Globally, energy companies that are into oil exploration and refining have had a good run over the past year. With global crude oil prices peaking above $120 barrel levels, the last three quarters, particularly, have been a bumper one for companies in this space.

Investors in these stocks also made neat gains. Sample this: the US-based energy major Exxon Mobil saw its revenue and net income (Profit) grow by 49 per cent and 191 per cent in the September 2022 quarter, on a year-on-year basis. The company’s stock has also gained a good 80 per cent since the start of 2022.

While energy producers and exporters world over have raked in big gains from spiralling energy costs (oil and gas), in India the story has been quite different. Even as Indian refiners and oil drilling companies have, in the past, benefitted significantly from higher global crude oil prices, they could not capitalise on the buoyant global crude oil prices this time around. Secondly, energy-deficient countries such as India, which are heavily reliant on other countries for energy sources, had to face the brunt of high oil prices.

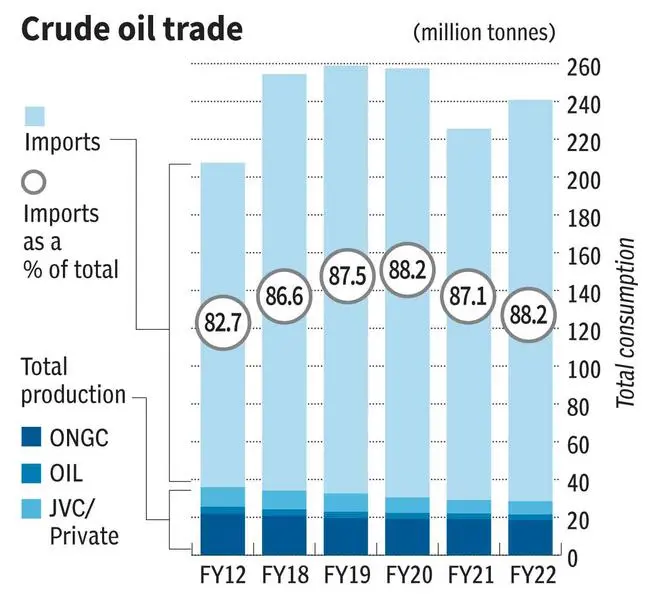

In India, crude oil imports have only been on an increasing trend. In FY12, India’s crude imports stood at 171.7 million tonnes and domestic production was at 35.9 million tonnes. Back then, imports constituted 82.7 per cent of the country’s total requirement. Ten years hence, in 2022, India’s crude oil imports have risen to 212.4 million tonnes, implying an annual growth of 2 per cent. Interestingly, domestic production has declined by about 21 per cent over the past decade. As a result, imports as a percentage of total requirement rose to over 88 per cent. This trend has continued in the first half of FY23.

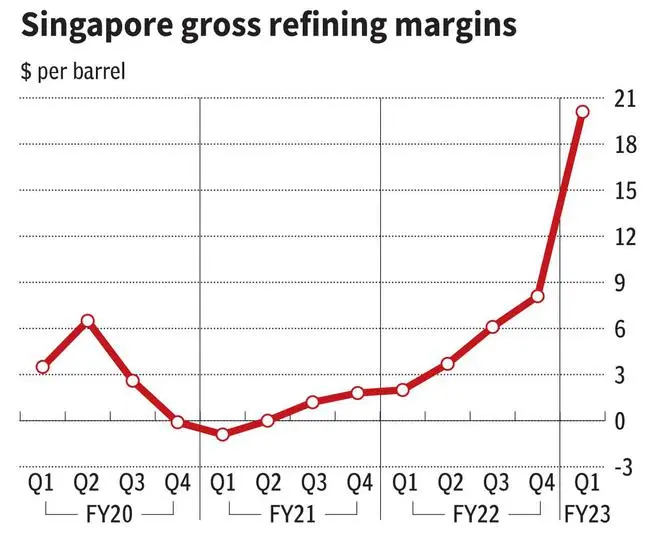

Even as global crude oil prices were ruling above $100 per barrel, petrol and diesel were sold to domestic consumers at prices that were equivalent to crude oil prices of $70-80 levels to keep a lid on inflation, lest it impair growth. As a result, public sector oil marketing companies such as Indian Oil Corporation (IOCL), Hindustan Petroleum (HPCL) and Bharat Petroleum (BPCL) took a haircut on their marketing margins, as they ended up incurring losses on their sales of auto fuels. Thus, while these companies recorded historic gross refining margins at over $20 per barrel in Q1FY23 compared to $3-6 per barrel in 1QFY22, due to higher realisation on the downstream products, the losses on marketing eroded their profitability completely.

Indian Oil Corporation, which is the largest refiner and marketer, posted a modest profit of ₹883 crore, compared with ₹6,141 crore, in the same period last year. For BPCL and HPCL, it was record losses of ₹6,148 crore and ₹8,557 crore, respectively, in Q1FY23

Now, with the correction and volatility in crude oil prices, the refining margins have also come off from their highs, even as there has been some respite on the marketing losses due to a moderation in the crude oil prices from ₹120-plus levels to below ₹100 levels in recent months. For HPCL, the moderation in marketing losses has helped narrow losses in the September quarter with a net loss of ₹2,476 crore. In the case of IOCL, which enjoyed refining margins superior to HPCL and BPCL at $31.81 a barrel, the fall in refining margins resulted in the company posting a loss of ₹910 crore in the July-September 2022 period.

Second, to add to the sky-high crude oil prices, the falling rupee only accentuated the worries for India. It was a double whammy for the country, with an inflating subsidy bill due to rising oil and falling rupee on one hand and increased outflow of dollars, due to higher imports, on the other. To ease the pressure on the country’s finances, Government of India, on July 1, introduced the windfall tax (known as the special additional excise duty) aimed at absorbing the super normal profits earned by domestic crude producers, given that their realisation is linked to higher global prices.

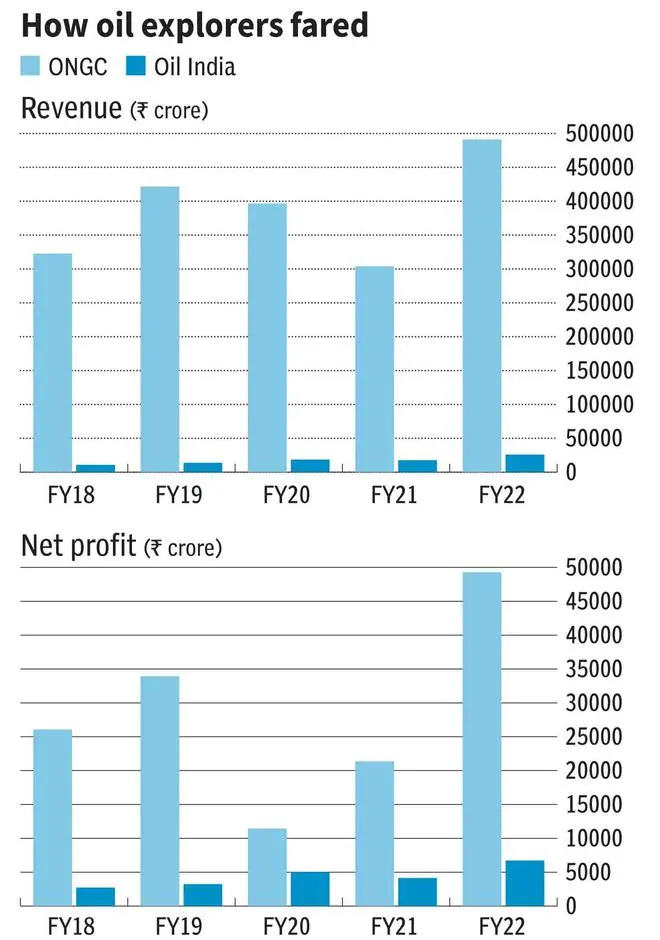

For domestic crude producers Oil and Natural Gas Corporation (ONGC) and Oil India, the new tax meant lower net realisation on the crude produced. From ₹23,250 a tonne on July 1, the Government, which has been reviewing the rates on a fortnightly basis and making suitable revisions, has now reduced it to ₹9,500 for a tonne of crude. Likewise, to ensure domestic availability of downstream products — petrol, diesel, and aviation turbine fuel (ATF) — it had imposed additional duty on exports, at ₹6 per litre on petrol and ATF and ₹13 per litre on diesel. This has led to erosion of profits for upstream companies such as ONGC and OIL and export-focussed downstream refiners such as Reliance Industries.

Reliance Industries’ lacklustre performance in September 2022 quarter, with a flat net profit of ₹15,512 crore, was largely on account of the windfall tax on exports of downstream products, even as other segments such as Retail and Telecom reported solid performance.

Given the current scenario of volatile crude oil prices, what could be in store for the upstream and downstream companies?

If crude prices move up from hereon, going by history, it is good for both upstream and downstream companies in a normal scenario. For oil exploration upstream players such as ONGC and Oil India, higher crude prices help higher realisation. Besides, higher realisation, inventory gains also add to margins and profits in a rising crude price scenario. However, now with the advent of windfall tax, the quantum of revenue and profit growth will be limited to the extent of the tax. Should brent crude price move above $100 levels for a barrel, Government is likely to revise the windfall tax upwards, just as how it has been downward-revising the same with the moderation in global prices. However, even after adjusting for the tax, higher crude prices may still be good for upstream companies.

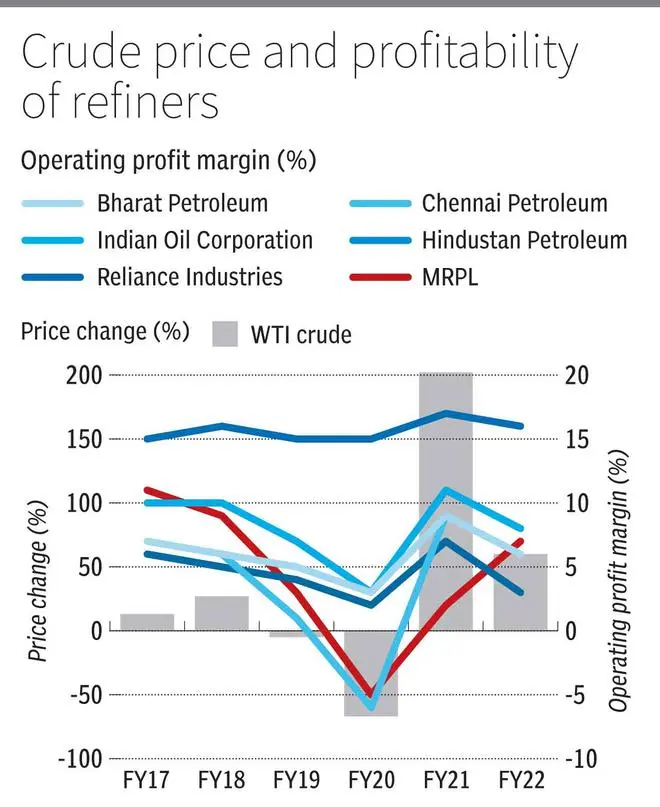

Likewise, strong crude oil prices have helped margins of refiners and oil marketing companies. Indian Oil Corporation, which is the largest refiner in the country, saw its operating profit margin expand from 2-5 per cent during FY13-15, when crude prices were on a falling spree, to 6-10 per cent in FY16-18, when global oil prices recovered and were ruling high. For HPCL, the operating profit margin improved from about 2 per cent in FY13-15 to 5-6 per cent in FY16-18.

Higher crude prices help refiners in two ways. One is by way of higher gross refining margins, given that the realisation on downstream products is also typically higher. Two, inventory gains due to rising oil prices can also help step up margins. However, for export-focussed refiners such as Reliance Industries, the windfall tax may be important to keep a watch on. Abolishment or significant moderation will be positive for Reliance Industries. For oil marketing companies (HPCL, BPCL, IOCL), any change in the retail sale price of petrol, diesel and ATF will be important to monitor. Higher crude prices, without any change in retail fuel prices, will also not help oil marketing companies since marketing losses would wipe off the higher refining margins.

While the case for a steady to higher oil prices in the near term may seem more realistic, should crude prices head south, the exchequer, for sure, will heave a big sigh of relief. However, for refiners and oil producers, this will mean not just lower realisation but also inventory losses, which will impact profitability. For oil marketing companies, it will be lower marketing losses compensating for lower refining margins. Hence, falling crude prices, while good for the country and consumers, may not help the performance of efficient refineries such as IOCL and exploration companies such as ONGC and Oil India.

While it is hard to predict the way forward for oil prices, there are a few factors that one needs to keep a close watch on. One is changes in the windfall tax. Any downward revision of the quantum of tax, or Government completely doing away with the new tax regime in a very optimistic case, will spell a big relief for the industry. Also, changes in the retail prices of petrol, diesel and ATF will play a crucial role in determining the profitability of OMCs. After all, given the capital-intensive nature of the business, the Government should ensure a fair and remunerative policy framework in order to help companies sustain operations and also commit more capital in the long term.

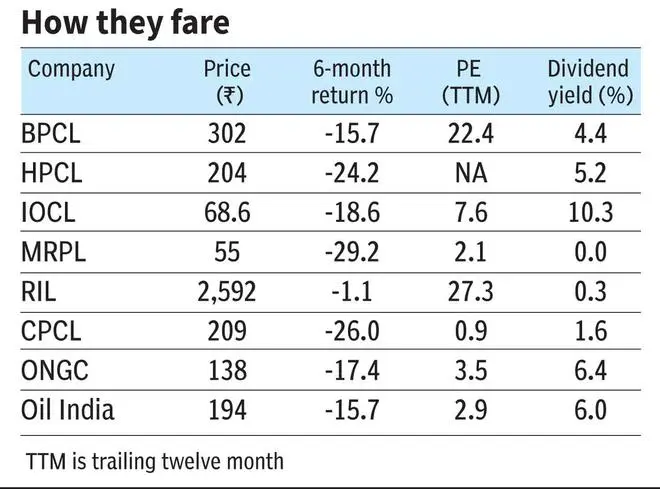

Given the regulatory controls and volatility in the crude prices, the performance of upstream and downstream companies has never been consistent. Long-term investing in this sector has not worked well, given the up and down cycles and volatility in financial performance of these companies. For investors who still want to play the opportunity in oil, it is important to time it right and invest in the right business. For instance, if you want to play the upside in refining margins in a rising crude oil scenario, Reliance Industries and Indian Oil Corporation, which enjoy superior refining margins, relative to the industry may be a better idea to consider. During downcycles and / or volatile times, you may be better off staying away from refining and exploration stocks.

Published on November 5, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.