Inflows into debt and solution-oriented schemes jumped to Rs 195 crore (Rs 142 crore) and Rs 112 crore (Rs 16 crore) month-on-month | Photo Credit: ayo888

Net inflows into systematic investment plans jumped 17 per cent to Rs 7,499 crore in October, against Rs 6,399 crore in September, on the back of a bullish trend in the equity market.

Net SIP inflow is the difference between the value of gross and discontinued SIPs. While gross SIP data is available on the AMFI website, net SIP, along with detailed market analysis, is only distributed to top mutual funds executives to gauge market trends.

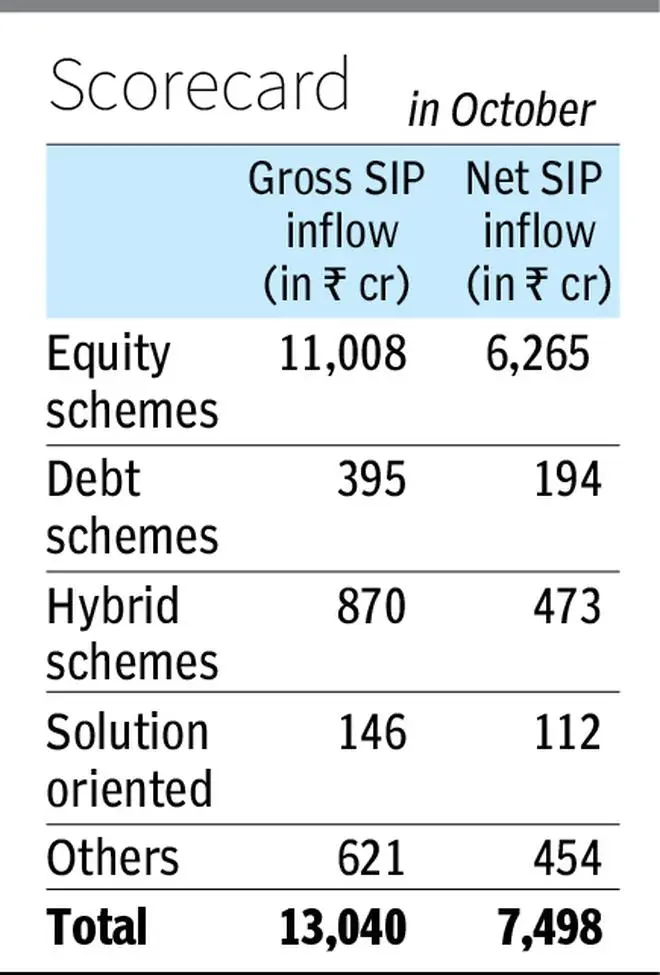

Equity schemes attracted the lion’s share of inflows at Rs 6,265 crore last month, against Rs 5,325 crore in September, an 18 per cent increase. While inflows into debt and solution-oriented schemes jumped to Rs 195 crore (Rs 142 crore) and Rs 112 crore (Rs 16 crore) month-on-month, that of hybrids fell to Rs 473 crore (Rs 502 crore), according to data with the Association of Mutual Funds in India.

Net SIP inflows into other schemes increased to Rs 454 crore (Rs 414 crore). The value of net inflows accounted for 57 per cent of gross investment of Rs 13,041 crore in October, compared to 49 per cent of gross inflows of Rs 12,976 crore logged in September.

Siddharth V, an independent mutual fund distributor, said investors who were waiting for a big fall in valuation to enter the equity market, have started taking the plunge on expectations that India will ride out theglobal economic uncertainty better.

The bellwether Sensex rallied six per cent to 60,747 points in October, against 57,570 in July, amid intense volatility. It moved up further to 62,294 in November, as some debt investors started moving money to the equity markets, he added.

Net non-SIP inflows into equity schemes dipped 66 per cent to Rs 2,988 crore, against Rs 8,753 crore in September, whiledebt and hybrid schemes registered a net outflow of Rs 3,014 crore (outflow of Rs 66,772 crore) and Rs 3,292 crore (outflow of Rs 3,190 crore).

Shrikant Chouhan, Head of Equities Research (Retail), Kotak Securities, said a steady softening of global bond yields on expectations of ‘peak’ inflation and a decline in crude prices helped equity markets, with the Nifty-50 index hitting an all-time high last week.

Going forward, D-street will be dominated by global news flows and steps taken by different governments to tackle the economy, he said.

Published on November 26, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.