The Indian benchmark indices, the Sensex and Nifty 50, were down about 1.8 per cent each last week

Global equity markets are under pressure on the back of the US banking sector crisis. Although, some recovery was seen towards the end of the week, the sentiment is broadly negative. So, the upside is likely to be capped and the global equity markets can witness more fall from current levels.

The Indian benchmark indices, the Sensex and Nifty 50, were down about 1.8 per cent each last week. Among the sectors, the BSE Power index outperformed by rising 1.41 per cent. The BSE Auto index, down 3.78 per cent, was the worst performer. This was followed by the BSE IT index, down 2.44 per cent.

The foreign portfolio investors (FPIs) were net sellers of Indian equities last week. However, the quantum of selling was less. The FPIs sold $247 million last week. The FPI action over the last few week signals that they are not much inclined towards selling. It also indicates that the FPIs could be buying the dips. This is a positive from a long-term perspective. So, if the FPI does not sell heavily as the market continues to fall, then that will be a positive sign from a long-term perspective.

The fall to 16,850 mentioned last week has happened as expected. Nifty made a low of 16,850.15 and has risen back very well from there. The index has closed at 17,100.05, down 1.8 per cent.

The week ahead: The bounce from the low of 16,850 has given some breather for the index. However, strong resistance is around 17,200. Nifty has to surpass this hurdle. Only in that case, a rise to 17,400 and 17,600 can be seen this week.

Failure to breach 17,200 can continue to keep the index under pressure. In that case, a fall back to 16,850 can be seen again. That will also keep the chances alive of the Nifty breaking below 16,850. Such a break can drag it down to 16,600-16,500 in the short term.

As such, 16,850 and 17,200 are crucial levels to watch this week. A breakout on either side these levels will determine the next direction of move.

Chart Source: MetaStock

Medium-term outlook: The nervousness in the market is keeping the medium-term outlook vulnerable. Nifty has to sustain above 16,850 and then rise past 17,600 decisively to ease the downside pressure. Considering the weakness in the US markets, the chances of a fall below 16,850 cannot be ruled out. Such a break can drag the Nifty down to 16,600 and 16,300 and even 16,000. A weekly close below 17,000 will increase the danger of the above-mentioned fall. However, such a fall towards 16,000 will be a good buying opportunity from a long-term perspective.

Our bullish view of seeing 20,000 and higher levels on the upside will come back into the picture only if the Nifty breaks above 17,600-17,800.

Contrary to our expectation, Sensex fell breaking below the support at 58,000. The index made a low of 57,158.69 and has recovered slightly from there. It has closed the week at 57,989.90, down 1.94 per cent.

The week ahead: The bounce from near 57,000 has given some relief for the Sensex. If it manages to rise above 58,000, at test of 58,500-58,700 and 59,000 is possible this week. There after the price action will need a close watch.

Failure to breach 59,000 can take the Sensex down towards 57,000 again. In that case, 57,000-59,000 can be the short-term trading range. Sensex will come under more selling pressure only if it falls below 57,000.

Chart Source: MetaStock

Medium-term outlook: 57,200-57,000 is a very crucial support for the Sensex. The chances of a fresh rally will remain alive as long as the Sensex sustains above 57,000.

Strong resistances are at 59,500 and 60,500 which has to be broken to become convincingly bullish again. For now, we expect 57,000-60,000 to be the broad range of trade. The chances of the rise to 64,000 is still not been completely ruled out. This bullish view will come under threat only if Sensex falls below 57,000. In that case, a steep fall to 55,000 and lower levels is possible.

Nifty Bank index fell well beyond our expected level of 39,500 last week. The index made a low of 38,613.15 and has recovered well from there. It has closed at 39,598.10, down 2.2 per cent for the week.

On the daily chart, the price action towards the end of the week indicates strong buying around 39,000. However, on the weekly chart, the picture is mixed. Last week’s candle reflects indecisiveness in the market.

Chart Source: MetaStock

Important resistances are at 39,800 and 40,300. Nifty Bank index has to break above 40,300 to ease the downside pressure. Such a break can take it up to 41,000 and 41,500 again.

But failure to break 40,300 can keep the index under pressure. In that case, a fall back to 39,000 can be seen again. It will also keep the danger of testing 38,000-37,500 on the downside alive in the coming weeks.

However, from a long-term perspective, the region between 38,000 and 37,500 is a strong support zone. We can expect the current fall to end in the 38,000-37,500 region. As such, we will be looking for a fresh leg of long-term rally from this support zone. So, the fall to 38,000-37,500 will be good long-term buying opportunity.

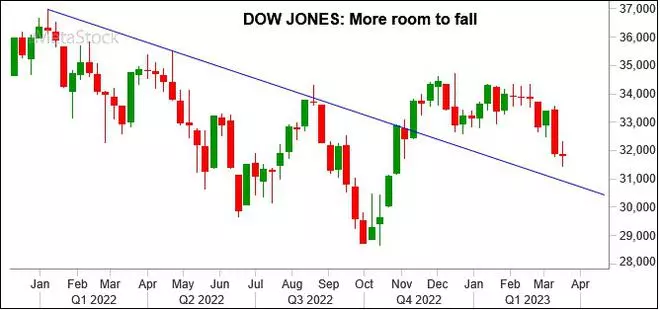

The Dow Jones Industrial Average oscillated broadly in a sideways range all through last week. The index has closed the week at 31,861.98, down 0.15 per cent.

Chart Source: MetaStock

The range-bound move last week could just be a pause and a consolidation within the broader down trend. Key resistance is in the 32,450-32,500 region. As long as the Dow remains below 32,500, the outlook is negative and the broader down trend is likely to remain intact. As such we can expect the Dow Jones to see a fresh fall to 31,000 and 30,500 in the coming weeks.

The region between 31,000 and 30,500 is a strong long-term support zone. So, long-term investors can consider entering into the market around 31,000.

Published on March 18, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.