The Groww Nifty Total Market Index Fund is the maiden passive offering from Groww Mutual Fund house. It is open from October 3. The New Fund Offer (NFO) period will conclude on October 17. This fund stands out, aiming to track the performance of all market-cap segments of the Indian market through a single offering. Specifically, the underlying Nifty Total Market index encompasses about 750 stocks, spanning the large, mid, small, and microcap segments. It’s the first Nifty total market index fund in India.

But is such extensive exposure necessary? How has the index performed compared to broader indices like Nifty 50, Nifty 100, Nifty 200, or Nifty 500? Here’s a detailed overview.

Launched in October 2021, the Nifty Total Market index comprises all stocks included in both the Nifty 500 index and the Nifty Microcap 250 index, with the stocks’ weights determined by their free-float market capitalization. The index undergoes a semi-annual review.

For several critical reasons, potential investors in index funds should be well-acquainted with and understand the underlying index.

Assessing risk: Understanding the composition of the underlying index enables investors to evaluate the risk associated with the index fund. Differences in portfolio lie mainly in the number of stocks, their weights, and market capitalization allocation among broader indices such as Nifty 50, Nifty 100, Nifty 200, and Nifty 500.

Market capitalization variance: The Nifty 50 and Nifty 100 can be classified as large-cap/giant-cap indices. In contrast, Nifty 200 leans more towards large and mid-cap stocks. The Nifty 500 spans are large, mid, and small caps, with over 70 per cent allocated to large caps, approximately 17 per cent to mid-caps, and the remainder to small caps.

Allocation: The Nifty Total Market index tracks 750 stocks across large, mid, small, and micro-cap categories. However, market capitalization allocation still assigns around 72 per cent to large-caps, similar to the Nifty 500. The rest is in mid-caps, small-caps and micro-caps. The allocation to micro-cap exposure can provide enhanced returns but also entails higher risk.

Understanding the historical performance and characteristics of the underlying index provides insights into the index’s performance over time and the kind of returns and volatility to anticipate.

While the Nifty Total Market Index commenced in October 2021, it’s important to note that index base values are available from April 2005. As such, any performance data presented beyond October 2021 relies on these base values.

From a returns perspective, the Nifty Total Market Index has outperformed other indices in both short-term and long-term horizons (refer to the chart below). The remarkable surge in small and micro-cap stocks appears to have contributed to this outperformance.

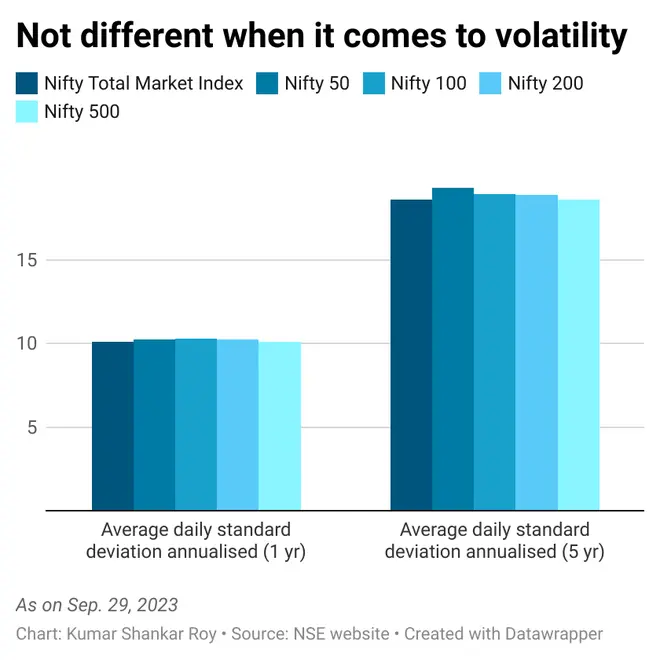

Crucially, higher returns don’t necessarily translate to higher volatility (see chart below) in the Nifty Total Market Index. This may be attributed to its substantial allocation to large-caps, which not only provides portfolio stability but also a balanced profile.

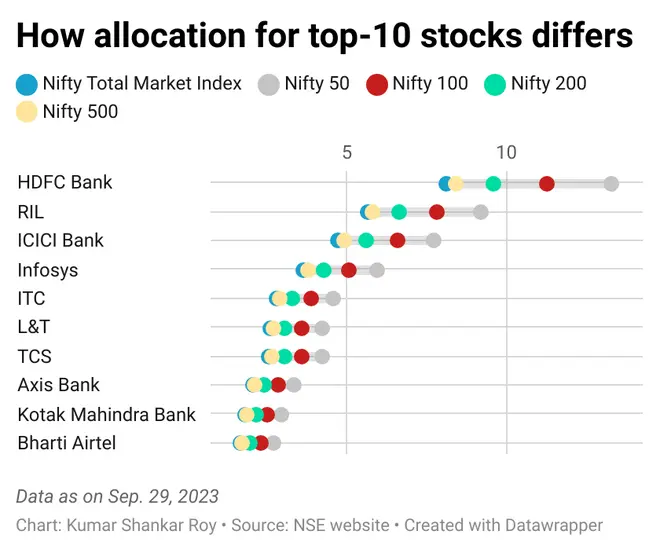

Interestingly, comparing the top 10 stocks in its portfolio to other broader indices, you’ll notice that the top 10 stocks are exactly the same. The primary distinction lies in stock weighting (see chart below).

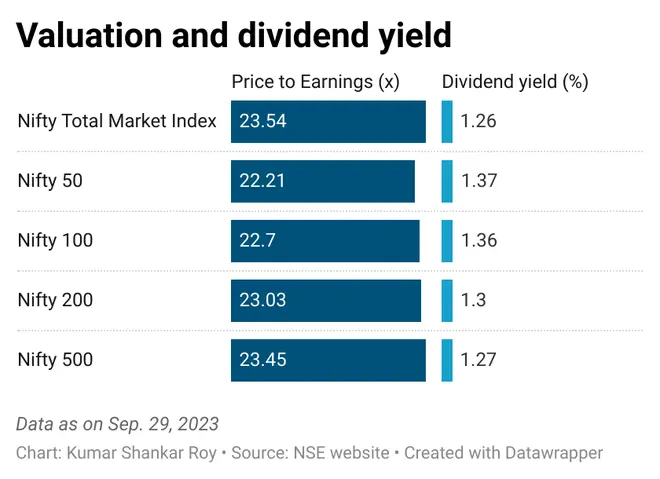

Considering that financial returns serve as the primary incentive for investors, the Nifty Total Market Index may appear attractive owing to its recent and historical gains. However, investors should take several additional factors into account:

Diversification: Index funds are utilized for diversification purposes. With 750 stocks, the Nifty Total Market Index might be excessively diversified. Beyond the top 100 stocks, the allocation becomes quite minimal. Additionally, managing an index with such a vast number of stocks can be challenging, potentially leading to scope of higher tracking errors compared to narrower indices. The efficacy of handling these matters will largely depend on the Groww MF team.

Passive Stock Selection: While large and mid-caps receive relatively extensive research coverage, small and micro-caps do not. This underlines why small and micro-cap stocks often command a discovery premium. Index-based investing in the less-researched segment of the Indian market comes with its own risks and rewards. Nonetheless, active stock selection is better suited for this segment. While small-cap index funds and recently-launched micro-cap index fund have delivered decent returns, these gains may be fuelled by current positive sentiments. We believe that active stock selection can potentially yield higher returns in small and micro-cap stock portfolios.

Total market indices are designed to represent the entire stock market or a substantial portion of it. The Groww Nifty Total Market Index Fund could be an attractive option for investors who appreciate simplicity and broad market exposure.

However, total market index funds are often weighted by market capitalization, which can result in overexposure to overvalued stocks. Moreover, the vast number of holdings in such funds may lead to over-diversification for some investors, potentially reducing risk mitigation during market downturns.

Suppose you believe that the Groww Nifty Total Market Index Fund aligns with your investment objectives, risk tolerance, and preferences. In that case, it may be a suitable choice, especially if you are just starting.

Published on October 2, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.