The National Pension System (NPS), under its ‘All Citizen Model’, provides investors with four asset classes in both Tier-I and Tier-II accounts: Equity (Fund E), Corporate Bonds (Fund C), Government Securities (Fund G), and Alternative Assets (Fund A). Choosing the right mix helps maximise retirement savings while keeping risk in check. Among them, Fund C and Fund G, both debt-focussed, are particularly attractive options for conservative investors who seek capital stability over aggressive growth.

Over time, these debt funds have shown strong long-term performance, often outperforming similar mutual fund debt fund categories. The NPS is currently managed by 10 pension fund managers, with six having track records exceeding a decade. According to the data as of June 20, 2025, Tier-I has seen robust participation, with over 6.9 million investors contributing around ₹60,905 crore in Fund C and nearly ₹1.1 lakh crore in Fund G. Tier-II participation is notably lower, with approximately 1 million investors in each contributing ₹1,375 crore in Fund C and ₹2,472 crore in Fund G.

Here is a closer look at how these two debt funds perform, their portfolio structures, and which investors they best serve.

Fund C primarily invests in listed corporate debt, including bonds from PSUs, private firms, real estate investment trusts (REITs), and infrastructure investment trusts (InvITs). Regulatory norms limit single business group exposure to 10 per cent and cap total sectoral allocation at 15 per cent across all schemes by a fund manager. These funds adopt a semi-passive and mostly buy-and-hold approach, as seen with LIC Pension Fund’s portfolio of 471 debt instruments. HDFC Pension Fund C, the largest Tier-I scheme, manages ₹25,539 crore with 298 holdings. Tier-II Fund C portfolios typically have fewer holdings typically, ranging from a few dozen to over 200 holdings depending on the fund manager.

To maintain a long-term investment orientation, only up to 10 per cent of Tier-I Fund C investments can be in bonds maturing within three years. Tier-II has a higher 20 per cent limit due to its more liquid, open-ended structure. Despite similar investment norms, this distinction reflects the unique operational flexibility of Tier-II.

Fund C schemes generally avoid interest rate bets, keeping a portfolio modified duration between 4 to 6 years in most periods. Although regulations allow up to 10 per cent

exposure to lower-rated bonds (AA- to A as defined by the regulator), managers are still cautious. For instance, Aditya Birla SL Pension Fund holds the highest such exposure to only 2 per cent, while others mostly hold top-rated (AAA) instruments.

Fund G allows managers greater flexibility in selecting bond tenures, which can span from 1 to 50 years depending on market conditions. While there are no maturity limits, most securities are held until maturity. Modified durations currently range between 8 and 11 years.

This fund type can invest in central and state government securities. They can also invest in bonds backed or serviced by the government, such as those from Food Corporation of India (FCI) or MTNL — though such exposure is limited to 10 per cent of the portfolio. Additionally, up to five per cent of assets may be allocated to gilt or long-duration debt mutual funds. These investments do not attract any management fee.

The number of holdings in Tier-I Fund G ranges widely — from 52 to 445. HDFC Pension and SBI Pension are the largest Tier-I managers, overseeing ₹41,770 crore and ₹24,411 crore with 445 and 190 securities, respectively. They also lead in Tier-II, with HDFC managing ₹876 crore and SBI ₹626 crore.

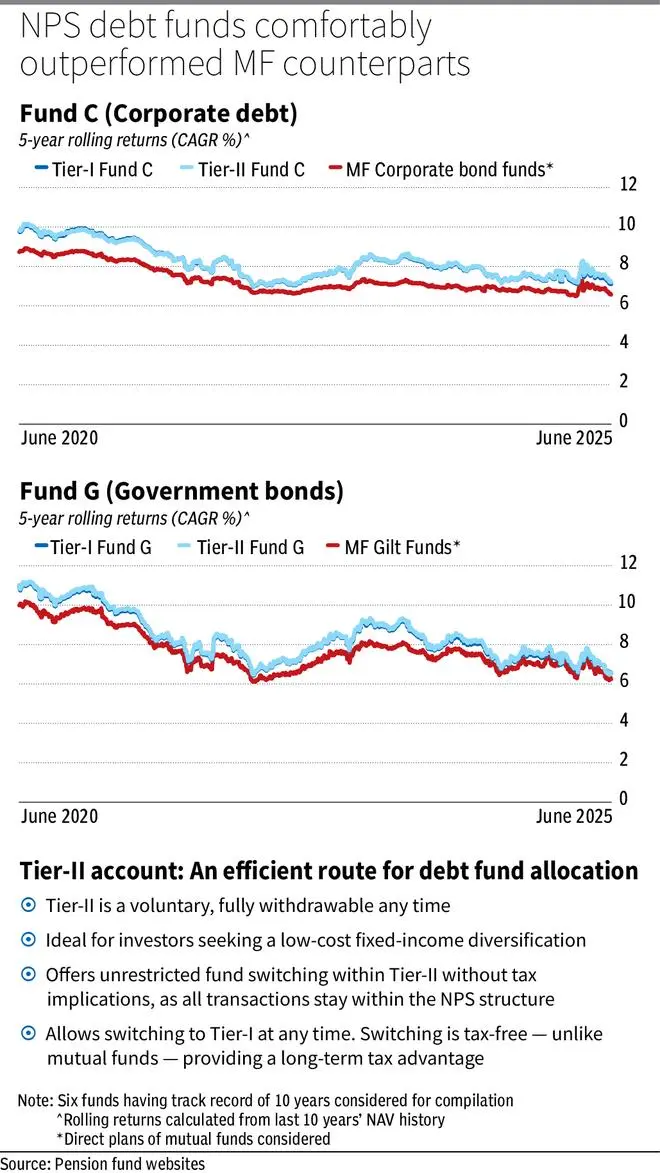

Both Fund C and Fund G have outshone their mutual fund counterparts over the long term. A study of five-year rolling returns over the last 10 years revealed that Fund C and Fund G returns were nearly identical across Tier-I and Tier-II. Fund C delivered a compound annual return of 8.24 per cent in Tier-I and 8.2 per cent in Tier-II, which was far better than the 7.35 per cent offered by corporate bond mutual funds (direct plans). Fund G posted returns of 8.42 per cent (Tier-I) and 8.35 per cent (Tier-II), exceeding the 7.7 per cent gain from gilt mutual funds.

Based on five-year rolling returns, the top-performing Fund C options under Tier-I were HDFC, ICICI Prudential, and LIC Pension Funds, while in Tier-II, the leading performers were LIC, HDFC, and ICICI Prudential Pension Funds. For Fund G, LIC, HDFC, and Kotak Pension Funds stood out in Tier-I, while LIC, HDFC, and ICICI Prudential Pension Funds led the performance in Tier-II.

It’s noteworthy that the number of holdings can vary considerably between Tier-I and Tier-II within the same fund. For instance, UTI Pension’s Fund C holds 247 securities in Tier-I, while its Tier-II version holds 124. However, since their core portfolio positions are still largely aligned, the returns from both have been nearly identical.

Debt funds under NPS suit conservative investors, particularly those approaching retirement who prioritize capital protection. They are also beneficial to those extending their NPS accounts post-retirement, as the scheme allows investors to continue until age 75.

Fund C and Fund G address different risk preferences and life stages. Industry trend is that younger investors generally prefer equity allocations, while mid-career individuals often opt for Fund C for its better return potential. As retirement nears, many switch to Fund G for its safety and sovereign guarantee. This lifecycle approach aligns with asset-liability matching and prudent risk management.

From an operational standpoint, Tier-II offers more flexibility, allowing unlimited fund switches and asset reallocations without tax implications since transfers are still within the NPS structure. Tier-I, by contrast, allows only four switches a year and one fund manager change, though separate managers can still be chosen per asset class.

While Tier-II’s tax treatment isn’t explicitly outlined under NPS rules, for NPS debt funds, it generally mirrors that of debt mutual funds where gains are taxed as per the investor’s income bracket. All these make Tier-II suitable for investors seeking low cost, long-term, flexible fixed-income diversification. By aligning debt fund choices with their financial goals, investors can strike the right balance between returns and safety.

Published on June 28, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.