The S&P BSE Realty index has been on fire over the past one year, with the benchmark more than doubling over this period. In a segment that has found favour with the market, we have a reasonable quality company that has been an underperformer.

The stock of Sunteck Realty, which is focused exclusively on the Mumbai Metropolitan Region (MMR), has risen by a little under 30 per cent in the last one year.

At ₹462, the stock trades at 36 times its likely per share earnings for FY24 and 20 times its expected EPS for FY25, making it a reasonable bet for investors with a 2-3-year perspective, especially given the stratospheric valuations that most real estate companies trade at currently. Sunteck’s PE multiple of 20 times for FY24 appears reasonable in light of the strong earnings growth expected over FY24-26 as a few large projects would be completed.

A strong pipeline of projects that are to be handed over in the next couple of years is set to usher in record revenues. Sunteck Realty has a track record of strong execution, follows a robust asset-light model and has a strong balance sheet. In addition, the company consistently partners with reputed institutions to deliver on joint developments on specific projects.

As a company that recognises revenues on a project completion method rather than on percentage completion mode of Indian accounting standards, its financials tend to be lumpy. Revenue is recognised in the Profit & Loss statement only upon project completion, but pre-sales — a measure of how home-buyers confirm bookings and pay advances, apart from signing agreements with the developer much before the property is ready — continue to be healthy.

For example, in the first two quarters of this fiscal, there was limited traction for the company, while the second half is expected to be quite strong. The Sunteck Maxx World project in Naigaon is expected to result in revenue recognition of ₹750-850 crore by end of FY24. Similarly, Sunteck City 4th Avenue, ODC,Goregaon West, is expected to result in ₹950-1,050 crore in FY25. These are in addition to other expected completions and would give a strong push to profits as well.

Established record of execution

Sunteck Realty has presence across the luxury home-buying value chain — uber, premium and aspirational — which ensures that it is able to tap into customers coming from a range of income levels: wealthy to mid-income, even lower mid-incomes for some of its projects.

As mentioned earlier, it operates in the MMR region (including suburbs) and has ongoing, completed or upcoming projects in areas such as Vasai, Naigaon, Mira Road, Borivali, Goregaon, Andheri, Vile Parle, BKC, Airoli and Kalyan, among a few others. In addition, it does commercial property development to sell and lease as well, though this is a relatively smaller business.

The MMR is an attractive and growing market. According to a report from Anarock, around 1.54 lakh units were sold in the MMR during 2023, a 40 per cent increase over 2022. It is the fastest growing real estate market among the top seven cities in India. MMR is likely to be a top growth market for the foreseeable future.

The company acquired 38.5 million square feet in the MMR region via joint development, redevelopment and joint venture modes between 2018 and 2022. By going on an acquisition spree even during the Covid pandemic, Sunteck Realty was able to acquire real estate at attractive and near rock-bottom prices.

These moves are in keeping with the company’s asset-light model of property development as outright land purchases can be prohibitively expensive in MMR and there is a huge scarcity premium. Thus, it picks up slum rehabilitation projects, redevelopment of dilapidated old buildings in good locations and joint ventures with land owners as alternatives to direct land purchase.

Sunteck Realty executes projects with in-house expertise and has full control over the construction and handover of properties.

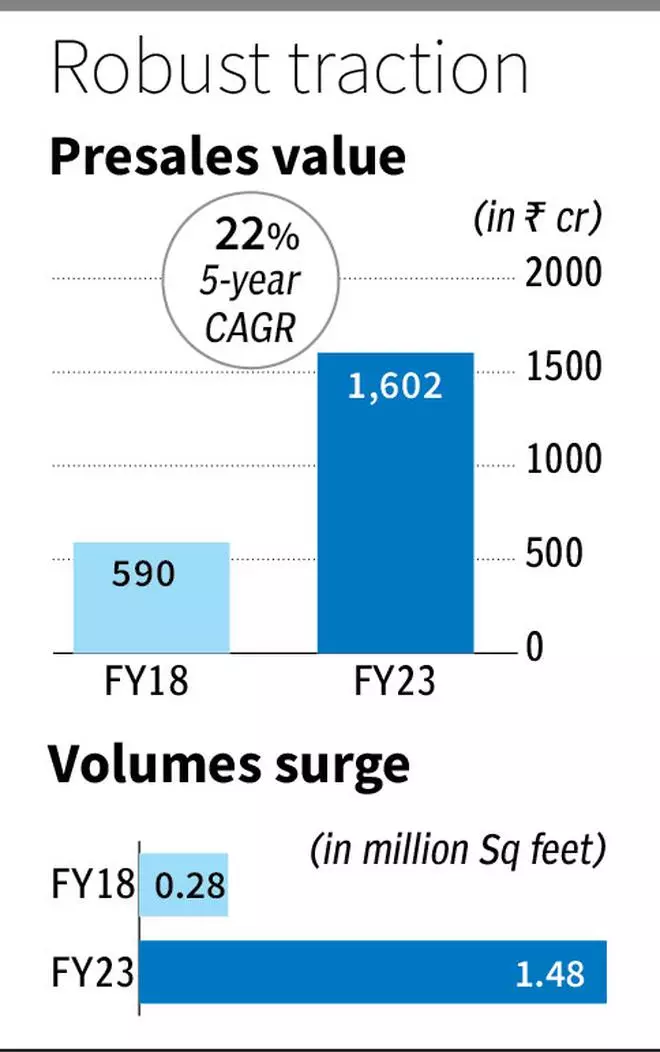

Pre-sales grew at 22 per cent annually over the previous five financial years to ₹1,602 crore in FY23, from ₹590 crore in FY18. Sales volume rose more than five-fold over the same period — from 0.28 million sq feet in FY18 to 1.48 million sq feet in FY23. Operating margins have generally remained in the 30-40 per cent range for the company.

Healthy partnerships and low debt

Sunteck Realty also undertakes projects in partnership with financial institutions. Recently, it tied up with the International Finance Corporation (IFC) to form a joint investment platform of around ₹750 crore. The project involves building green-quality residences for the mid-income group in the MMR region. Sunteck Realty would have to work on 4-6 housing projects and develop around 12,000 housing units.

In the past, it has partnered with the Ajay Piramal group and Kotak Realty Fund on JV and SPV basis to develop housing projects.

It is important to note that the company exited with IRR (internal rate of return) in excess of 20 per cent in each of these projects.

The IFC partnership thus promises reasonable revenue visibility with healthy margins.

Sunteck Realty has a robust balance sheet. It has a net debt of only ₹250 crore. The net debt to equity is at a healthy 0.09 as of September 2023. This is down from 0.22 levels seen in FY20.

The debt-equity ratio is among the lowest in the industry.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.