The share price of Bengaluru-based Sobha Developers was initially on a roll since BL Portfolio’s buy call in June last year at ₹ 460.85, more than doubling to over ₹ 1014 in early 2022. However since then, the stock has given up much of those gains. The general market meltdown and concerns on rising interest rates and inflation may have spoiled sentiments. The company had a change of Managing Director in April, which may have also added to uncertainty.

For the quarter ended March 2022 and FY22 overall, Sobha delivered stellar results - revenue, profit, sales volume, cash inflow and sale price increased while debt reduced.

At ₹535, the stock trades at 17 times FY23 earnings as per Bloomberg. Peer, Prestige Estates trades at 22 times.

While the near-term outlook is uncertain, company has a strong brand and operational fundamentals, which limit the downside. So, investors with a three-year horizon and patience to look past near term outlook can accumulate the stock, as the long-term potential is good.

Sobha earns revenue from multiple verticals - property development, construction contracts and material manufacturing, along with a small commercial rental segment. In FY22, contractual and manufacturing sales was down 10 per cent yoy to ₹ 720 crore while overall revenue increased 29 per cent yoy to ₹ 2789 crore. This was thanks to a strong 53 per cent increase in real estate revenue. Potential over-reliance on property development could be a cause for concern, if the trend continues.

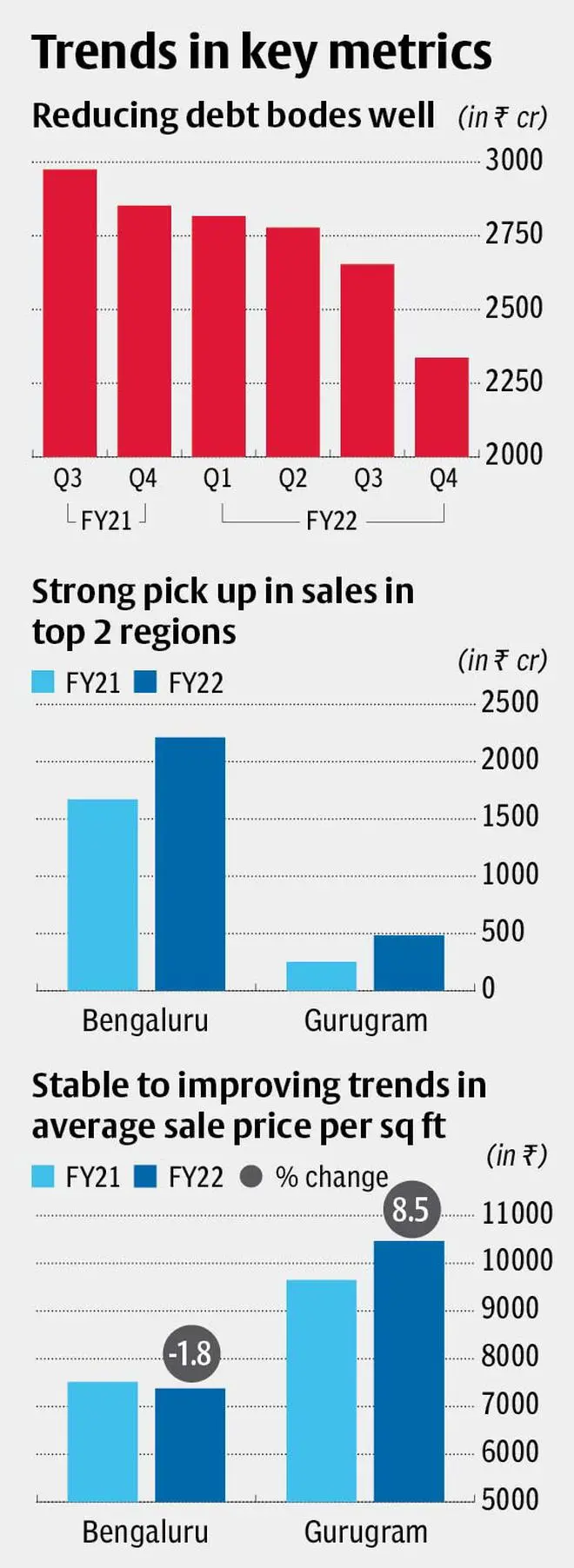

The company also had its highest ever quarterly cash inflow, up 32 per cent yoy to ₹ 1291 crore in Q4 of FY22. Another big positive was the reduction in debt, by ₹ 317 crore during the quarter. Overall debt to equity stands at a comfortable 0.93 times, as the company had been lowering its debt levels steadily and delivered on its expectation of a debt/equity ratio of 1 in FY22. Borrowing cost reduced by 25 basis points (bps), to 8.4 per cent.

Sales volume growth at 22 per cent increase in FY22 from pre-pandemic levels (FY19) to 4.9 million square feet (msf) and average price increase at 4.4 per cent in the March quarter to ₹ 8,265 per square feet has been robust. However, Sobha management’s outlook is a bit muted on growth.

One cause for concern is the uptrend in raw material prices that adds to cost. To offset that, the company expects to increase price, by about 6 per cent in FY23. It expects that this, coupled with small sales volume growth, can help achieve lower double-digit revenue growth. While the Bengaluru market, helped by good IT/ITes hiring and wage growth has seen good demand, the ability of the market to absorb higher prices and maintain/grow volumes is unclear in the near-term. Buyer sentiments may be affected if interest rates also rise fast.

The impact of the current inflationary environment on Sobha’s margin is also a point to consider, given its low unsold inventory. Currently projects with 19.25 msf of saleable area are in the works, with only 5.4 msf unsold. There is also negligible amount of completed projects that is unsold. While this would be a great positive - for revenue and cashflow – with rising raw material costs and fixed sale price, margin may take a hit as price increases cannot be passed on. Sobha plans to continue its ‘sell as we build’ strategy and hopes to manage costs through its manufacturing and supply chain expertise.

EBITDA margin shrunk in FY22 to 19 per cent, from 23 per cent in FY21. Still, net profit jumped 84 per cent yoy in FY22, to ₹116 crore , thanks to higher revenue. The balancing act of maintaining margins while growing sales volume will be the key monitorable over the next few quarters.

Sobha has a presence in 10 cities - Bengaluru, Gurugram, Chennai, Pune, Coimbatore, Thrissur, Kozhikode, Kochi, Gujarat (Gift City) and Mysore. However, over two-thirds of the sales volume and value is from Bengaluru. While this share is expected to reduce with NCR (currently 14 per cent of value) and other cities such as Pune and Ahmedabad ramping up, it may be only gradual – 61 per cent of its residential launch pipeline of 13.2 million square feet (msf) is planned for the Bengaluru market.

Expected strong demand, especially for larger spaces, post Covid , by the IT/ITES home buyers in Bengaluru, Pune and other markets, where this is a good pipeline of launches, is a key positive. Also, Sobha’s strong brand value for quality and on-time delivery will continue to help drive sales.

The company has strong sustainability practices; its Sobha City project in Thrissur was recently recognized with a platinum status for being net water positive.

The writer is an independent consultant and doesn’t hold positions in this stock.

Published on June 25, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.