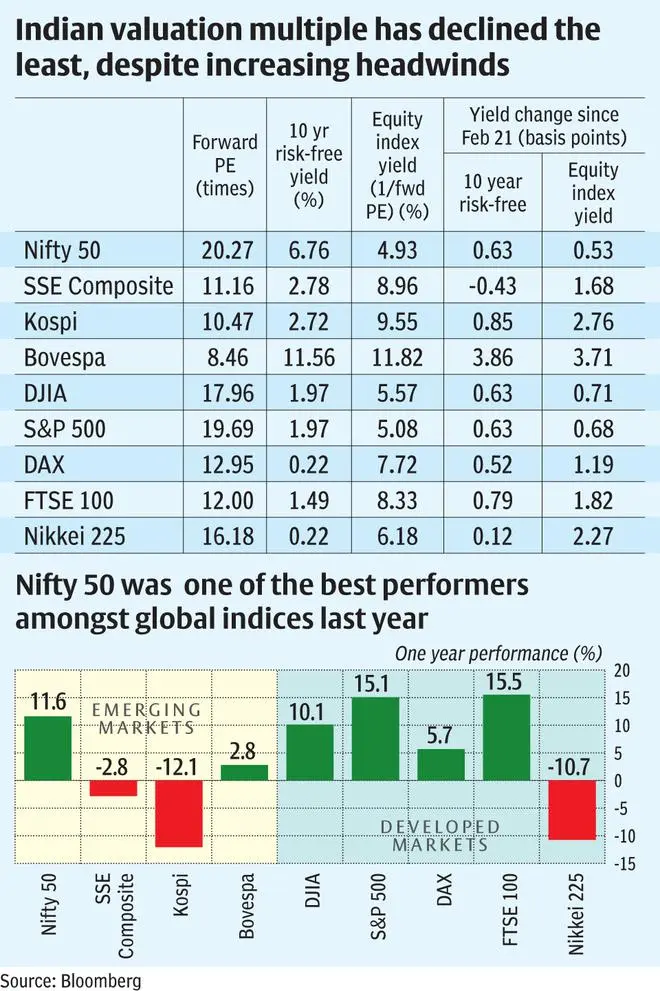

Over the last one year, the Indian benchmark index Nifty 50 has outshined many major global indices sporting returns of around 12 per cent. This is despite the Nifty 50 having been the second most expensive among key developed and developing markets at the same time last year.

Today, too, the story is no different. The Nifty is the most expensive among key global markets, trading at one-year forward multiple of 20.27 times. However, this time, the Indian market may not be second time lucky.

In 2021, the premium valuation for Nifty 50 was driven by hunger for yields from global investors in a zero-interest regime. This benefited Indian investors as well as the FPI flows that kept the markets buoyant. But today, bond yields across the globe are beginning to rise.

India is perhaps the only country where the equity index yield (calculated as 1/Forward PE) is lower than the yield on 10-year government securities. These factors make the Indian markets more vulnerable to a correction.

Lower relative attraction

Across all major economies in the developed and developing world including India, bond yields have been on the rise in recent months (see table). The German 10-year government bond yields turned positive inIn January 2022, for the first time since May 2019. When the yields were negative, investors were in a way paying the government to keep their money, making the global hunt for equity yields a worthwhile game despite the risks, as anything positive was better than negative yields. Yields were so depressed that even Greece, which was bordering on bankruptcy last decade, saw its 5-year bond yields briefly turn negative last year. This low interest rate regime is now undergoing a deep change with inflation at multi-decade highs in many developed markets including the US.

While global bond yields initially cooled off on the news of Ukraine invasion, they have subsequently started retracing as concerns on inflation have only increased.

The Fed Model

In this backdrop, if one were to compare the relative attractiveness of equities based on forward earnings with the risk-free investment option — a valuation tool known as the ‘Fed Model’ — India is the only country where the equity earnings yield is lower than the domestic risk-free 10-year bond yield.

While good growth prospects for Indian companies can be a factor, the earnings growth going ahead for the Indian index is not by any means an outlier, as other major indices such as China’s SSE Composite, US’s S&P 500 and UK’s FTSE 100 are expected to show better earnings growth in CY2022 versus Nifty 50, as per data from Bloomberg.

Low bond yields in developed markets, relatively favourable regulatory regime/policy stability in countries like China and Brazil have been other key factors aiding this phenomenon of equity yields trailing bond yields in India.

While globally valuation multiples declined the last year (reflected in increase in earnings yield), Nifty 50 earnings yield has increased the least (see table).

This, in a situation where bond yields have moved up, indicates that the relative attractiveness of Indian equities has reduced as per the Fed Model.

Besides, international investors have now started to look for value in Chinese markets despite the risks. Trading at PE of around 11 times, China’s SSE Composite is getting a valuation of just 50 per cent that of India’s Nifty 50.

Further, while central banks across the word, including India’s RBI , are tilting towards monetary tightening, China has stepped up monetary easing to support a slowing economy.

According to data from research firm EPFR Global, mainland Chinese stock funds saw inflows of $16.6 billion in January. This compares with outflows of $4.7 billion from Indian equities during the same month.

Given these factors, the Indian markets will face a test of resilience in 2022. The benchmark valuation is around the same levels as at the same time last year; however, the significant variables that impact equity valuations – bond yields, earnings growth and relative attractiveness of other markets — are all less favourable in 2022 than in 2021.

As though existing headwinds are not enough, geo-political tensions have now come to fore to unsettle markets across the globe and the impact on Indian markets needs to be seen.

With Indian markets getting less attractive for international investors on key macro factors, it will be up to domestic investors to do the heavy lifting.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.