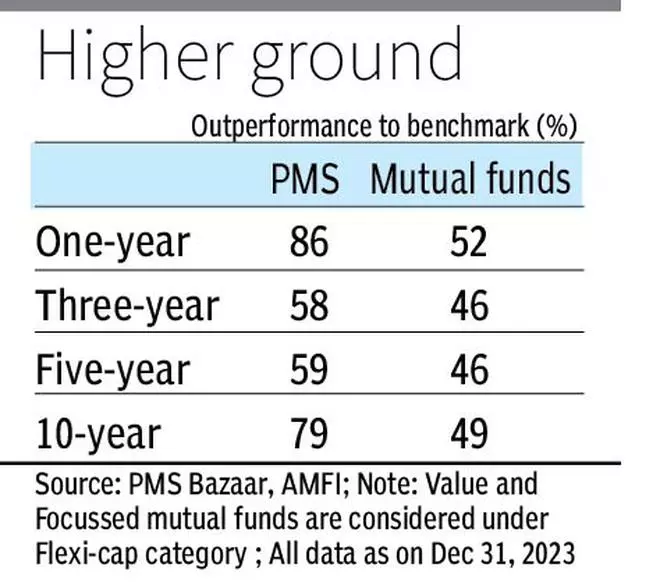

A study by PMS Bazaar that analyzed 335 PMS investment approaches and 388 mutual funds (regular funds) across one, three, five and 10-year periods showed that PMS investment approaches outperformed their benchmarks by 70 per cent on average across all timeframes and categories, while mutual funds outperformed 48 per cent of the time.

The study was conducted across seven market categories including largecap, midcap, smallcap, large-midcap, multicap, flexicap, and thematic.

PMS investment approaches consistently outperformed mutual funds across all timeframes. For example, in the five year period, 59 per cent of PMS investment approaches outperformed their benchmarks compared to just 46 per cent of mutual funds.

In the one-year period, all the PMS investment approaches have outperformed their benchmark and mutual funds across all the categories.

In the 3-year period, six out of seven PMS investment approaches outperformed their benchmark and mutual funds. The PMS smallcap approaches thrived, exceeding the benchmark by 91 per cent compared to mutual funds’ 41 per cent. Midcap PMS also shone, surpassing the benchmark by 84 per cent compared to 17 per cent of mutual funds. Similar dominance was seen in the large, large-midcap, multi and flexi cap categories. In the thematic category, however, mutual funds outperformed the benchmark by 61 per cent compared with 36 per cent for PMS schemes.

In the 5 year period, PMS investment approaches dominated in five of the seven categories including large, mid, small, flexi and multi-cap categories. But lost out in the large-mid and thematic categories to mutual funds.

In the 10 year period, all the PMS investment approaches outperformed mutual funds and benchmarks.