Pricing pressures in the US markets as well as additional challenges from presence in Russia have seen the Dr.Reddy’s stock fall by 9 per cent since our ‘Accumulate’ call in September 2021. Even as these difficulties persist, higher contribution from India and other EMs where pricing power is intact and high-value launches in the US promise a sanguine outlook for the company. The stock is trading at 22 times FY23 earnings, which is in line with last one-year average and 10 per cent premium to its peers. We reiterate our ‘accumulate’ call on the stock, where investors can use opportunities from market volatility to take or add exposures.

Emerging markets (EMs) account for 18 per cent of Dr.Reddy’s revenues (Q1FY23) of which Russia and other CIS countries constitute a large part. The direct impact on revenues of the ongoing Russia-Ukraine war was felt in the declining channel stocking in the first quarter of FY23. But biosimilar launches (bevacizumab) provided a cushion in FY22. Net-net, the company reported 14 per cent YoY decline in revenues in Q1FY23 in Russian operations. The forex impact from the Russia-Ukraine war played out in the last quarter too, resulting in 150 basis points decline in gross margins on rouble depreciation, but the impact may be lower, going ahead. The company does not hedge its rouble exposure due to high costs involved.

The US operations, while comparatively better than peers with many limited competition product launches, are facing high erosion in base business. However, high-value launches have eased the pressure in this segment and this trend can be expected to continue.

Margin pressure from input material, logistics and energy cost inflation can continue in the near term, based on how the macro-economic situation turns out. But higher contribution from India and EMs (with pricing power) and high-value launches in the US are margin levers for Dr. Reddy’s in FY23-24.

The company has strong growth prospects, thanks to its US complex filings and Indian operations.

Generic Revlimid is a big opportunity for most others such as Natco, Cipla, Sun, Aurobindo and Zydus too, but Dr. Reddy’s also has 180-day exclusivity over two of the six dosage forms. The product, launched in September 2022, is expected to add 5-6 per cent to total yearly revenue growth (annualised) for Dr. Reddy’s, with further upside from traction gained in the exclusivity period. By allocating volume limits in confidential agreements with the innovator for generic Revlimid, price competition is not expected to be high till 2026.

Dr. Reddy’s has added a higher number of such limited competition products in the last year, such as Generic Nexavar, vasopressin, Revlimid Canada, and pemetrexed. These could have contributed 1-3 per cent each to total revenue growth, but will soon face high competition similar to other generics. The ‘25 products’ launch plan by the company for FY23 is expected to benefit if such large products are unveiled, offsetting high erosion and supporting margins. Injectables account for 16-18 per cent of US revenues. The company has commercialised a new facility (FTF-11) in the segment and acquired injectable portfolio from Eton Pharma (upfront cost of $5 million) which adds further strength to this segment.

The Indian operations gained from the sizeable Wockhardt acquisition in FY21 (62 domestic brands for ₹1,600 crore) and Dr.Reddy’s has been pruning its Indian portfolio (selling some products) and adding/inlicensing other products (Novartis recently) to improve the profitability of the segment. Going by management commentary, Dr. Reddy’s may also be inclined to pursue inorganic addition in this geography, further strengthening its Indian presence.

Dr. Reddy’s is pursuing a global approach, where it leverages filings and development of one region to expand presence in other regions as well. In such a scenario, biosimilars developed for EMs can benefit from eventual launch in developed markets through partnerships. This extends to Revlimid and other injectables portfolios in Europe, India, and EMs. By cross leveraging, Dr. Reddy’s can improve its return on investments, which is one of its aspirations.

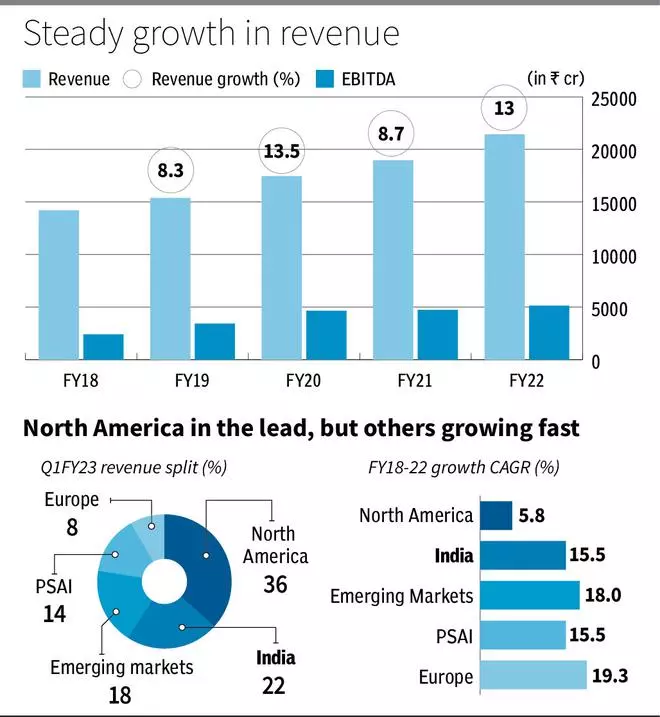

Dr.Reddy’s has a strong balance sheet with net cash of ₹1,080 crore as on June-30, 2022, and this is the basis for the company’s inorganic growth plans. In FY22 the company reported 12 per cent growth to ₹21,132 crore and EBITDA margin of 23 per cent. On the top line, the annualised revenue growth for the next two years is expected at 9 per cent (according to Bloomberg consensus). This will be driven by India, and to a lower extent by US (high-value launches offset by industry-wide price erosion) and Europe. The annualised EBITDA growth (over 13 per cent in FY22-24) should benefit from pricing levers in India, high-value portfolio in the US and possible cooling of input prices over the next two years. The company aspires to generate 25 per cent ROCE and EBITDA margins over the next two years.

Published on October 22, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.