Bank credit growth, which has been growing in double-digits since April 2022, is expected to sustain, and combined with a pick-up in private capital expenditure (capex), will usher in a virtuous investment cycle, according to the latest Economic Survey.

The credit upcycle will also be aided by constant monitoring of the risks in the financial system by the regulators and their efforts to contain them.

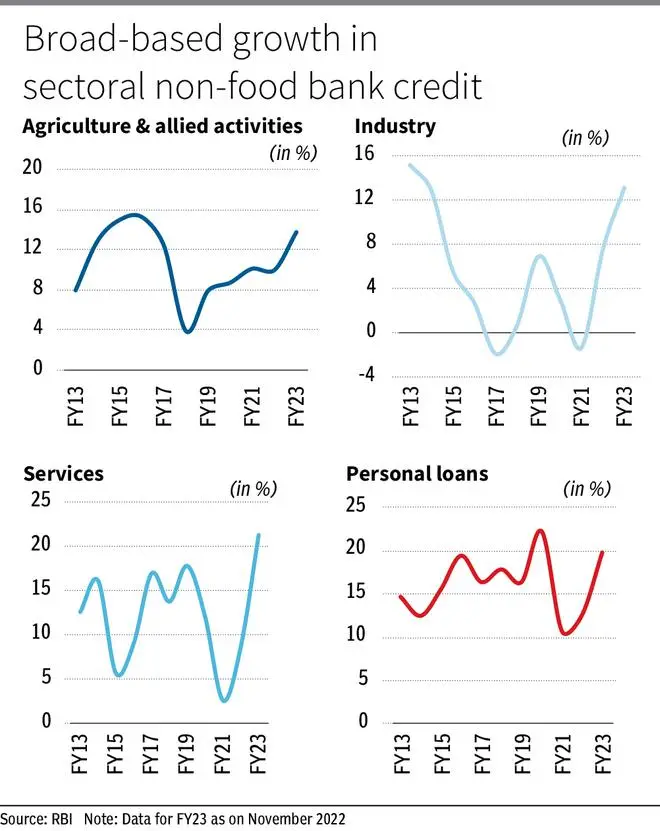

Referring to the year-on-year growth in non-food bank credit to 15.3 per cent in December 2022, the Survey emphasised that this not only shows an acceleration in the growth of current economic activities but also an anticipation of continued momentum in economic activity in the future.

“As funds raised from the primary segment of domestic equity markets declined during FY23, reliance on bank credit for funding regular operations and capacity expansion increased.

“The accumulation of deposits in the past few years has enabled banks to fund the growing credit demand,” the report said

The well-capitalised banking system, with a low NPA ratio and more robust corporate sector fundamentals, will continue to enhance the flow of bank credit into productive investment opportunities, notwithstanding the rising interest rates, it added.

The Survey noted that credit growth has been broad-based across sectors, with retail credit driving the growth primarily owing to rising demand for home loans.

An increase in demand for housing induces greater investment which, in turn, sets off a virtuous cycle of growth and investment, it added.

Agricultural credit

“Credit to agriculture and allied activities gained momentum supported by the Government’s concessional institutional credit and higher agricultural credit target.

“Industrial credit growth has been buoyed by a pick-up in credit to MSMEs, assisted by the benefits accrued from the effective implementation of the Emergency Credit Line Guarantee Scheme (ECLGS) and the support provided by the government’s production-linked incentive scheme and improvement in capacity utilisation,” the report said.

The report noted that credit growth in services was driven by a recovery in credit to NBFCs, commercial real estate and trade sectors.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.