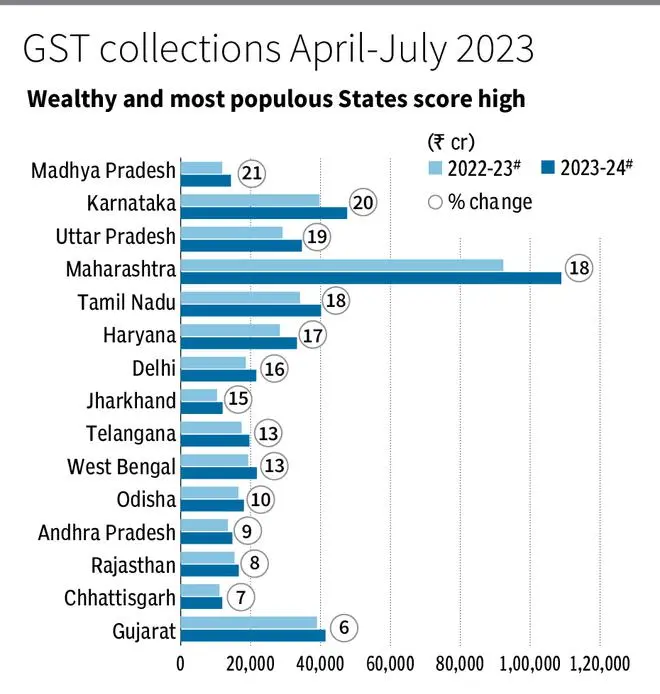

Madhya Pradesh, Karnataka and Uttar Pradesh topped the list of States with the highest growth rate in Goods and Services Tax (GST) collections in the first four months of the current fiscal compared to the same period last year.

Higher growth seems to be led by growth in consumption, large population, higher purchasing power and improved compliance.

businessline analysed the top 15 States with highest GST collection in value terms, which account for 68 per cent of the total collections by all States and UTs.

Within the sample States, Madhya Pradesh clocked 21 per cent y-o-y growth in GST collections during April-July. Madhya Pradesh is an agrarian economy with 35 per cent share of gross value added (GVA) coming from agriculture and allied sectors.

Higher realisation from farm produce could have led to increased rural spending in the State.

It was followed by Karnataka (20 per cent) and Uttar Pradesh (19 per cent). India’s first and second largest economies- Maharashtra and Tamil Nadu - pencilled a growth rate of 18 per cent.

Surprisingly, the industrially rich Gujarat saw only 6 per cent growth in GST collections. Andhra Pradesh, Rajasthan, and Chhattisgarh also recorded single digit growth in GST collections.

National numbers

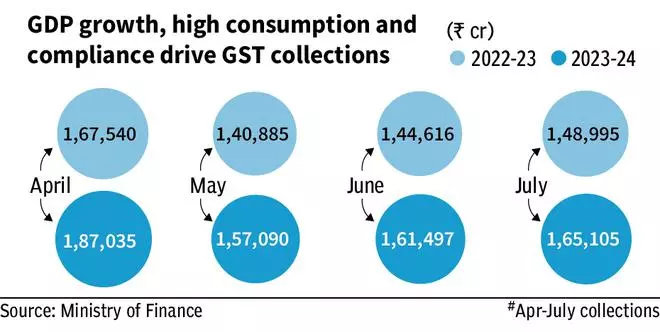

The gross total GST collection of all States and Union Territories (UTs) combined grew by 15 per cent year-on-year to ₹5.10-lakh crore in April-July of the current fiscal as compared to ₹4.42-lakh crore in the same period of 2022-23, reflecting stronger consumption across States.

But at the national level, growth was lower at 11.4 per cent to ₹6.70-lakh crore compared to ₹6.02-lakh crore in the previous fiscal. The growth appears to have been pulled down at the gross level because this number includes integrated GST (including imports) and cess, besides Central GST and State GST.

IGST clocked the lowest growth at 8 per cent during April-July due to declining commodity inflation and lowered value of imports.

Record collection

A comparison of GST collections in value terms throws a different picture altogether. Maharashtra tops the list of States with highest GST collections at ₹1.09-lakh crore followed by Karnataka (₹47,608 crore), Gujarat (₹41,428 crore). Tamil Nadu and Uttar Pradesh collected ₹40,135 crore and ₹34,694 crore respectively.

Abhishek Jain, Partner & National Head - Indirect Tax, KPMG in India, said, since GST is a consumption-based tax, States with high consumption will naturally see more tax revenues.

“Uttar Pradesh is the most populous State and the consumption in any case will be more. Maharashtra, Gujarat, and Karnataka are well-developed. So, the spending power of people in these States are much higher,” Jain said.

For instance, sales of luxury cars will be much higher in States like Maharashtra and as compared to Bihar or Uttar Pradesh, he added.

Although Kerala’s GST collections grew by 15 per cent, in value terms, its GST collection of ₹10,413 crore was lower than Jharkhand and Chhattisgarh.

Compliance

Jain said, the average GST collection was ₹1.51 lakh crore last year. With the overall economy growing at about 12.5 per cent (6.5 per cent GDP growth and 6 per cent inflation), GST collections will naturally go up to ₹1.6-lakh crore this year.

“Also, the government’s drive to weed out fake registrations and fake invoices and expiry of the 2017-18 GST audit period by September will contribute to GST collections going forward,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.