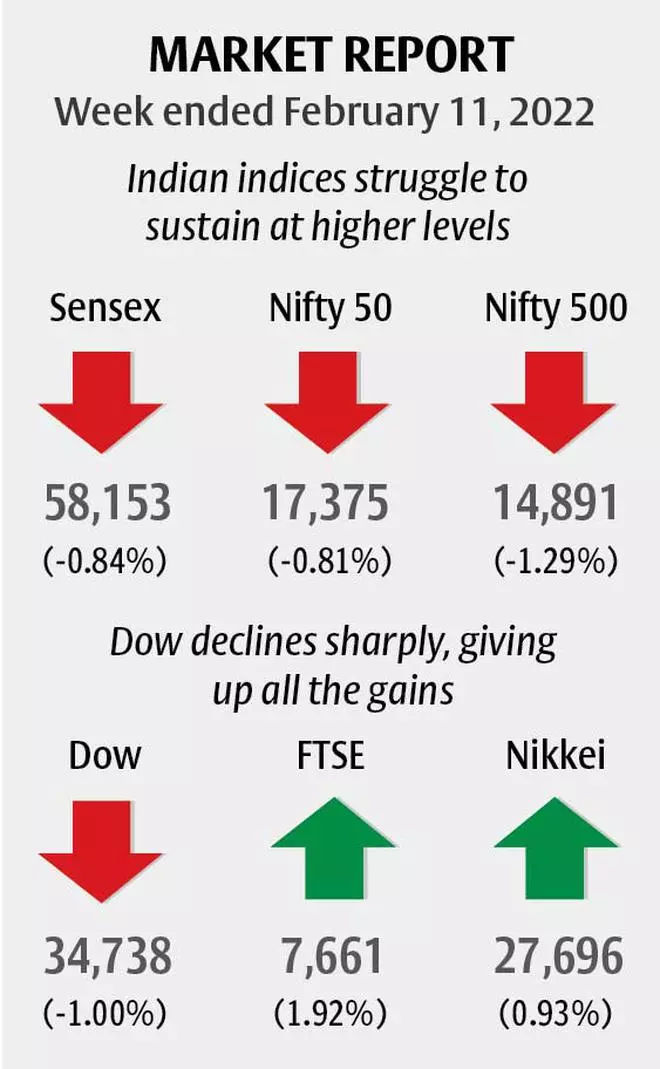

The Indian benchmark indices are stuck in a narrow sideways range over the last couple of weeks. Sensex is stuck in between 57,000 and 59,500. Nifty 50, on the other hand, has been oscillating between 17,000 and 17,800. The price action in the last two weeks indicates that both Sensex and Nifty are lacking strong follow-through buying to move decisively higher. This could keep the indices vulnerable for a fresh fall, going forward. Sensex and Nifty closed lower by 0.84 and 0.81 per cent respectively last week.

Among sectors, barring the BSE Metals (up 3.8 per cent) and BSE Auto (up 0.1 per cent) indices, all others closed in red last week. The BSE Capital Goods index fell the most by 3.78 per cent.

The Foreign Portfolio Investors (FPIs) were net sellers of Indian equities for the fifth consecutive week. They sold $862.9 million in the Indian equity segment last week. FPIs have pulled out over $5 billion from Indian equities since the beginning of this year. As long as FPIs continue to sell Indian equities, the upside is likely to be capped in Sensex and Nifty.

The development on the Russia-Ukraine front Friday night could impact the Indian stock markets on Monday. Escalating tension between Russian and Ukraine weighed on the US stock markets on Friday. Increasing concerns that Russia could invade Ukraine anytime now triggered a strong sell-off in US equities on Friday and the Dow Jones Industrial Average tumbled by 1.4 per cent. The Indian benchmark indices are likely to see a strong gap-down open on Monday on the back of this recent development.

Nifty fell sharply initially to make a low of 17,043.65 on Tuesday. The index managed to bounce back and recover the loss thereafter but failed to sustain high. Nifty made a high of 17,639.45 on Thursday and fell back to close the week at 17,374.75, down 0.81 per cent.

The week ahead: The near-term outlook is mixed. But the Russia-Ukraine political tension is most likely to drag the Nifty down in the opening trades on Monday. It will have to be seen if the sell-off intensifies below 17,000. Important support below 17,000 is at 16,800. Nifty has to sustain above 16,800 to avoid a much steeper fall. A bounce from 16,800 can take the index back to 17,500-17,600 levels. But a break below 16,800 can take the Nifty down to 16,500 and even lower. As such the price action at 16,800 will need a close watch this week. Medium-term outlook: The region between 16,600-16,500 is an important short-term support for the Nifty. A break below 16,500 will keep our overall bearish view intact and drag it to 16,000 initially and then to 15,000-14,500 eventually. On the upside 18,000-18,200 and 18,500 will continue to remain as a strong resistance. Only a strong and sustained rise past 18,500 will negate the bearish outlook of seeing 16,000 and lower levels mentioned above. As long as Nifty remains below 18,500 we retain our bearish medium-term outlook for the index.

Trading strategy: The trailing stop-loss at 17,320 on the short position taken at an average rate of 17,550 has been hit. Traders can take fresh short positions on a break below 17,250. Keep the stop-loss at 17,700. Trail the stop-loss down to 17,100 as soon as the index falls to 16,750. Move the stop-loss further down to 16,600 as soon as the index touches 16,250. Book profits at 16,100.

Sensex fell to a low of 57,058.77 and then recovered all the loss from there. But the bounce-back move failed to rise past 59,000. Sensex made a high of 59,060.24 on Thursday and then reversed lower again to close the week at 58,152.92, down 0.84 per cent.

The week ahead: Near-term outlook seems to be range-bound for the Sensex. The index can oscillate between 56,500 and 59,500 in the coming days. Within this range, the bias is bearish to see a break below 56,500 and see a fall to 55,000 in the short term. In case the Sensex manages to break above 59,500, an extended rise to 61,000-61,500 is possible.

Medium-term outlook: The broader picture is still bearish. As mentioned last week, the broad 61,000-62,000 region will be an important resistance zone. Sensex will have to rise past 62,000 decisively to negate the medium-term bearish outlook. As long as the index trades below 62,000 the bias will remain negative. As such the chances are high for the Sensex to break below 55,000 in the coming weeks. Such a break can drag it to 53,000-52,000 in the coming months.

The Nifty Bank index began the week on a weak note. The index fell sharply to a low of 37,319 by Tuesday and then rose back sharply to a high of 39,197 on Thursday. However, it failed to sustain higher and fell back to close the week 0.7 per cent lower at 38,517.25.

An important support is at 37,700. The index has to break below this support to come under more selling pressure. Such a break can take the Nifty Bank index down to 37,000 initially. A further break below 37,000 can drag the index further down to 36,000 in the short term. The level of 36,000 is the next crucial support from a medium-term perspective. A decisive break below 36,000 will then pave the way for a steeper fall to 34,000, going forward.

On the other hand, if the Nifty Bank index manages to sustain above 37,700, it can bounce back to 39,000 again. In such a scenario, the short-term outlook will continue to remain bullish to see 40,000 on the upside. For now, it is a wait-and-watch situation. The price action this week will need a close watch to see if the index sustains above 37,700 or not.

As such we prefer to stay out of the market for this week with no trades in Nifty Bank.

The Dow Jones Industrial Average (34,738.06) failed to breach 35,500 decisively for the second consecutive week. The index rose well to a high of 35,824.28 but then fell sharply in the second half of the week, giving back all the gains. The news on Friday that Russia could invade Ukraine anytime added to the downside pressure.

The Dow can dip to 34,200-34,000 this week. On the charts, the failure to breach 35,500 increases the chances of seeing a break below 34,000 in the coming days. Such a break can drag the Dow down to 33,000, going forward. The price action around 34,000 will need a close watch. In case the Dow manages to sustain above 34,000, it can rise back to 35,000-35,500 again.

Published on February 12, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.