In May 2022, when the RBI began the current rate hike cycle with a sudden 40 basis points hike in repo rate, there was much squirming all around. For the Indian central bank had emphatically stated just a month before that the surging inflation was transitory and that there was no need to begin increasing rates yet.

The reason for the RBI’s volte face was clearly the US Federal Reserve meeting scheduled on the next day, when the Fed was expected to announce a rather large hike in the Fed Funds rate. The RBI was slightly behind the curve then since the US Fed began its rate hike cycle in February and FOMC projections had signalled a series of aggressive rate hikes in 2022. Stock and bond markets had turned turbulent from the last quarter of 2021 in expectation of the rate hikes and foreign portfolio investors had already pulled out ₹1.34-lakh crore out of the Indian equity and bond market in the first four months of 2022.

The sharp appreciation in the dollar in the first quarter of 2022 had led to turmoil in currencies of emerging economies and the rupee was not spared either. The RBI had to act fast to maintain the spread between US and Indian bond yields to buttress the rupee.

But the tables have been turned on the dollar since then and the rupee is now in a much stronger position. This implies that the RBI need not worry too much about shielding the rupee while framing the monetary policy, going ahead.

Rupee movements. Tracing the dollar-rupee movement since the pandemic

The dollar weakness

The US dollar index, which captures the movement of the dollar against a basket of major currencies, raced up from 95 in the beginning of 2022 to 113 by September 2022 as the Fed rate hikes sent treasury bond yields shooting higher. Five-year US treasury bonds traded at 4.2 per cent in October 2022, up from 1.6 per cent in January 2022. Higher yields along with strengthening currency made global funds move into dollar-denominated assets, leading to a sell-off in emerging market currencies including the rupee.

But the dollar is losing its lustre, with the dollar index currently down 11 per cent from its September peak. Several factors have contributed to this slowdown. One, the US Fed’s war against inflation is taking a toll on growth with GDP growth projected at 1.3 per cent in 2023, down from 2.1 per cent in 2022. Federal Reserve Chairman has been reiterating in the FOMC meetings that there is marked slowdown in consumption and output because of the rate hikes.

On the other hand, the growth outlook for Euro zone and China has been improving with the pandemic abating. This has reduced the relative allure of US denominated securities.

Two, the banking crisis in the US triggered by the collapse of the Silicon Valley Bank has made Fed realise the problems with aggressive monetary tightening, making it slow the pace of its rate hikes. This has led to the dollar losing ground against the euro and other reserve currencies. US treasury yields have also paused their upward march.

Three, though Fed is beginning to slacken the pace of its rate hikes, other central banks such as European Central Bank and Bank of England are continuing to hike rates aggressively, making these currencies appreciate against the dollar.

Tide turns for rupee

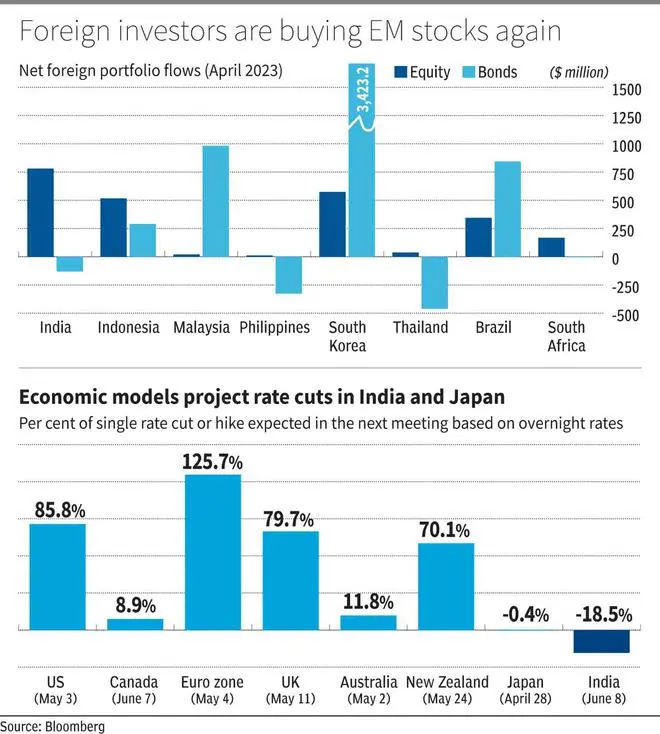

As the dollar loses its mojo, the rupee is gaining ground. The rupee is the second-best performer against the dollar since the beginning of this year. The RBI’s decision to pause rate hikes in the recent monetary policy has worked in favour of the rupee with foreign portfolio investors turning net buyers in equity markets in April. The rupee has also strengthened towards the 82 mark and the RBI has been able to mop up the dollar inflows to bolster its forex reserves.

What’s more, there is a consensus building that the RBI could begin to reduce rate hikes soon. According to Bloomberg’s forecasting model, rate hikes are expected to continue in the upcoming policy meetings of most countries including the US, the EU and the UK. But overnight rates are indicating a rate cut in the next policy meeting in India and Japan.

This bodes well for India’s growth, which is already the fastest in the world. Corporate earnings will also benefit, leading to improved flows into equity markets. Other factors working in the rupee’s favour include weakening crude oil prices leading to lower merchandise imports, strong services exports and NRI remittance from overseas.

FPI flows into debt

Foreign portfolio flows into debt tend to be more sensitive to policy rate movement and the pause in rate hikes or a reversal could lead to money flowing out of Indian debt. But most emerging markets are now moving towards a pause in rate hike cycle or even a reversal. The hunt for higher yield is likely to bring foreign investors to emerging market debt, as risk aversion abates.

This is already evident in the numbers. FPIs have net purchased $292 million of Indian bonds in 2023 implying that they are not too concerned about RBI’s decision. This is because there is still a spread of over 300 bps in the real yield of the sovereign bonds of the US and India.

Also, FPIs had been aggressive sellers of Indian debt between FY19 and FY21 with average net sales of ₹46,000 crore in these three years. This has resulted in a considerable reduction in the FPI holding of Indian government and corporate bonds. So, FPI pull-out from the debt market is not a material threat anymore.

The tide appears to be turning in favour of emerging markets at large and for India in particular as the dollar begins losing ground and the US grapples with the consequences of its monetary policy. Global investors are likely to once again turn their attention towards emerging markets as risk aversion ebbs.

This makes the task of the RBI easier as it can formulate policy based on the needs of the Indian economy without having to worry about FPI outflows and a run on the rupee.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.