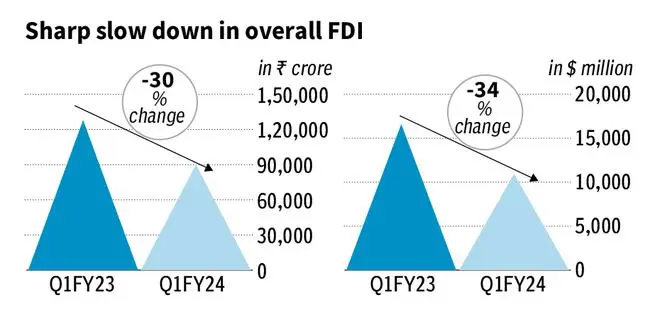

Foreign Direct Investment (FDI) into India recorded 30 per cent decline in rupee terms and 34 per cent decline in dollar terms, compared to the same period last year, as an uncertain global environment and rising cost of finance hurt investors.

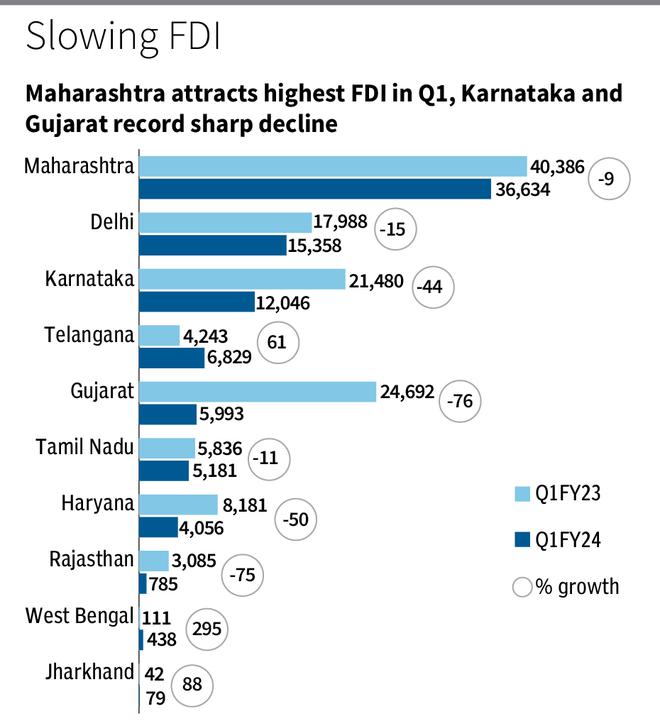

The fall was broad based across States. But the larger States — Gujarat and Karnataka — saw foreign investments decline by 76 per cent and 44 per cent, respectively. FDI inflows into Gujarat fell to ₹5,993 crore in Q1 FY24 from ₹24,692 crore in the same quarter of the previous fiscal. FDI inflows to Karnataka also halved to ₹12,046 crore during this period.

Maharashtra bucks trend

Despite a broader slowdown in FDI inflows, Maharashtra managed to attract ₹36,634 crore of FDI equity inflows in the first quarter of the current fiscal. Maharashtra’s FDI inflow was higher than the combined inflows of Delhi, Karnataka, and Telangana in the April-June quarter. However, on a year-on-year basis, Maharashtra’s FDI inflows were down by 9 per cent, against ₹40,386 crore in the same quarter of the previous fiscal.

Historically, Maharashtra, Karnataka and Gujarat are the highest recipients of FDI inflows. These three States have cumulatively received over ₹10-lakh crore in FDI equity, accounting for 68 per cent of the country’s total FDI inflows between April 2000 and June 2023.

The decline in FDI in States such as Maharashtra and Karnataka could be attributed to the prolonged funding winter faced by Indian start-ups, as investors are holding back on fresh funding due to the slowdown in the developed economies such as the US and Europe. Maharashtra has the highest number of recognised start-ups at 13,519, followed by Karnataka (8,881), and Delhi (8,636) as of June 2022.

Telangana is the only major State that saw year-on-year increase in FDI inflows. The State’s FDI inflows increased 61 per cent to ₹6,829 crore.

Liquidity tightening

Madan Sabnavis, Chief Economist, Bank of Baroda, said the decline in FDI in is only a continuation of slower flows into India. “Last year, the FDI was lower at $71.3 billion against $84.8 bn in FY22.”

“With tightening policies in the West, it has meant quantitative tightening and the excess funds made available to investors have disappeared. Therefore, there is a smaller pool of invisible funds,” he added.

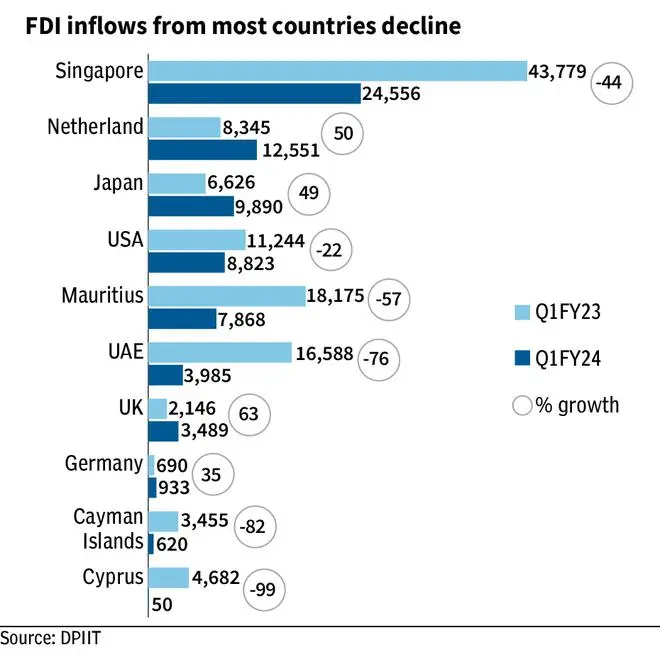

From the point of origin, FDI from Cyprus dwindled nearly 100 per cent to ₹50 crore in Q1 FY24, against ₹4,682 crore in the same quarter of last fiscal. FDI inflows from Singapore, US, Mauritius, and UAE dropped in the range of 20-80 per cent. Inflows from the Netherlands, Japan, and UK saw a year-on-year growth.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.