In the past week, the benchmark indices, Sensex and Nifty 50, declined 0.6 per cent each, respectively. Most of the sectoral indices ended in red. BSE Metal declined the most by 3.9 per cent followed by BSE Oil and Gas 1.3 per cent and BSE Bankex 0.8 per cent. BSE Power and BSE Consumer Durables gained 0.5 and 0.2 per cent.

Among the BSE 500 stocks, the top gainers with fundamental news driving the shares were Cochin Shipyard and Alok Industries.

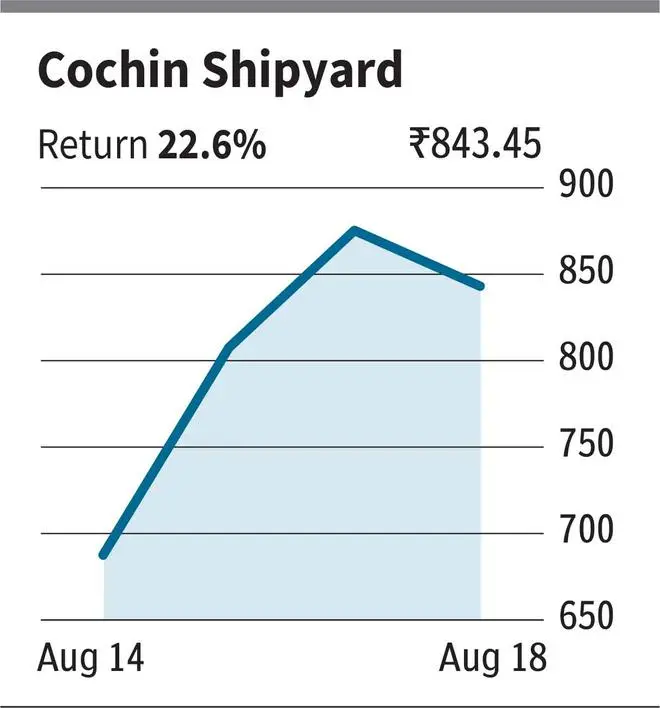

Cochin Shipyard

The stock of Cochin Shipyard returned 22.6 per cent for the week and registered the largest single-day gain of 27 per cent on August 16, 2023. The main trigger for the movement of the stock was the announcement made by the government regarding the fleet support shipping project. The government had recently declared that it has sanctioned ₹19,000 crore for the construction of five fleet support ships. Another trigger for the stock rallying was the results for June 2023 quarter. The company’s revenue grew 13 per cent YoY to ₹560 crore, whereas the profit for the same period grew 134 per cent to ₹98.65 crore.

The trailing PE of the company is 36.42 times and the trailing price to book ratio is 2.51 times.

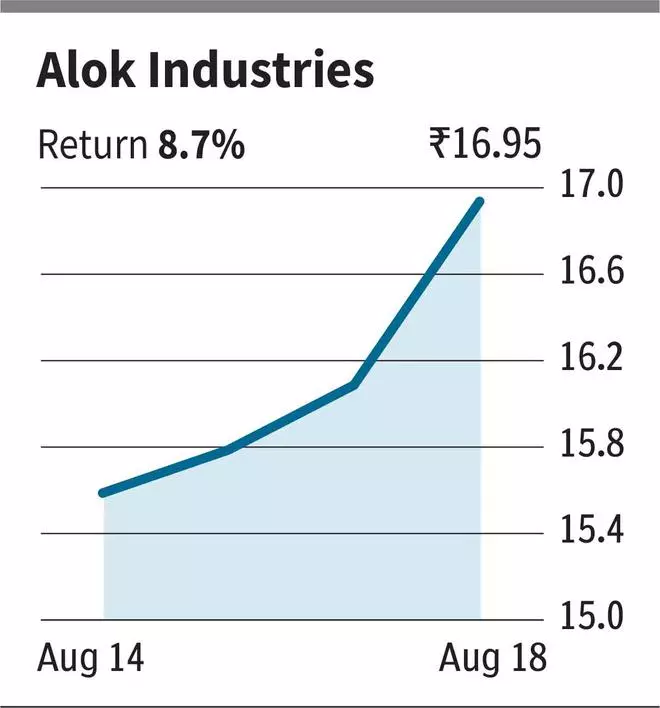

Alok Industries

The stock of Alok Industries gave returns of around 9 per cent for the week ending August 18, 2023. The highest single-day gain of the company was on August 18, 2023, when it increased by 6 per cent. The main trigger for the rally is the news regarding capital infusion by its promoter, Reliance Industries. According to news reports, Reliance Industries Ltd has earmarked ₹14,200 crore for investments in its subsidiaries and joint ventures, out of which ₹7,000 crore is likely for Alok Industries. AIL was acquired by a consortium led by RIL and JM Financial ARC. The report further mentions that RIL targets product and service sales to ₹5,000 crore for Alok Industries in FY24.

Other gainers

In addition, the other top gainers were Apar Industries (16.96 per cent) and Mishra Dhatu Nigam Ltd (12.18 per cent). The trailing twelve months PE of Apar Industries is 29.18 times, and the price to book is 8.3 times. On the other hand, Mishra Dhatu Nigam is trading at a trailing PE of 46.78x, and the price to book is 5.6 times. However, there was no significant fundamental news relating to these stocks last week.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.