India not finding a place in any major global bond index was a thorny issue so far and JP Morgan becoming the first index provider to include India in its emerging market indices was therefore met with resounding cheer. The effort is worth lauding since various hurdles including capital controls, accessibility of the Indian G-Secs and taxation related issues had to be overcome before the index provider made the inclusion. But the optimism needs to be tempered because the projections being given for potential inflows are overstated.

Such inclusion in global indices is needed because global passive funds such as exchange traded funds and index funds, make their portfolio allocation in line with the index to which they are linked. With the country weight for India set to increase to 10 per cent in JP Morgan emerging market bond index, over a 10-month period commencing in July 2024, all passive funds tracking the index may invest in Indian government bonds too, thus increasing the demand for these bonds. This can help flatten the sovereign yield, support government borrowing and the rupee and bolster foreign exchange reserves.

But the figures being commonly used — $20 billion to $50 billion — for potential fund inflow into Indian G-secs from July 2024 to March 2025 seem stretched. The numbers are derived from the JP Morgan press release which states that, “GBI-EM GD (the index where India has been primarily included) accounts for $213 billion of the estimated $236 billion benchmarked to the GBI-EM family of indices.”

Analysts have assumed that 10 per cent of $213 billion, which is $21.3 billion is the minimum amount which will come to India over next two years. This number has been stretched further based on the assumption that passive funds linked to other JP Morgan indices and indices of Bloomberg-Barclays and FTSE Russell will also be coming to India over the next few years.

The basic problem is that the projections are assuming that all the funds linked to the JP Morgan indices are passive funds. But this may not be so.

Two, passive funds do not exactly follow index weights, making the projections imprecise.

Three, global bond funds are already allowed to invest in India, but they have not been keen to buy Indian government securities. This is because Indian G-Secs are relatively less attractive vis-à-vis other sovereign bonds.

Benchmarking not tracking

It needs to be noted that JP Morgan has stated that the emerging market index, GBI-EM GD has $213 billion benchmarked to it. The term ‘benchmarked’ is used by both active as well as passive funds whereas the term ‘track’ is used by passive funds.

Active funds give the fund manager the liberty to invest in any security in the mandated category. These funds are not mandated to invest in all the securities in the benchmark index.

For instance, many Indian large-cap mutual funds are benchmarked to the Nifty50. But they are not mandated to invest in Nifty50 stocks or follow the Nifty50 stock weights in their portfolio allocations.

So, active funds benchmarked to the JPM EM indices may or may not invest in Indian government bonds.

Passive funds, on the other hand, track the index. In other words, the fund manager has to invest in all the securities in the index, mostly in accordance with the index weight, though the allocation can vary slightly in some instances. The fund manager does not make any active investment decisions, hence the name ‘passive funds’.

The $213 billion of funds linked to the JP Morgan EM bond index could be either active or passive funds. Since active funds linked to the index will not have to allocate 10 per cent of their portfolio to the Indian G-Secs, the minimum fund inflow could be lower than the projection of over $20 billion.

Numbers do not add up

Also the assets under management of the passive funds tracking the JP Morgan EM bond index are not very large. Emerging market bond funds, in general, appear to be out of favour. There are only handful of such ETFs with assets over $1 billion. These include iShares JP Morgan USD Emerging Markets Bond ETF, one of the largest emerging market bond ETF has the asset of $14 billion, Vanguard EM government bond ETF, VanEck JP Morgan EM Local Currency Bond ETF and SPDR Bloomberg EM local bond ETF.

Two, global exchange traded funds are free to invest in other securities, not forming a part of the index which they track.

For instance, both iShares JP Morgan USD Emerging Markets Bond ETF and JP Morgan USD Emerging Markets Sovereign Bond ETF are required to invest only 80 per cent of their assets in securities forming part of the index. They are free to invest the remaining 20 per cent in other securities. This can lead to under or over allocation of Indian g-secs compared to the index weight in passive funds too.

Signals from the bond market

The response from the Indian government bond market too shows that the street is not very impressed by the move. Indian 10-year bond yield declined slightly on September 21, when the news was announced. But yields have hardened since then.

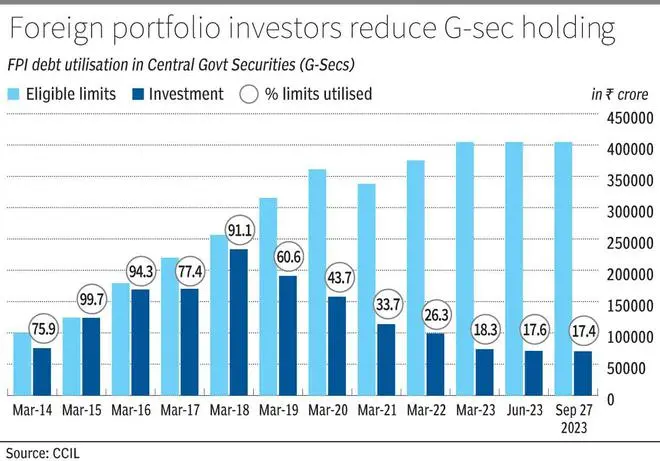

This is because foreign investors have been consistently selling Central government securities over the last five years. FPI holding in G-Secs is down from ₹2.3-lakh crore in March 2018 to ₹70,589 crore in September 2023. While they were utilising 99 per cent of the limit given to them in 2015, they are currently utilising only 17 per cent.

The reason for this indifference is that FPIs take a relative call on their bond investments after comparing yields, inflation, currency volatility and fiscal situation across countries. The large government debt and the rising inflation in India makes our government securities less attractive now, especially when the treasury yields in the US are moving higher and the real yield in the US has turned positive.

Of the global portfolio investments in debt, US, Luxembourg and Ireland have the largest share, implying that most funds are flowing to the US and Europe. This is not surprising given the rising sovereign yields in advanced economies. Until the global economy stabilises and inflation is brought under control, emerging market debt may not find too many takers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.