Chennai market has reported a decline in office space absorption during the first quarter of 2024, while other major cities have reported strong growth during the period.

The calendar year has started on a strong note with the overall office leasing market reporting a 35 per cent year-on-year increase at total leasing of 13.6 million sq ft across the top-6 cities. However, this is a significant drop in office space absorption when compared with December 2023 quarter levels, according to a report by real estate consulting firm Colliers.

The strong year-on-year growth is indicative of upbeat occupier sentiment, given the fact that the first quarter is typically slower. Bengaluru and Hyderabad emerged as frontrunners for demand of Grade A office space in Q1 2024, cumulatively accounting for more than half of the India leasing activity

The office market of Hyderabad exhibited a strong momentum with 2.2x space uptake in Q1 2024, driven by the healthcare & pharma and technology sectors. Mumbai also reported an impressive 90 per cent increase in leasing activity in this quarter.

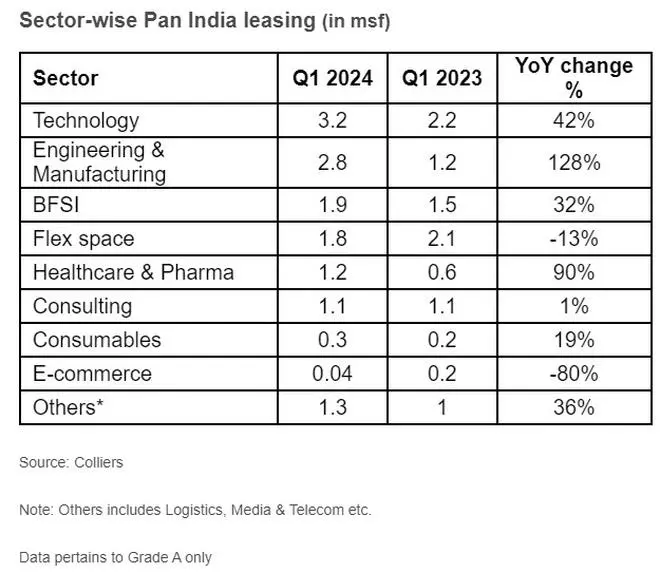

“During Q1, occupiers from technology, engineering & manufacturing, and BFSI sectors collectively accounted for 58 per cent of total leasing activity across the top 6 cities. Healthy demand-supply dynamics are likely to prevail throughout 2024. As business sentiments and economic outlook remain positive, domestic occupiers, especially will continue to drive the office market of the country.” says Vimal Nadar, Senior Director and Head of Research, Colliers India.

At 2.8 million square feet, Engineering & manufacturing leasing soared to over 2.3x times in Q1 of 2024 when compared with the year-ago period. Bengaluru accounted for about 55 per cent of the activity in the sector, underscoring occupiers’ continued preference for the market. BFSI and Flex space also continued their healthy space absorption across most cities, garnering 14 per cent and 13 per cent share respectively in overall India leasing for Q1 2024.

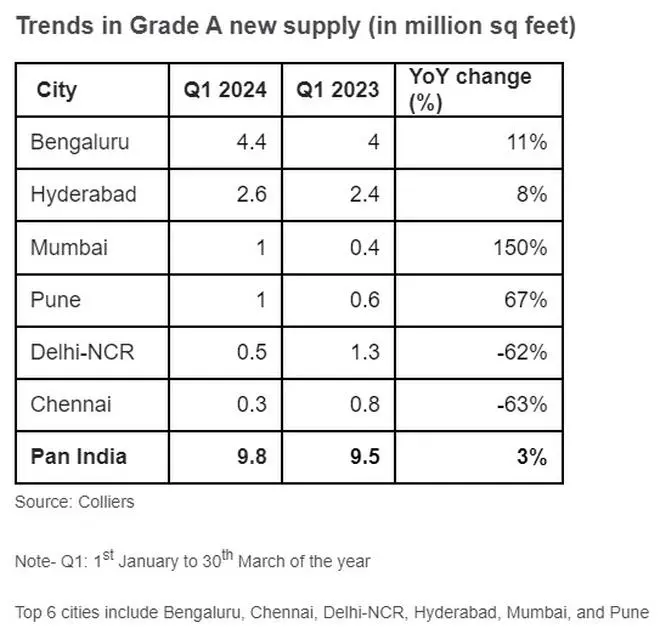

During Q1 2024, the new supply of 9.8 million sq ft across the top 6 cities was almost at par with the level seen in Q1 2023. Bengaluru witnessed significant new project completions, contributing to 45 per cent of the total new supply, followed by Hyderabad at 27 per cent share.

With demand outpacing supply, average rentals saw up to an 8 per cent uptick on a Y-o-Y basis across most of the major markets. Vacancy levels, meanwhile, are expected to remain steady, hovering around 17.3 per cent by the end of Q1 2024, it added.