The year 2023 has seen a sharp increase in sell-downs by promoters (majority shareholders) compared to the previous years. The selling by promoters largely reflects strategic compulsions. Domestic investors have absorbed the bulk of the sell-downs. Here are the 4 charts that give you more insights.

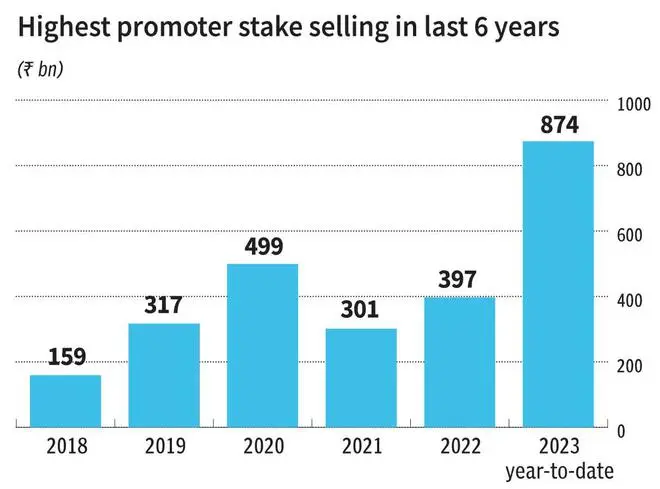

Multi-year highs

2023 on a YTD basis has seen the selling by promoters (through bulk/block deals in NSE-500 stocks) amounting to ₹874 billion. This is the highest quantum since at least 2018, as per available data. According to Kotak Institutional Equities, only a small portion of promoter sales to bullish equity market conditions. A large portion of the sales by promoters pertains to holding companies of promoters raising cash to manage ‘high’ purported debt in promoter holding companies (like Adani Group companies). Another meaningful portion is due to the exit of one of the promoters from a company (HDFC Life, CIE India) for strategic reasons (portfolio rationalization).

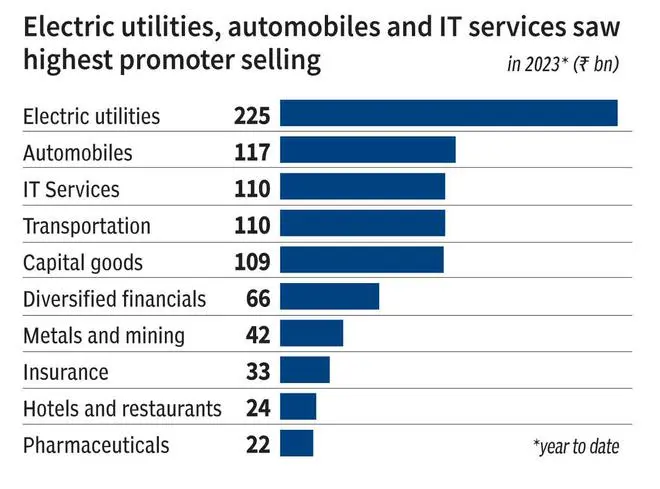

Sectors: Maximum selling

Automobiles and components, capital goods, electric utilities, IT services and transportation sectors have seen the bulk of the promoter selling so far this year. However, insurance and IT services accounted for a large portion of promoter selling over 2018-23 period

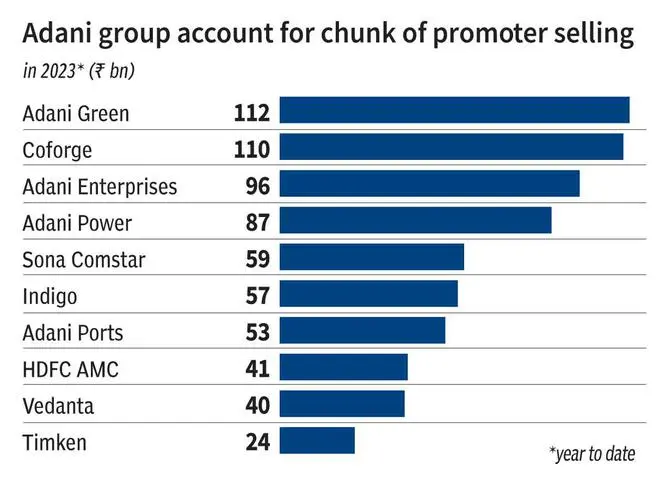

Adanis leading the way

While Adani group accounts for around 40 per cent of total promoter selling in NSE 500 companies, promoters of companies such as Coforge, Sona Comstar and Indigo have also seen significant selling

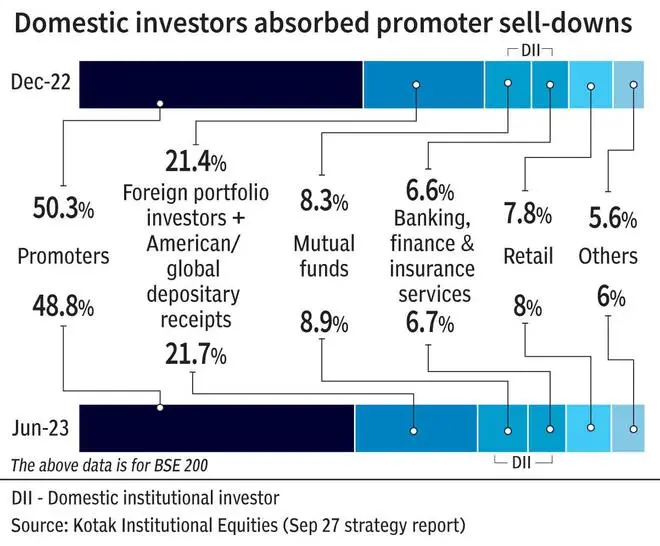

Shareholding changes

As a result of promoter sell-downs, (promoter holding in the BSE-200 Index has declined to 48.8 per cent in the Jun-2023 quarter (latest available data) from 50.3 per cent in the Dec-2022 quarter. The combined holding of domestic investors (Mutual Funds + Banking Finance & Insurance + Retail Investors) has increased by 90 basis points (bps) to 23.5 per cent at the end of the Jun-23 quarter. The holding of Foreign Portfolio Investors has increased modestly to 21.7 per cent over the same period, while the holding of others (AIFs, PMSes fall under this category) has increased 31 bps to 6 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.